When you start your e-commerce business, funding is the fuel for growth. It’s often said that it takes money to make money, and that’s especially true in online retail.

Whether you need to stock up on inventory before a busy season or invest in marketing to reach new customers, having access to capital (and managing cash flow) can make or break your ability to scale.

Simply put, cash is king in e-commerce, and a lack of working capital can halt even a thriving store’s momentum.

In exploring ways to fund, I came across 8fig, an innovative funding platform for e-commerce entrepreneurs. 8fig takes a very different approach compared to traditional financing options.  Even better, it pairs the funding with AI-driven planning tools to help manage your supply chain and cash flow. How cool is that? My goal is to give you a clear perspective on how these options stack up, so you can decide which route might be best for your online business.

Even better, it pairs the funding with AI-driven planning tools to help manage your supply chain and cash flow. How cool is that? My goal is to give you a clear perspective on how these options stack up, so you can decide which route might be best for your online business.

Traditional E-commerce funding options

Before examining 8fig in detail, let’s look at two of the most common traditional e-commerce financing avenues I considered: bank loans and venture capital.

Each comes with its own process, benefits, and challenges that every online business owner should understand.

Bank Loans

The first thought for funding was a traditional business loan from a bank. The concept is straightforward: if you qualify, the bank gives you a lump sum of money up front, and you pay it back over time with interest.

source: investopedia.com

In practice, though, getting a bank loan for an e-commerce venture can be an uphill battle. Banks and credit unions have strict requirements and lengthy processes for approving loans. They typically scrutinize your financial health and want proof you’ll be able to repay on schedule.

That means preparing months of paperwork – past bank statements, detailed financial projections, business plans – and often putting up collateral like personal assets or inventory to secure the loan.

Many lenders won’t even consider you unless you have a strong credit history and at least two to three years of operating history under your belt.

source: nbcbanking.com

This rigidity can strain your cash flow if sales slow down or you hit a seasonal dip. The bank expects its payment no matter what. There’s also often zero tolerance for adjusting the plan; if you run into trouble repaying, you risk default, penalties, or losing any collateral you pledged.

Don’t get me wrong – bank loans have their advantages if you can get one. They typically offer relatively low interest rates and longer terms, so the cost of capital is lower than many alternatives.

Venture Capital

On the more glamorous end of the funding spectrum is venture capital (VC). We’ve all seen the headlines of startups raising millions from VC firms.

Essentially, venture capital is a form of equity financing – you pitch your business to investors who provide money in exchange for a share of ownership (equity) in your company.

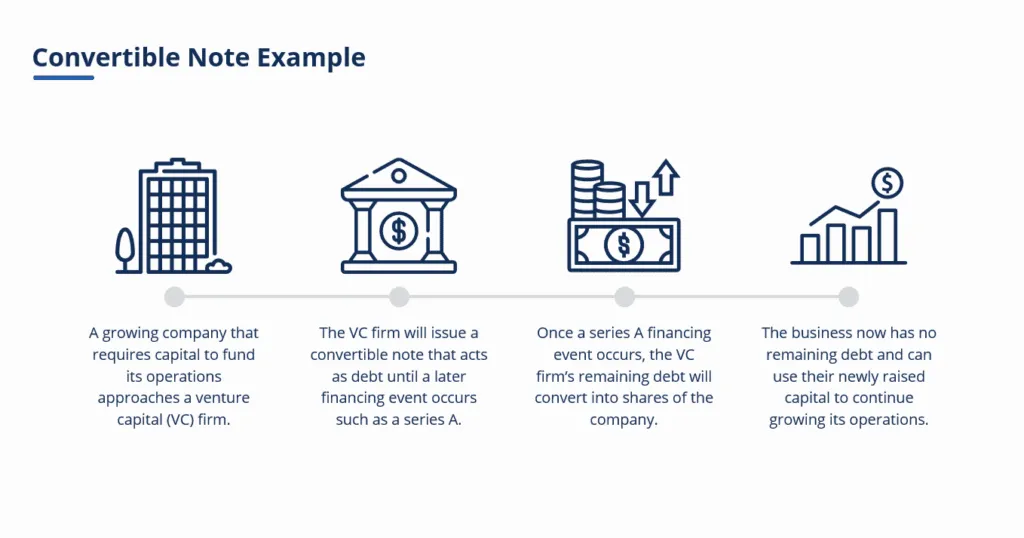

source: investopedia.com

Unlike a loan, you don’t have to repay VC funds month-to-month; instead, investors “get paid” by owning a piece of your future success (or failure). This can be appealing because it removes the immediate debt pressure and can provide significantly more capital than a bank might lend.

However, taking on venture capital is like getting married – you’re selling a chunk of your business to strangers, which comes with strings attached. As soon as you accept VC money, you’ve effectively diluted your ownership.

There’s also intense pressure to grow fast with venture capital. VC investors usually expect a high return on their investment within a few years, often by pushing the company toward an IPO.

It’s also worth noting that obtaining VC funding is anything but quick or guaranteed. The process can be long and arduous: you may spend months meeting with investors, pitching your heart out, and undergoing due diligence checks.

source: corporatefinanceinstitute.com

And success is far from guaranteed – VCs are extremely selective. Unless you have a truly standout business with huge growth potential, securing a deal can be very difficult (especially in the competitive e-commerce space).

In summary, traditional funding routes like bank loans and venture capital each have significant downsides for e-commerce sellers.

This context is what got me so interested in alternative solutions like 8fig, which claim to combine the best of both worlds – ample funding without the usual drawbacks.

Introducing 8fig’s Funding Model

8fig is a fintech company on a mission to help e-commerce businesses scale without the typical funding hassles. Founded in 2020 by experts in supply chain, e-commerce, and finance, 8fig set out to address the core pain points we just discussed.

In plain terms, 8fig provides continuous, equity-free funding that’s tailored to the unique needs and cycles of online sellers.

What do I mean by “continuous” funding? Unlike a bank loan, where you get one lump sum, 8fig gives you a series of cash infusions over time – whenever your business needs it to keep the supply chain moving.

It’s like having a funding partner that grows with you, rather than a one-and-done transaction.

For example, through 8fig’s platform, you might receive capital in tranches aligned with your inventory schedules: one portion to pay your supplier for a production run, another later for shipping costs, another for marketing, and so on.

Equally important, 8fig’s funding is flexible and customizable. If something changes – say, sales are slower this month or you need to increase your next inventory order – you can tweak your funding amount or repayment timeline in real time with just a click.

Traditional lenders generally lock you into fixed terms, but 8fig built their model to accommodate the ups and downs of e-commerce. They describe their approach as “cash flow friendly,” meaning your repayment schedules are tied to your business’s revenue cycles and supply chain timing.

Another standout feature is that 8fig is completely equity-free. Unlike venture capital, with 8fig you remain 100% in control of your business. Essentially, 8fig’s model is a form of revenue-based financing or working capital advance: you receive funds now and repay from future revenues, but you don’t sell shares or dilute your equity at all.

Finally, 8fig isn’t just throwing money at you and walking away. The platform comes with built-in AI-driven financial planning tools to help you manage growth.

When you sign up, you integrate your store data (for example, connect your Shopify or Amazon account) and bank info, and 8fig’s “AI CFO” analyzes your numbers to create a personalized growth plan

Traditional banks certainly don’t provide that kind of help, and even VCs, while they may advise you, won’t hand you software to manage your day-to-day operations. 8fig essentially combines capital + strategy in one.

To sum up, 8fig’s funding model is characterized by continuous infusions of capital aligned to your supply chain, the freedom to adjust funding and repayment as needed, and no loss of ownership.

It’s a modern approach designed for the realities of e-commerce.

8fig vs. traditional funding

From my perspective, these are the four biggest areas where 8fig’s model diverges from traditional e-commerce funding options:

Equity Dilution

One of the starkest differences is ownership. With traditional venture capital, you give up equity in exchange for funding, meaning investors become co-owners of your business.

By contrast, 8fig requires zero equity. You retain 100% ownership of your company with 8fig financing. In that sense, it’s more like a loan or revenue-share – they provide capital, and you pay it back over time, but your business is still entirely yours.

On the flip side, equity funding (like VC) doesn’t require scheduled repayments, and investors share the risk – if the business fails, you typically don’t owe them money back. With 8fig (or any debt-like funding), you do need to repay from your revenue.

In summary, 8fig = no equity dilution, VC = significant equity dilution, and that’s a fundamental consideration depending on your goals.

Repayment Flexibility

Another key comparison is how repayment works, and this is where 8fig stands out.

With a traditional bank loan, you have a fixed repayment schedule. Every month (or quarter, etc.) you must pay a set amount of principal + interest, no matter what your sales look like.

This rigidity can be tough for e-commerce, where revenue can fluctuate seasonally or unexpectedly. If you hit a slow period, those fixed loan payments can eat up your cash reserves and hamper your operations.

In contrast, 8fig offers much more flexible remittance terms. Since their model is tied into your revenue and supply chain, repayment amounts can scale up or down with your cash flow.

Bank loans simply don’t do that. They’re inflexible – miss a payment and you could face penalties or default. Even other alternative financing, like some merchant cash advances, can be quite rigid in their own way. 8fig’s flexibility is more like having a partner that succeeds when you succeed.

To put it plainly, traditional loans can sometimes strain your cash flow, whereas 8fig’s model is built to protect your cash flow. By syncing payments with income, 8fig helps ensure you’re not paying out more than you can afford at any given time.

If you’ve ever worried about a loan payment forcing you to cut back on marketing or not reorder stock, you’ll appreciate this flexibility.

Application Process

I often joke that applying for a bank loan requires providing everything short of your DNA sample. The application process for traditional funding can be painfully slow and paperwork-heavy.

Banks typically ask for an extensive amount of documentation – detailed financial statements, tax returns, business plans, personal credit history, collateral details – you name it.

The venture capital route isn’t any faster – it’s just a different kind of hard. You might spend months networking to get warm introductions, pitching multiple VC firms, undergoing due diligence, negotiating terms, etc. Lots of meetings, lots of legal documents. It can easily be a 3-6+ month saga to close a venture funding round. And that’s if you succeed at all.

8fig, by design, streamlines the application and approval process using technology. The entire process is online and AI-driven. When I applied to 8fig, I answered a few quick questions about my business and connected my e-commerce platform and bank accounts digitally

Their system (the AI CFO I mentioned) then automatically analyzed my sales data, inventory cycles, and revenue trends to assess funding eligibility

From start to finish, we’re talking days, not months. 8fig’s use of AI and integrations accelerates decisions dramatically.

Traditional funding applications = long, tedious, and slow; 8fig application = fast, data-driven, and relatively easy.

Financial Planning Tools and Support

One often-overlooked difference is what else comes with the money. With a bank loan, the relationship is very transactional – the bank gives you funds, and it expects repayment with interest. There’s no built-in support beyond maybe some generic small business resources.

With venture capital, you do often get intangible support like mentorship, strategic advice, or connections from experienced investors (that can be valuable, though it varies by investor). However, VCs aren’t going to help you with granular tasks.

You’re mostly on your own to figure out how to best use the capital.

This is an area where 8fig differentiates itself by providing operational tools and guidance alongside funding. As mentioned earlier, 8fig includes a full suite of financial planning tools, powered by AI, to help you map and manage your business growth.

It’s like having a financial planner dedicated to your e-commerce supply chain. 8fig’s free planning tool helps allocate funds to where your business needs it most at the right times, which keeps your growth sustainable.

For example, 8fig’s AI tools can forecast sales and optimize your payback schedule according to your cash flow.

In short, 8fig offers a combination of funding + planning software that helps you manage growth. Traditional options generally just give you funding and leave the planning to you (or charge you equity for advice).

Conclusion

It’s clear that e-commerce funding has evolved beyond the old-school bank manager or high-stakes VC pitch.

- No Equity Loss: With 8fig, you keep 100% ownership of your company. You don’t have to give up equity or control as you would with venture capital

- Adaptable Repayments: Unlike rigid bank loans that demand fixed payments regardless of circumstances, 8fig offers flexible repayment schedules.

- Fast, Streamlined Funding: Traditional financing can be painfully slow and bureaucratic. In contrast, 8fig’s AI-driven process means you can go from application to funding decision quickly.

- Built-in Planning & Support: Perhaps one of the coolest parts is that 8fig doesn’t just hand you money and walk away. You get access to AI-powered financial planning tools and a platform that helps you manage your supply chain and cash flow.

Ultimately, the best funding option for your e-commerce business depends on your situation and goals. But for a growing e-commerce seller who wants scalable, founder-friendly financing, 8fig offers a compelling middle path.

It combines the continuous capital injection you need to grow with the freedom to run your business your way.

As you consider your next steps, ask yourself: What could I achieve with the right funding behind me?

Whether it’s doubling your product line, expanding to new markets, or simply staying in stock during peak season, ensure the option you choose empowers you to reach those goals.

E-commerce funding isn’t one-size-fits-all, but thanks to innovative models like 8fig, entrepreneurs now have more flexible and founder-friendly choices than ever before.