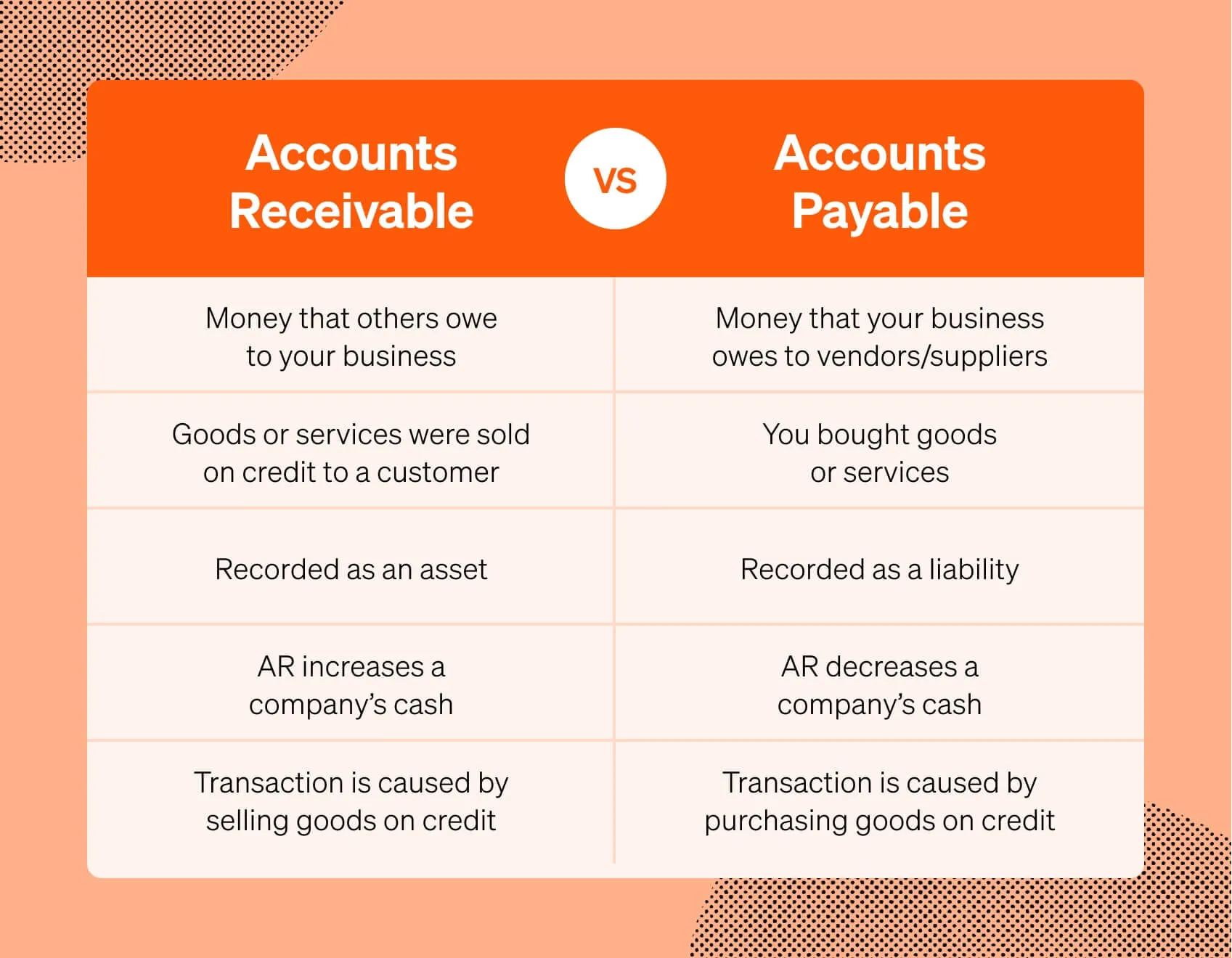

BILL (formerly Bill.com) has evolved from a niche accounts payable (AP) software into a complex, AI-powered financial operations platform. It now unifies AP, accounts receivable (AR), expense management, and even access to credit in one solution.

This transformation gives small and midsize business (SMB) finance teams a single system of record for payables, receivables, corporate cards, and cash flow, all improved by artificial intelligence for speed and accuracy.

BILL’s secret sauce is its advanced AI, trained on an enormous dataset of real business transactions. Having processed over $1 trillion in payment volume and 1.3 billion documents, the BILL platform leverages a scale of data that is unmatched in its category.

In practice, this means the software can intelligently automate routine financial tasks and flag anomalies with a high degree of confidence.

Since early 2025, BILL’s AI capabilities have increased the rate of “touchless” (fully automated) bill processing by more than 80%, while blocking over 8 million attempted fraud attacks in FY25 alone.

Today, roughly 500,000+ businesses and 9,000 accounting firms rely on BILL as their back-office workhorse, trusting its AI to eliminate manual busywork and reduce errors at scale.

In short, BILL is bringing Fortune 500-level automation and intelligence to the “Fortune 5 Million” SMBs that power the economy.

Below, we break down how BILL’s AI-driven platform tackles AP, AR, spend management, and embedded credit as a unified financial ops layer.

Accounts payable: AI-improved Bill

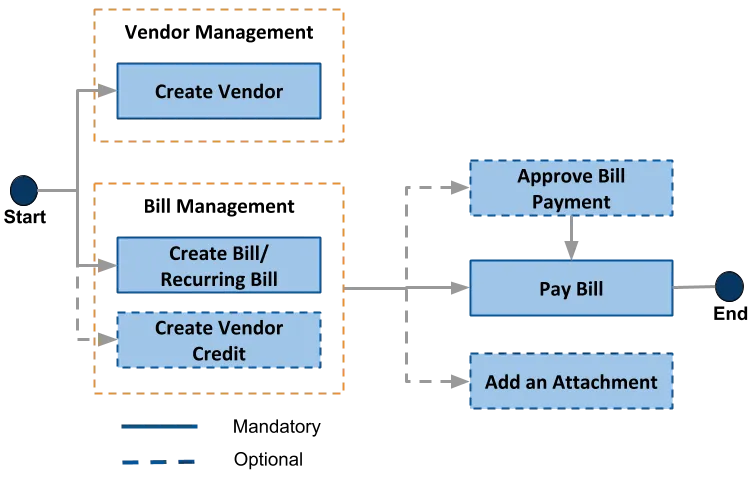

Accounts payable has always been BILL’s bread and butter, and with AI improvements, it delivers a hands-free AP process.

The platform automatically digitizes incoming bills through invoice capture, whether you email a PDF or snap a photo, BILL’s AI will extract all key details (vendor name, invoice number, date, amounts, etc.) in seconds.

This eliminates tedious data entry, as the system immediately inputs the bill information for you. Over time, the AI learns from patterns, improving its accuracy and even predicting how to code or categorize invoices based on past behavior (for example, recognizing a recurring vendor and suggesting the correct expense account).

In other words, the more you use BILL, the smarter and faster its invoice processing becomes. It has been trained on millions of invoices and continuously adapts to your business’s workflows.

Once the data is captured, approval workflows kick in. BILL enables customizable, rule-based approvals so that the right managers can review and sign off on bills digitally. A bill can move from reception to ready-to-pay without ever printing paper or chasing emails.

Turn finance ops into autopilot. Try BILL free.

When it’s time to pay, BILL offers multiple payment options. You can settle invoices via ACH transfer, corporate card, international wire, or even have BILL mail out a check on your behalf (they will print and send it for you).

Every step, from bill entry to payment execution, is tracked and logged, giving you a clear audit trail with minimal manual effort.

Importantly, BILL’s AI doesn’t just speed up AP; it also reduces risk and errors. The platform will automatically detect and flag any potential duplicate invoices, ensuring you never accidentally pay the same bill twice. It also uses predictive algorithms to monitor for anomalies or signs of fraud.

BILL AI accounts receivable

BILL went beyond AP by also tackling the other side of cash flow, accounts receivable. For SMBs, managing AR can be just as time-consuming as AP, so BILL’s platform includes robust tools to automate invoicing and collections.

Users can create professional, customized invoices directly in BILL, using templates with their company branding and line-item details. With a click, these invoices can be sent electronically to customers, and BILL will even handle printing and mailing paper invoices if needed for clients who require physical copies.

The system tracks invoice delivery and status, so you can see when a customer has viewed an invoice and know which invoices are due or overdue at a glance.

To accelerate collections, BILL provides a convenient online payment portal for your customers. Rather than sending a check, customers can pay their invoice through ACH bank transfer or credit/debit card, and the funds are deposited directly into your account.

BILL supports multiple payment methods to make it easy for your clients; they can even set up autopay for recurring bills. The platform also automates payment reminders and follow-ups: you can schedule polite reminder emails before and after the due date, nudging customers to pay on time without your team manually drafting emails.

Curious how touchless AR really feels? Test BILL for free.

Another huge benefit is that all incoming payments are automatically reconciled. BILL seamlessly integrates with your accounting software and matches payments to the corresponding invoices, updating your receivables ledger in real time.

By automating invoicing and collections, BILL transforms AR from a manual, reactive task into a smooth, proactive process. Businesses can reduce Days Sales Outstanding (DSO) and spend far less time chasing payments, all while offering a better payment experience to their customers.

Spend & corporate cards

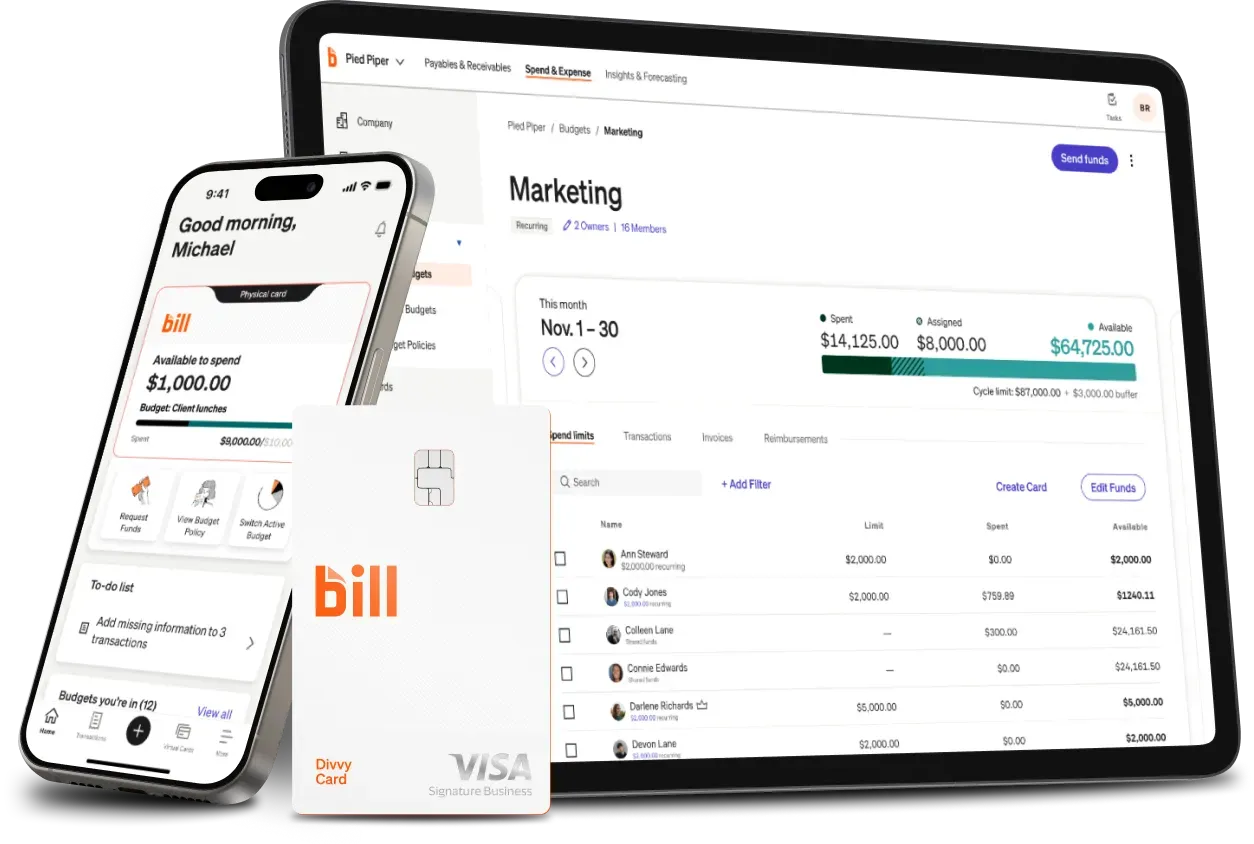

Beyond AP and AR, BILL also integrates spend management through its Divvy corporate card solution (now called BILL Spend & Expense).

This brings an AI-driven approach to company expenses and corporate cards, giving finance teams granular control and visibility over every dollar spent.

BILL Spend & Expense combines a Visa-powered company card program with built-in expense management software, or as the company puts it, “Card first. Software second. Expense reports, never.”

The idea is that employees can spend within approved limits, and the software takes care of the tracking and reporting automatically, virtually eliminating traditional expense reports.

BILL Divvy Card

With the BILL Divvy Card, businesses can issue physical or virtual corporate cards to employees and set custom budgets and limits for each card in advance.

For example, you might give your marketing team a $5,000/month budget on a Divvy card for advertising spend, or issue virtual cards with a one-time limit for specific subscriptions or vendors.

Each purchase on a BILL card is captured in real time on the platform, categorized, and matched with a receipt (employees can snap photos of receipts with the mobile app).

AI-driven auto-categorization and receipt matching mean that as transactions occur, they are automatically coded to the correct expense accounts and tied to the corresponding receipt documentation, with minimal effort from your team.

Finance managers maintain strategic control over spend by configuring policy rules in BILL. You can enforce spend limits by department, vendor, or expense category, and get real-time alerts for any out-of-policy transactions.

In sum, BILL’s Divvy-powered spend module gives SMBs enterprise-grade expense control, from smart corporate cards to automated expense tracking, at no extra cost (the Spend & Expense software is free to use, with the card program).

Embedded credit: On-demand financing

A standout differentiator for BILL is its embedded credit offering. Through the Divvy integration, BILL’s platform can provide businesses with access to a revolving line of credit from as low as $1,000 up to $5 million.

This isn’t a generic referral to a bank loan; it’s a credit line built directly into the BILL Spend & Expense solution, meaning approved companies can draw funds and make purchases within the same system they use for day-to-day finances.

Notably, applying for the BILL Divvy credit line does not require a personal guarantee from the business owner in many cases, unlike traditional SMB credit cards. Instead, credit limits (which can scale as high as $5M) are determined by the business’s financial profile, and the card operates as a charge card (balance paid in full each month) to encourage fiscal discipline.

Having on-demand credit integrated with your AP and expense platform is a game-changer for cash flow management.

BILL’s software makes it easy to request funds and draw on the credit line as needed, and because it’s tied to the Divvy card, you can use it wherever Visa is accepted or simply transfer funds to cover vendor payments.

Moreover, every transaction made using the credit line is tracked in BILL’s platform like any other, so purchases made with borrowed funds are automatically recorded and categorized in your expense ledger.

Final conclusions

BILL’s journey from an AP automation tool to a full-fledged financial operations platform mirrors the evolving needs of SMB finance leaders.

The payoff is huge: teams save countless hours on data entry and reconciliation, gain better control over spending, and can confidently make cash flow decisions backed by real-time data. Automation is not just about efficiency, but also accuracy and security, with BILL’s AI catching errors and fraud signals that humans might miss.

Perhaps most importantly, freeing staff from manual finance chores means they can focus on higher-value work like analysis, strategy, and advising the business. As one BILL report noted, finance professionals are moving from being mere bookkeepers to strategic partners.

By deleting the busywork from the back office, BILL AI agents allow small-business teams to act with the “power and precision” of a Fortune 500 finance department.

For any growing company researching automation, the message is clear: BILL is no longer just AP software; it’s an AI-powered finance ops layer that scales with you, unifying your payables, receivables, expenses, and capital in one intelligent platform.

With over half a million businesses already on board, BILL’s proven suite (from invoice capture and coding suggestions to anomaly detection and autonomous workflows) is transforming how businesses manage money, making financial operations faster, smarter, and ready for whatever comes next.