- Global payments can make or break your international expansion.

- Fragmented payment methods and currency issues hurt conversions.

- 2Checkout’s 2Sell module unifies international payment processing and improves authorization rates.

- Optimizing global payments boosts conversions and customer trust.

- Streamlining multi-currency checkout helps businesses scale globally.

Selling globally is exciting until you hit the wall of complex payment issues: fragmented local methods, multiple currencies, and compliance hurdles. Many merchants expanding internationally see revenue slip away due to failed transactions, hidden fees, or clunky checkout experiences.

The good news is, you can turn payments from a barrier into a growth driver by using the right tools and strategies. In this article, we explore how 2Checkout’s 2Sell module simplifies international payment processing, reduces friction, and helps you optimize global payments to increase conversion rates across borders.

What are global payments?

Global payments refer to online transactions between buyers and sellers in different countries. These involve handling multiple currencies, navigating various local banking systems, and complying with regional regulations.

A well-optimized global payment system enables businesses to:- Accept payments in multiple currencies: Let customers pay in their home currency.

- Support local payment methods: Offer region-specific options (e.g. local cards, e-wallets).

- Handle tax, fraud, and compliance automatically: Manage VAT/sales tax, fraud screening, and regulatory requirements behind the scenes.

In short, a robust global payments strategy forms the foundation of successful worldwide e-commerce.

Why global payments matter for international merchants

Optimizing payments isn’t just a technical necessity; it’s a conversion driver for merchants expanding internationally. Every failed transaction, missing local payment option, or surprise conversion fee can cause shoppers to abandon their cart.

By streamlining your international payment process, you remove friction and inspire customer confidence — two keys to higher global conversion rates.

Key benefits of optimizing global payments with 2Checkout (now Verifone)

- Unified checkout across markets: 2Checkout centralizes multi-currency, multi-language checkout in one platform. Merchants can manage all transactions in one place, simplifying back-end operations while keeping the customer experience consistent across regions.

- Increased authorization rates: 2Checkout’s 2Sell module uses smart routing to find the most efficient payment path for each transaction, which reduces declines and improves overall success rates.

- Localized experience for higher trust: Shoppers prefer familiar payment methods and paying in their own currency. 2Checkout provides a localized checkout in each market—supporting over 45 payment methods and 100+ currencies across 200+ countries—to ensure a seamless, trustworthy customer experience.

- Simplified compliance & Fraud management: 2Checkout has built-in fraud prevention and tax compliance tools, so merchants automatically adhere to local regulations without needing extra integrations. This reduces risk and administrative burden when selling globally.

- Mobile-optimized checkout: With mobile commerce booming, 2Checkout’s checkout is responsive and optimized for smartphones and tablets, helping maintain high conversion rates on mobile devices.

What is 2Checkout (now Verifone)?

Common challenges in global payment processing

Expanding globally comes with a host of payment challenges, such as:

- Exchange rate fluctuations and currency conversions – Constantly changing rates can impact pricing and margins.

- Limited local payment options – Some markets have only a few popular payment methods, and not offering them can limit sales.

- Complex regulations – Navigating diverse laws (PSD2 in Europe, GDPR for data, local tax rules, etc.) adds compliance overhead.

- Higher fraud risk – International transactions face increased fraud and chargeback risks.

Each of these issues can lead to lower payment approval rates and lost revenue. The key to overcoming them is to use a payment solution that unifies and automates global checkout operations, handling the complexity behind the scenes.

How 2Checkout (now Verifone) simplifies global payments

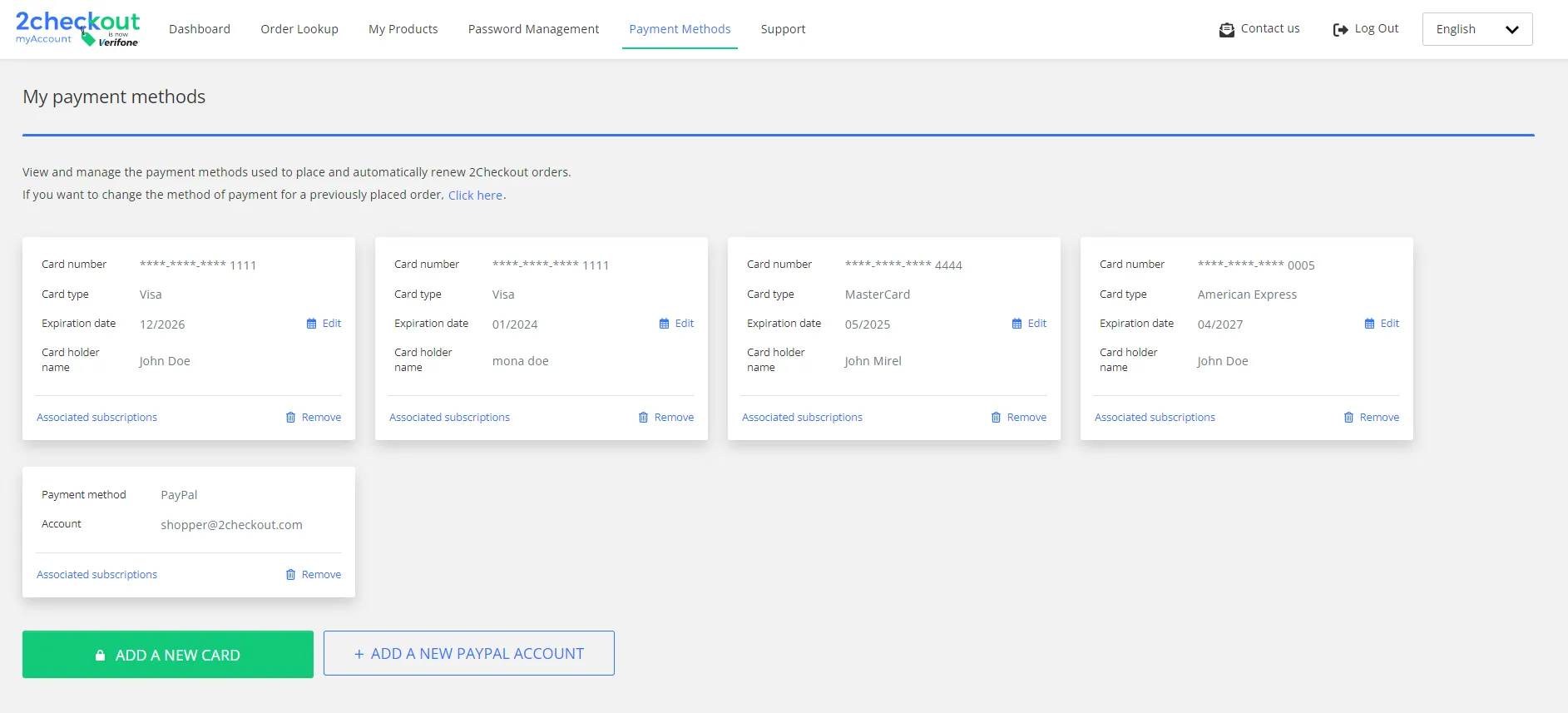

2Checkout’s 2Sell module streamlines global payment operations as you enter new markets. It supports all major credit/debit cards, PayPal, and integrates with 120+ shopping carts (Shopify, Wix, and more), allowing you to accept payments online and via mobile in over 200 countries.

Most importantly, 2Checkout delivers a localized checkout for each customer, displaying prices in their currency, offering familiar local payment methods, and speeding up transactions.

This localized approach directly boosts conversion rates by making international customers feel at home during checkout.

Turn every currency into revenue!

Behind the scenes, 2Checkout handles the heavy lifting of cross-border payments for you. It provides advanced fraud detection, automatic tax/VAT handling, and ensures compliance with regional regulations.

It also offers secure international payouts in multiple currencies, simplifying how you receive funds. In short, 2Checkout (now Verifone) turns international payment processing into a easy, reliable system, so you can maximize global sales and expand across borders with confidence.

How brands optimize global payments with 2Checkout

Many companies have leveraged 2Checkout to power their global sales. For instance, e-learning platform Mondly, form-builder SaaS 123FormBuilder, and software company Copernic all use 2Checkout to streamline international payment processing.

By using features like localized checkout pages, automated subscription renewals, and built-in compliance, 2Checkout’s 2Sell module helped these brands reduce payment friction, enter new markets faster, and significantly improve conversion rates across borders.

Tips to increase conversion rates

- Localize and test your checkout: Tailor the checkout experience for local audiences. Run A/B tests on different languages, layouts, and payment options to see what works best in each region.

- Be transparent with pricing: Clearly disclose all costs (taxes, fees, currency conversion rates) upfront. Unexpected charges at payment time erode trust and lead to cart abandonment.

- Add trust signals: Include elements like clear return policies, money-back guarantees, and security badges (e.g. SSL, PCI compliance logos) on your checkout page. Visible trust cues reassure customers, especially first-time international buyers.

- Stay compliant: Make sure you meet regional laws and standards (e.g. PSD2 for European payments, GDPR for customer data, PCI DSS for card security). Compliance not only avoids penalties but also signals to customers that their information is safe.

- Monitor & Optimize: Regularly review your payment funnel metrics (authorization rates, abandonment rates, etc.). Identify where international customers drop off and use those insights to continually refine your checkout process.

Future trends in global payments

Rise of Instant Payments & Digital Wallets: Expect more consumers to use real-time bank transfers and mobile wallets (Apple Pay, Google Pay, Alipay, etc.) for online purchases worldwide.

AI-Powered Fraud Prevention: Payment providers are increasingly deploying AI and machine learning to detect fraud in real time, making global transactions more secure and reducing chargebacks.

Hyper-Localized Experiences: The push for frictionless checkout will continue with even more localization, offering region-specific payment options, languages, and personalized UX to each market’s preferences.

Global Expansion of BNPL:Buy-Now-Pay-Later options (BNPL) are growing in popularity across regions. Shoppers around the world are adopting installment payment services (like Klarna, Afterpay) for greater flexibility, so global merchants will integrate more of these options.

Final verdict on global payments

Global payments are more than just a technical necessity, they’re a catalyst for conversion and growth. When optimized properly, your payment system can increase customer trust, open the door to new markets, and improve cash flow for your business.

By leveraging tools like 2Checkout’s 2Sell module to offer smooth, localized checkouts, merchants can simplify compliance and payment operations while boosting conversion rates internationally. Don’t let fragmented payment processes slow down your global expansion.

Start selling globally.

Start optimizing your global payments strategy today, and let a platform like 2Checkout handle the complexity while you focus on scaling your business.

Finally, remember to explore other SaaS tools and payment solutions that can support smarter growth and help you sell globally. With the right payment infrastructure in place, nothing can stop your business from reaching customers worldwide.