Mid-sized companies often struggle with tight cash flows: sales are growing, but receivables are slow, expenses are rising, and securing financing can be challenging.

The result is a persistent cash crunch that erodes margins and growth. Finance leaders report that irregular payments, rising costs, and debt service have “compressed margins and cash flow” in many mid-market firms.

Even as companies expect growth, few optimize their cash processes – one study found that only one-third actively manage cash flow, while 94% forecast expansion.

- Unpredictable receivables: Late or partial payments are the norm. Only about 36% of invoices are paid on time, while the majority arrive days or weeks late.

- Rising costs: Inflation has squeezed budgets across the board. In one survey, 77% of firms said rising costs (wages, materials, etc.) are cutting into margins, with nearly half of companies in construction/trades reporting smaller profits due to higher input prices.

- Seasonal and cyclical swings: Many industries see big peaks and troughs. Retailers struggle in off-seasons; services peak at quarter-end. Without reliable forecasting, slow periods can cause cash to dry up.

- Limited financing: When cash runs short, loans aren’t guaranteed. About 77% of business owners worry about capital access, and only half of those who apply get the funding they need. Higher interest rates make borrowing costlier, pushing some to rely on personal credit or high-rate lenders – a perilous stopgap.

Fortunately, this complex challenge can be managed. By adopting a modern, integrated financial platform, mid-market CFOs can transform cash flow from a crisis into a controllable, strategic asset.

Sage Intacct – a cloud financial management solution built for growing businesses – is designed precisely for this. It combines core accounting, automated workflows, and real-time intelligence to help companies see and steer cash across every entity, department, and bank account in one place.

The cash flow crisis reality for mid-market finance teams

Cash flow challenges aren’t just a “small business problem.” They are equally pressing for mid-sized companies, where growth often brings new complexity.

Finance leaders at firms with $5M+ in annual revenue face a different reality: juggling multi-entity consolidations, rising operating costs, and compliance requirements while still trying to maintain healthy liquidity.

Even though the majority of mid-market companies expect revenue growth, surveys show that fewer than half have the tools or processes in place to actively optimize cash flow. Many controllers are watching sales increase, but still operating on the edge of a liquidity cliff.

Here are the four main factors fueling today’s mid-market cash flow crisis:

-

Unpredictable customer payments

Payment delays remain a top pain point, especially for firms with recurring revenue, project-based billing, or international clients. Industry benchmarks show that fewer than 40% of U.S. invoices are paid on time, and mid-sized companies often wait 10+ days past due before collecting.

For finance teams, that means payroll, supplier obligations, and debt service can outpace receivables, straining working capital.

-

Rising operational costs

Mid-market controllers are under pressure from inflation and wage growth, but also from increasing technology, compliance, and supply chain costs. According to recent reports, more than 70% of mid-sized companies cite rising expenses as the leading threat to margins.

When cash outflows accelerate faster than inflows, the lack of real-time visibility leaves finance leaders without room to maneuver.

-

Multi-entity and seasonal fluctuations

Managing cash across multiple subsidiaries, geographies, or business lines magnifies volatility. Peaks and troughs don’t align across entities, making it difficult to maintain a consolidated cash position. Seasonal downturns or cyclical demand add another layer of stress.

Without accurate forecasting and automated consolidations, reserves dry up, and finance teams are left reacting instead of planning.

-

Limited access to efficient financing

While mid-sized companies may qualify for more credit than Main Street businesses, access is far from guaranteed. Only about half of loan applicants in this segment secure the capital they need, and higher interest rates make borrowing costlier.

Controllers often resort to internal transfers, credit lines, or delayed investments, short-term fixes that create long-term risk.

Cash flow management in Sage Intacct

Sage offers a suite of products built to solve one of the biggest pain points for small businesses: cash flow. From lightweight cloud accounting to enterprise-level ERP, Sage tools help owners tackle late payments, poor visibility, seasonal dips, and inefficient processes.

What is Sage?

Sage is a global provider of accounting, payroll, and financial management software designed to help mid-sized businesses manage money, payments, and operations more efficiently.

Ditch the spreadsheets. Run your business with Sage – free to start.

-

Core financial automation

Sage Intacct automates laborious accounting tasks so finance teams focus on cash strategy, not spreadsheets. Its core modules – General Ledger, Accounts Receivable, Accounts Payable, cash management, and more – work together in the cloud.

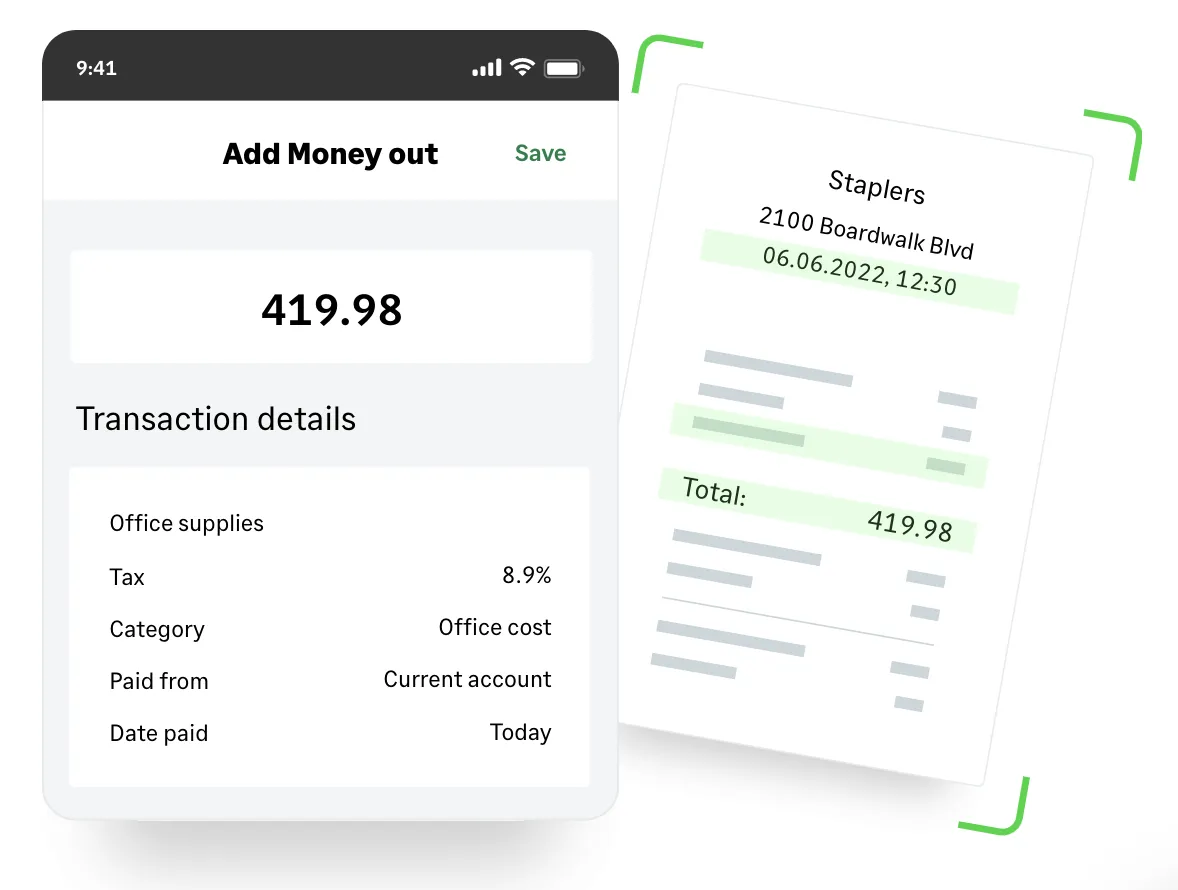

Sage Intacct’s Accounts Receivable automation helps remove billing delays and speeds up collections. On the payables side, Accounts Payable automation saves time on invoice entry and approvals, so teams can focus on optimizing payments.

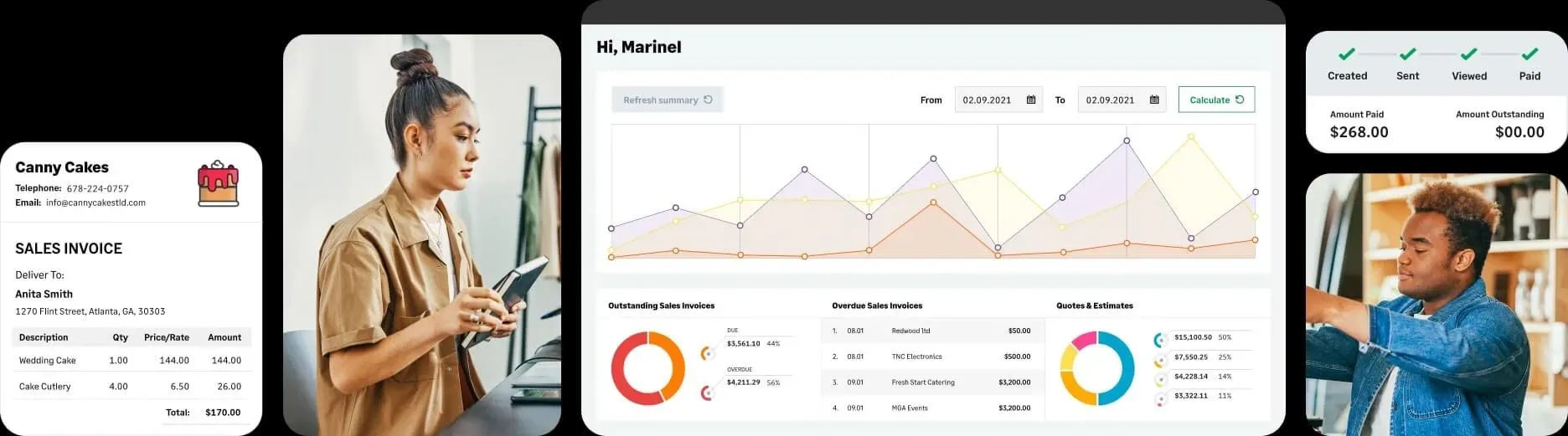

Finance teams can prepare invoices with ‘pay now’ links, send automatic payment reminders, and quickly reconcile bank deposits. As a result, they can reduce days sales outstanding (DSO) and prevent revenue loss.

-

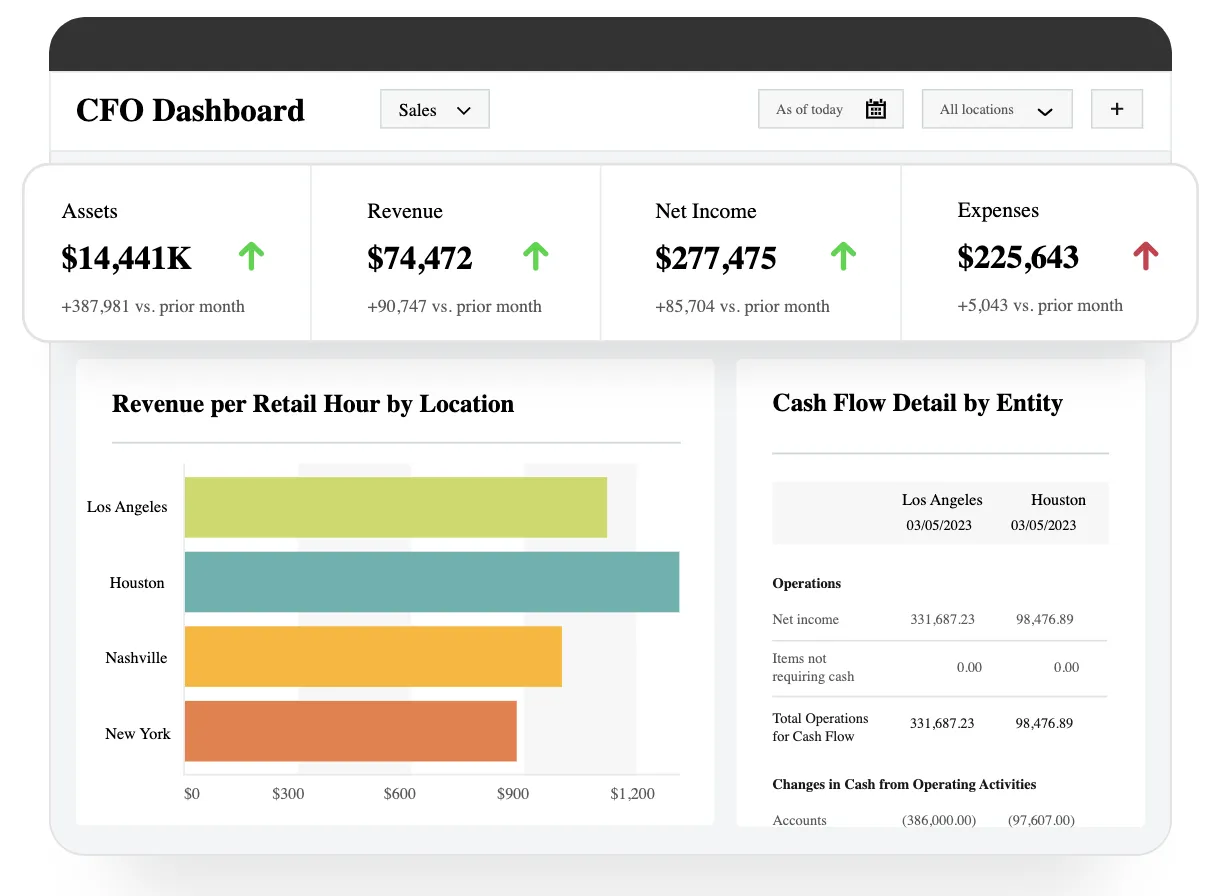

Real-time dashboards & Reporting

With Sage Intacct, financial data updates continuously as transactions occur. The platform offers custom dashboards and reports that roll up multiple entities and dimensions instantly, without waiting for the month-end close.

Sage Intacct gives you a real-time, consolidated view of cash, trends, and key metrics across all entities, with instant access to detailed or high-level dashboards.

Shared data on one platform builds trust in the numbers, while connecting sales, operations, and finance eliminates manual entry errors and provides real-time visibility into customers and transactions.

-

Multi-entity consolidations

Many mid-market firms operate across states or countries, with multiple subsidiaries or locations. Consolidating books can be a nightmare in spreadsheets.

Sage Intacct lets you quickly set up and consolidate new entities, with all branches managed in one shared environment. Inter-entity transactions are automated, and multi-entity consolidation is done instantly, reducing close time from days to seconds. Every consolidation is audit-trailed for transparency and compliance.

-

Cash management & Bank integration

Sage Intacct provides a complete, centralized view of cash. Its Cash Management module pulls in balances and transactions from every checking, savings, or credit card account in real time.

The system supports direct bank feeds to thousands of banks – over 10,000 worldwide according to Sage – so daily transactions import automatically.

Reconciliation becomes a breeze

Sage Intacct matches payments to invoices, flags discrepancies, and lets you post the few remaining items with a click. Automated bank feeds and auto-matching save hours each month and help maintain accurate cash balances.

You can easily keep track of cash flows on screen. Sage Intacct displays all payments and inflows from every account and entity in a single dashboard.

If you need more details, you can look closer by account or location. The software also helps you spot potential fraud by highlighting anything unusual, like unexpected deposits or new vendors, so you can respond before small issues become bigger problems.

Every cash crisis starts with poor visibility. End it with Sage Intacct!

You can get more in-depth with Sage Intacct’s pricing with our full review.

Sage AI: Turning data into cash Flow intelligence

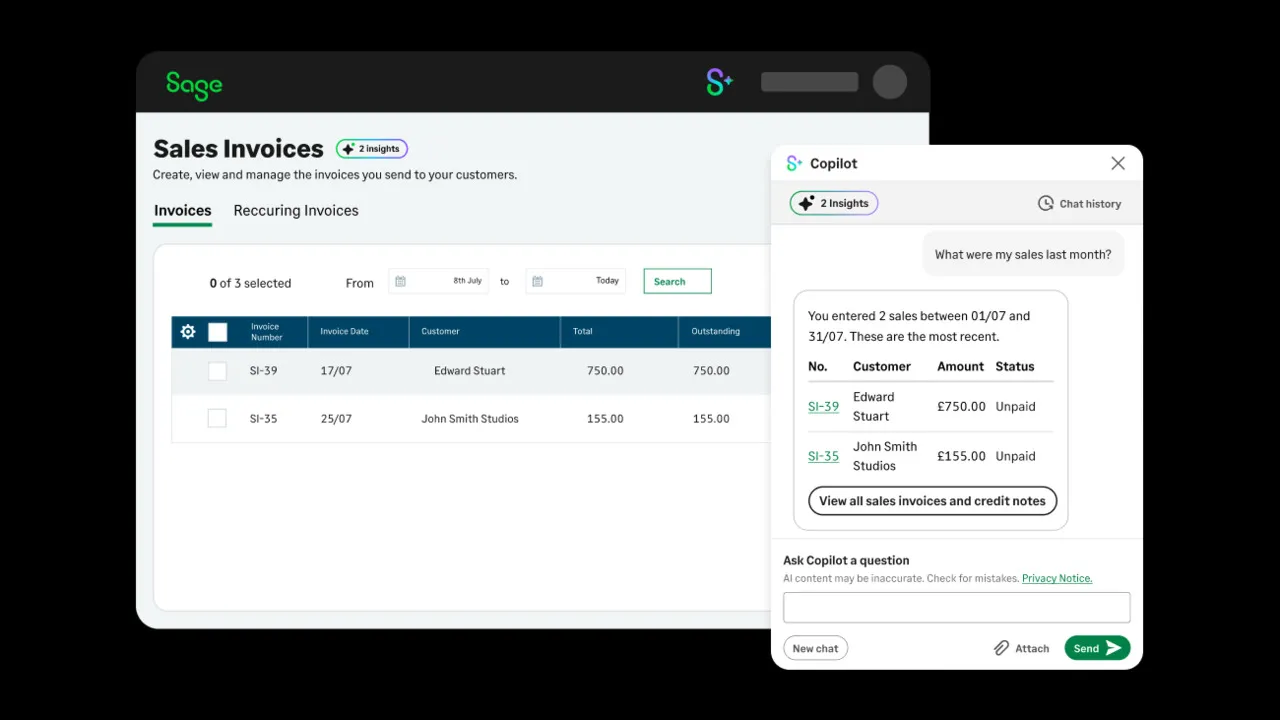

Beyond automation, Sage is investing heavily in AI-powered tools to give mid-sized businesses real financial intelligence. For U.S. companies, Sage AI (including the new Sage Copilot) is embedded in products like Sage Intacct to make cash flow management smarter, faster, and more predictive.

Key Sage AI capabilities

-

Sage Copilot (Generative AI Assistant)

A built-in AI assistant inside Sage Intacct that helps finance teams handle daily tasks. It can summarize reports, flag anomalies, draft communications, and suggest actions. For example, if invoices are trending late, Sage Copilot can highlight the issue and recommend adjusting payment terms or sending reminders.

-

Automated Forecasting

AI analyzes historical transactions, seasonality, and customer payment patterns to generate cash flow forecasts with higher accuracy than manual spreadsheets. This helps owners anticipate shortfalls weeks in advance and prepare funding or spending adjustments.

-

Smart Invoicing & Collections

Sage AI can predict which customers are likely to pay late by analyzing payment history, then adjust reminder timing or suggest stricter credit terms. It turns collections into a proactive process, rather than a reactive chase.

-

AP Bill Automation & Outlier Detection

AI scans incoming bills and ledger entries to auto-categorize transactions and flag unusual or risky activity. This reduces human error and protects against fraud while maintaining accurate cash records.

-

Real-Time Insights & Alerts

Instead of waiting for month-end reports, Sage AI surfaces cash flow risks or opportunities the moment they appear — e.g., “Customer X is likely to pay late” or “You have enough surplus to pay suppliers early.”

Why it matters for cash flow

For business owners, cash flow stress usually comes from not knowing enough, soon enough. Sage AI changes that by:

- Predicting risks before they become crises.

- Automating repetitive admin (like invoice chasing).

- Providing data-backed recommendations for smarter decisions.

These AI features, especially Sage Copilot and machine-learning automation, are available to businesses using Sage Intacct today. That means finance teams can benefit immediately from AI-driven forecasting, collections, and reconciliations, built directly into their existing Sage workflows.

How Sage’s cash flow tools solve common pain points

By leveraging the above Sage products and features, businesses can directly address their biggest cash flow pain points:

- Late payments: Automated invoicing, online payment links, and collections workflows speed up receivables.

- Poor visibility: From Sage Accounting’s dashboards to Intacct’s real-time reporting, owners always know their cash position.

- Seasonal gaps: Forecasting tools help plan reserves or arrange credit before slow periods hit.

- Inefficient processes: Bank feeds, automated billing, and reconciliation save hours each month and eliminate manual errors.

Integrations & Ecosystem of Sage Intacct

Cash visibility is only as good as the data flowing into the system. Sage Intacct boasts a rich integration ecosystem, connecting financials to banks, CRMs, payroll, and more:

- Banking & Payments: Sage Intacct’s Bank Feeds (partnered with providers like Fiserv) pull in settled transactions nightly. It also links with payment processors (PayPal, Stripe, Square, etc.), so receivables post instantly when customers pay online

- CRM (Salesforce): By integrating with Salesforce (native connector built by Sage Intacct), sales and finance share a single source of truth. The biggest benefit is elimination of duplicate data entry – finance sees real-time customer and transaction data from the CRM.

- Payroll & HCM: Payroll is often a black box for finance. Sage Intacct offers a full-service Payroll powered by ADP solution. This syncs all payroll entries, liabilities and employee data into Intacct in real time.

- Other integrations: The Sage Intacct Marketplace offers dozens of connectors. For example, e-commerce platforms (Shopify), procurement systems, and expense tools can push data into Intacct. Third-party apps for project management or inventory sync with Intacct’s transactions.

Compliance & Accountability

Mid-market companies often face regulatory and audit pressures as they grow. Sage Intacct helps them stay compliant with robust controls and audit trails:

-

SOX and Audit Readiness

For public companies or firms eyeing an IPO, Sarbanes-Oxley (SOX) compliance is critical. Sage Intacct is designed for SOX: it enforces strong internal controls (segregation of duties, approvals, etc.) and logs every change.

In practice, Intacct’s dashboards and reports generate the financial statements and disclosures CFOs need, and role-based access ensures only authorized staff post entries.

-

Revenue Recognition (ASC 606)

For companies with contracts, subscriptions, or multiple deliverables, revenue recognition rules can be complex. Sage Intacct includes a revenue management module that fully supports ASC 606 (and IFRS 15) out of the box.

You can define revenue recognition templates that automatically allocate and amortize revenue based on contract terms. Intacct’s tool “removes the complexity” of revenue accounting by automating compliance tasks.

-

Other regulations

Sage Intacct is secure and SOC-validated, helping with data protection compliance. Its audit trails also cover tax (e.g. sales tax automation) and industry-specific rules.

In short, Sage Intacct not only makes day-to-day cash management easier; it also makes finance teams more confident that their books can withstand scrutiny.

Turning insight into action with Sage Intacct

When you use Sage Intacct, cash flow becomes a strength instead of a challenge. With accurate data and automation, mid-sized businesses can start planning instead of just responding to problems.

Sage Intacct offers forecasting and planning tools, including AI-powered Copilot assistants, that help you see your cash position weeks or months in advance by analyzing real invoices, orders, and payment trends. If a risk comes up, such as a customer who might pay late, the system can alert you and recommend steps like adjusting credit terms before any issues arise.

Implementing these changes follows a clear path. Finance teams can start by measuring current cash metrics – DSO, days payable outstanding, and cash conversion cycles – using Intacct’s dashboards.

From there, they configure the system.

As the company grows, it shifts from reacting to problems to planning. Treasury teams can view cash forecasts and plan borrowing or investment decisions early.

Controllers close the books more quickly, often in just a few days, because of real-time data and automated journal entries.

Executives receive up-to-date KPIs like cash burn rate and liquidity ratios to help shape their strategy.

So, what are the next steps?Final Verdict on cash flow management

Managing complex cash flow challenges can be easier than you think. Many mid-market finance leaders now use Sage Intacct to bring their financial data together, automate consolidations, and get real-time insights that older systems just can’t offer.

Sage Intacct gives you one clear view of your cash, with current balances, automated bank reconciliations, and detailed reporting in one place.

Finance teams considering a new system should explore Sage Intacct’s capabilities: request a demo, run live reports, and see how multi-entity consolidations close in minutes.

With automated workflows and real-time dashboards guiding every decision, you’ll have the clarity and agility needed to navigate cash flow challenges in the mid-market.

Commit to modernizing your cash flow management, and set your business on a course for stability and success.