Simplifi Reviews

& Product DetailsWhat is Simplifi?

Quicken Simplifi is a modern financial management tool designed to simplify the complexities of personal finance. Recognized as the “best budgeting app of 2023,” Simplifi offers a powerfully simple approach to managing finances.

With features like automation, real-time alerts, and personalized savings goals, users can effortlessly track their spending and plan for future expenses. The platform provides a clear view of one’s financial health, allowing users to make informed decisions and achieve their financial objectives.

One of its standout features is the ability to project cash flows, giving users a glimpse into their future financial state. The platform also promotes collaboration, enabling users to share their finances with a partner.

With a user-friendly interface and a commitment to data security, Quicken Simplifi is a reliable choice for individuals seeking a comprehensive financial management solution. Whether you’re budgeting, saving, or planning, Simplifi has you covered.

Found in these Categories

Best For

- StartUps

- Freelancers

- Small Business

- Medium Business

- Large Enterprise

- Non-profit Organization

- Personal

- Cloud, SaaS, Web-Based

- Mobile - Android

- Mobile - iPhone

- Mobile - iPad

- Desktop - Mac

- Desktop - Windows

- Desktop - Linux

- Desktop - Chromebook

- On-Premise - Windows

- On-Premise - Linux

-

Company Name

Intuit

-

Located In

United States

-

Website

quicken.com

Starting from:

$3.99 /month, billed annually

Pricing Model: Subscription

- Free Trial

- Free Version

Pricing Details:

Simplifi by Quicken comes with one pricing plan that of $3.99 with annual billing.

See Simplifi Coupons- Reporting/Analytics

- Activity Dashboard

- Mobile Access

Additional Features

- Automated expense tracking

- Budgeting tools

- Cash flow projections

- Customizable categories

- Data security

- Financial insights

- Future planning tools

- Personalized savings goals

- Real-time alerts

- Shared finance collaboration

- Simplified interface

- Spending analysis

- Transaction categorization

- User-friendly design

Tell us your opinion about Simplifi and help others.

Financial objectives are critical. However, it might be impossible to tell how your money management practices are hurting your goals without looking at a large collection of accounts where your money is housed.

Simplifi by Quicken: A New Money Management App

Simplifi by Quicken is an easy-to-use personal finance app that allows you to manage your finances and budget from anywhere. Owned by Aquiline Capital Partners, the same company that brought you Quicken, Simplifi offers a simplified approach to account management, saving goals, and budgeting with a clean, visually appealing interface and streamlined process.

As a financial aggregator and money management app, Simplifi is available both on mobile and online. If you’ve used apps like Mint or Personal Capital, you probably already know what Simplifi does. It brings together all of your financial accounts in one place, providing you with a comprehensive view of your financial situation.

While some may dismiss Simplifi as just another financial aggregator, the fact that Quicken is behind it makes it worth taking a closer look. Quicken has been a household name in the financial services market for over 30 years, and even though the company was sold to H.I.G. Capital in 2016, it remains a trusted brand.

With Simplifi, you can create your own categories, budgetary limitations, watch lists, and spending plan. And because it’s a premium service, you won’t be distracted by ads on your smartphone, allowing you to focus on your financial goals.

About Simplifi

Quicken has developed a money management software called Simplifi, which aims to provide a comprehensive view of your finances to help you manage them better. Quicken is a well-established player in the financial management software industry, with over 30 years of experience, so you can trust that Simplifi provides a dependable service.

Although Simplifi is a basic financial monitoring and budgeting tool, it offers several appealing features that set it apart from other similar apps. For instance, Simplifi has an excellent net worth tracker that allows you to see your net worth per account or overall. Additionally, it features a spending plan that lets you manage income, fixed bills, and discretionary spending. The software works well to keep detailed spending logs, divide transactions, or ignore specific transactions (such as work expenses that will be reimbursed later). The expenditure visualizations were particularly impressive on both the desktop and app versions.

Simplifi is a new way to manage all of your finances in one simple interface. You don’t have to waste time switching between accounts to see how your funds are doing. Instead, you can log into Simplifi anytime and get the complete picture. Besides, the app can help you manage little financial activities that influence your daily expenses.

To sum up, Simplifi by Quicken is an excellent money management tool that provides a comprehensive view of your finances to help you manage them better. If you’re looking for a reliable and user-friendly app to manage your finances, Simplifi may be the right choice for you.

Is Quicken’s Simplifi reliable?

We normally offer Better Business Bureau ratings so you can examine how a company handles consumer complaints and difficulties. Quicken has yet to be rated by the BBB.

A solid BBB rating isn’t always the deciding factor. You may also communicate with other app users or read consumer feedback. Quicken hasn’t been the subject of any recent public debates.

What’s the point of a Personal Finance App?

If you’ve never used one before, you might be intrigued by the advantages of a personal financial app. They offer one location where you may combine all of your financial accounts, including checking and savings accounts, credit cards, and brokerage accounts.

You’ll be able to check your accounts’ practically real-time activity and balances, both individually and in one aggregated register, after establishing an internet link to them. This means you may go in at any moment and view what transactions have cleared your accounts recently.

This talent can warn you of two types of danger. You could discover that someone has accessed your account or that one or more of your balances has reached unsafe levels. Personal financial applications can also remind you of neglected transactions.

How Does Quicken’s Simplifi Work?

Simplifi is accessible as a web app and a mobile app. It includes the following features:- Organize your finances: You may immediately link to over 14,000 banking institutions. You’ll be able to know exactly what your financial status is at any moment by adding those accounts to the site. This will assist you in identifying income, expenditure, and net worth patterns.

- Tracking spending and budgeting: A basic budget will help you better manage your income and costs and ensure that you are not spending more than you earn. You can also use the tool to classify your expenditure and keep track of it over time.

- Create and achieve personal management objectives: You can set goals for specific purposes such as retirement, saving for a down payment on a home, vacation planning, or even your wedding. Set your objective, and Simplifi will assist you in achieving it.

- Create and achieve personal management objectives: You can set goals for specific purposes such as retirement, saving for a down payment on a home, vacation planning, or even your wedding. Set your objective, and Simplifi will assist you in achieving it.

How to Sign Up for Quicken Simplifi?

You must be a US citizen or resident to sign up for Simplifi and be ready to have your credit card on file. Non-US residents are presently unable to use the service. You will also be limited to US-based financial institutions as a financial aggregator.

The steps to sign up for the service are as follows:- Sign up for a free trial at simplifimoney.com and click “Start Free Trial.”

- Choose your chosen option.

- You can sign in with your Quicken ID and password if you have already generated one. If you haven’t already done so, enter your email address, mobile phone number, and a unique password before clicking “Create.”

- Click “Subscribe” after entering your billing information.

- Click “Let’s Get Started” when your order has been processed.

- Quicken won’t allow you to utilize the 30-day free trial unless you have a credit card on file.

What can Simplifi be used for?

Quicken’s Simplifi is great for anyone who wishes to keep track of their finances. The budgeting software is quite thorough and goes above and beyond a basic budgeting tool to break down your savings and spending.

Start by integrating your bank accounts, investment accounts, and credit cards into Simplifi. Then, you’ll be able to design a dashboard that gives you an overview of your money. It also uses charts and statistics to assess your expenditure and savings.

Individual savings objectives can be developed, or a monthly spending plan with several categories might be created. In addition, the app offers a watchlist that records areas of your spending and can monitor invoices to ensure you pay them on time if you want more granular information.

Monthly data for expenditure, gross income, net income, savings, and shopping refunds are also available through the app. Monthly subscriptions are $5.99, while yearly subscriptions are $47.99.

Watch out for You may try the app for free for 30 days, but you’ll have to pay up for a subscription when you create an account. Also, if you try the app and realize it’s not for you, you may return it.

Simplifi Detailed Features

Simplifi has several useful tools to assist you in managing your finances.

-

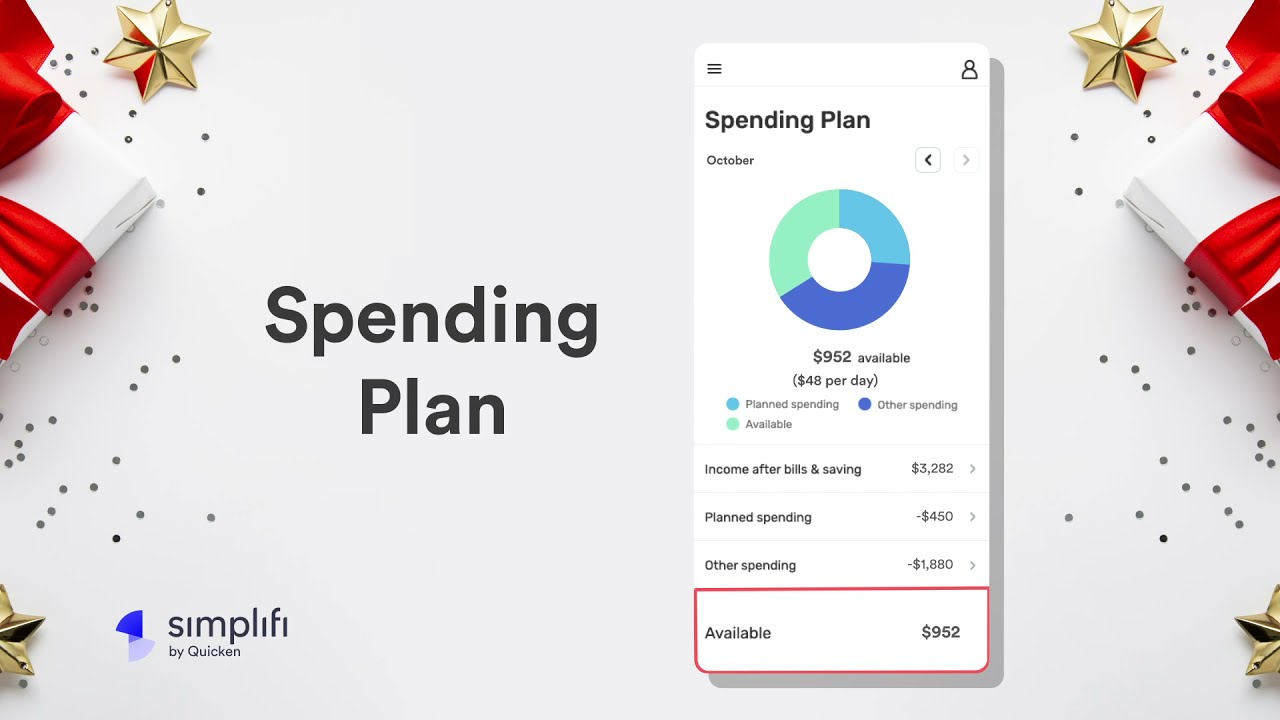

Spending Strategy

Simplifi will create a spending plan for you after you link your accounts. The spending plan aims to show you your monthly income and fixed costs.

Your discretionary income is the gap between your income and planned costs, which Simplifi can help you prepare for. You may use that extra cash for whichever purpose you like. However, the funds might also be utilized to pay an unforeseen expenditure. The Spending Plan assists you in determining how much you can afford to spend.

Let’s imagine you want to treat yourself to a nice evening out. Instead of basing your selection on the amount of money in your bank account, Simplifi displays how that purchase will affect your monthly spending ability.

-

Watchlist made easy

The Simplifi Watchlist is ideal for anyone who has trouble sticking to a budget. You may select to get informed when you spend any proportion of a budget category when you create it.

Let’s assume you set a budget of $100 for fast food this month. When you spend any portion of that objective, the app can notify you. You may set the reminder to go off at the 90% point if you want to know when you’re almost out of fast-food dollars.

The notification is a simple method to stay on track with your budget, and you won’t have to check your bank accounts to stay on track continuously.

-

Simplifi Dashboard

You may personalize your dashboard according to your tastes. However, you’ll start with some preset titles to assist you in arranging your finances:

- Expenditure Plan (Account List) – breaks down spendable income, bills, and subscriptions, leaving money for discretionary spending.

- You’ve sent a message (in the last few days)

- Top Spending Categories in the Previous 30 Days

- Watchlists for Spending (You can establish numerous spending watch lists, which may be seen from the Dashboard view.)

- Income by Month Spending Over Time

-

Cash Flow Forecast

Simplifi makes it simple to keep track of your expenses and revenue. In addition, Simplifi allows you to predict your income and spending to see what your future account balances could look like and the current position in your bank account.

You may use this tool to predict when your bank account balance will decline. This glimpse into the future might help you budget for purchases and avoid worrying when a large payment arrives in your account.

-

Savings Objectives

Everyone has a large financial aim. Setting financial goals is critical whether you want to go on a fantastic trip or support early retirement. Setting financial goals is simple with Simplifi. More significantly, the app makes tracking your savings objectives straightforward.

You may check in with Simplifi to see how far you’ve come toward your savings objectives. If you routinely make savings goals, this might be a handy option.

-

Visual Reports

It’s not difficult to locate an app that gathers all your financial information in one location. Finding an app that makes this information aesthetically appealing, on the other hand, is more difficult. You won’t have to search much farther, thankfully. In a graphic style, Simplifi genuinely makes your finances shine.

Having access to a report of your whole financial situation may be quite beneficial. Not only that but the charts and graphs make it simple to understand the specifics.

-

Projected Balances Tool

One of the platform’s most useful features, this tool shows you a visual picture of your expected balance for the next 30 days. Projected Balances are calculated based on your periodic transactions and allow you to predict your account balances ahead of time.

Customer service is not available through phone, live chat, or email. However, the platform has a thorough Help Center that includes articles and tools to answer your difficulties.

-

Mobile Application

The Simplifi Mobile App is available on Google Play for Android smartphones running version 5.0 and higher, and over 10,000 people have already downloaded it. It’s also compatible with iPhone, iPad, and iPod touch and is available on The App Store for iOS devices running 9.0 or later.

-

Account Security

Account security is always a worry when consolidating all of your bank accounts on one platform. Data is securely delivered from your bank servers using 256-bit encryption while utilizing the Quicken system. Your bank account information is downloaded and kept entirely secret. It’s simply used to keep track of your accounts.

Are Quicken and Simplifi interchangeable?

No. Quicken users will see that Simplifi is not the same as Quicken.

Instead, Simplifi is a brand-new personal finance software developed by Quicken to help consumers better perceive their financial health.

Is Simplifi completely free?

No. Simplifi is a premium application. You’ll have to pay $47.99 per year or $5.99 per month. A yearly membership saves you around $2 every month.

-

What is the connection between Simplifi and my bank?

You may connect to a bank by entering the User ID and password you use to log in to your bank account once you’re in the app.

-

Is Simplifi protected?

Yes. Simplifi prioritizes the security of your financial information. For example, when sending data from your bank servers, the organization employs 256-bit encryption to maintain its security.

Alternatives to Simplifi

The top alternatives that are available in the market are listed down below:

- Mint

- Trim

- Personal Capital

- Truebill

- Lunch Money

- YNAB

- Monarch

- GoodBudget

- Plutus

Mint and Trim are your best alternatives if you’re looking for a free budgeting tool.

Mint

This budgeting software is comparable to Simplifi and is listed in our top budgeting apps guide. You may, for example, make a budget based on your spending habits, manage your expenses, or set personal savings objectives.

Trim will be a good choice if you seek more specific strategies to save costs. The software will advise you where you may save money and will negotiate your payments for you. For example, if you utilize Bill Negotiation, you’ll have to pay an annual fee of 15% of the money you saved. Mint provides a similar service, but you’ll have to pay 40% of your savings accumulated throughout a two-year subscription.

There is no free edition of Simplifi, only a 30-day free trial. However, suppose you haven’t discovered an attractive budgeting software or are looking for a budgeting tool that gives extensive information about your spending and saving. In that case, it could be worth looking into. Simplifi features monthly statistics on your income, expenditure, and more and the ability to set a watchlist for certain areas in your spending.

It could also come down to whatever platforms you choose to utilize. Online and mobile apps are available for Simplifi and Mint. Trim is now only accessible with Facebook or your Google email account.

Personal Capital

Personal Capital has budgeting capabilities. However, the budgeting tools do not compare to those of Simplifi. Simplifi will provide you with a higher-quality budgeting framework.

On the other hand, Personal Capital far outperforms Simplifi’s investment tracker. You can do more with Personal Capital than just glance at your investments. Instead, you may use various investment analysis tools to guarantee that your portfolio is on the proper track.

You may also use Personal Capital’s investment management services. So, if you want to keep a close check on your money, Personal Capital is the clear winner. However, if you want to concentrate on your budget, for the time being, Simplifi will take things to the next level.

YNAB

YNAB- The greatest app we’ve discovered that supports this strategy or philosophy of budgeting is You Need a Budget (YNAB). The intricacy of getting the allocations correct might take some time to grasp, but the payback can be huge for those who are a good fit for this strategy: your brain is educated to spend less. Unfortunately, in our tests, YNAB had significant synchronization difficulties with several banks, apart from the high learning curve. In addition, some Simplifi services, such as financial flow predictions, desktop notifications, and live customer assistance, are also missing.

Simplifi Review Conclusions

Simplifi is an excellent tool for anybody wishing to simplify their financial management. The app makes it easier to keep track of all of your transactions once you link your accounts. In addition, you may check-in with Simplifi at any moment to see your whole financial picture. You may also utilize it if you need to make a quick budget choice.

Finally, Simplifi is a useful tool for visualizing your budget, financial objectives, and spending trends. There’s no danger in trying it out with a free 30-day trial.

Should You Give Simplifi A Try?

If you’re looking for an app to help you manage your money in the broad picture, Simplifi is a smart choice. You’ll be able to track your money movements without going via different accounts after you’ve connected your financial accounts.

You can rapidly examine your income and spending trends if you have the relevant information at your fingertips. This will assist you in making the best financial decisions possible for your financial future.

Although Simplifi has many features, it’s worth noting that it doesn’t contain any investing advice. Other personal finance applications might assist you in creating investment strategies that are in line with your objectives. Unfortunately, however, Simplifi will be unable to assist you in this area.

Finally, Simplifi is a premium app that will deplete your bank account. Depending on your financial situation, you may not want to pay for these capabilities when a basic spreadsheet and the dedication to maintain it may accomplish identical goals.

Overall, Simplifi is a wonderful pick for personal finance software that allows you to track your money anywhere. It could be the best way for you to manage your money and achieve your objectives efficiently.