As a finance leader, choosing between Sage Intacct vs NetSuite from Oracle often comes down to whether you need a finance-first system or a broad all-in-one ERP. Both are cloud-native platforms, but they have fundamentally different focuses.

Sage Intacct was built specifically for accounting and financial management (indeed, its name comes from “intelligent accounting”), while NetSuite is a complex business suite that covers everything from CRM to supply chain. This question frequently comes up for mid-market companies looking to modernize.

I find that the key is aligning the software’s strengths with your core business needs.

Sage Intacct vs NetSuite – financial management and reporting

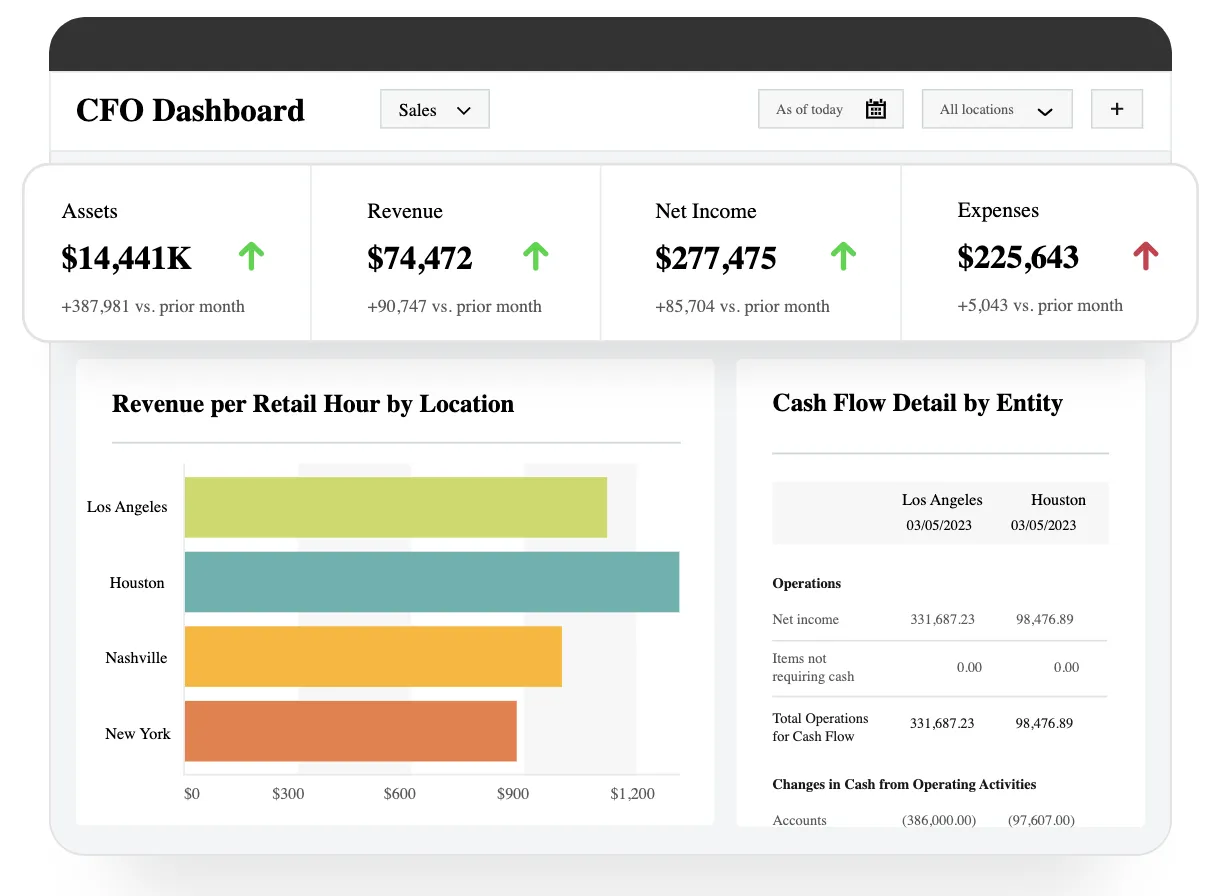

Sage Intacct shines in core accounting and finance features. It offers a powerful multi-dimensional general ledger, advanced consolidation and audit trails, and automation features that accountants love.

For example, Sage Intacct provides AI-driven outlier detection in the GL and automated month-end close tools, which help CFOs close the books faster and more accurately. The platform was even endorsed by the AICPA for its GAAP compliance capabilities.

In short, Sage Intacct handles complex financial processes – like project accounting, cash flow management, subscription billing, and inter-company eliminations – through built-in modules or add-ons.

Simplify SaaS finance with Sage Intacct!

NetSuite

NetSuite also has a strong financial core, but it is part of a broader suite. It provides real-time multi-entity consolidation, advanced budgeting, and native revenue recognition support across subsidiaries and currencies.

NetSuite’s ledger is less “multi-dimensional” than Sage Intacct’s (meaning fewer on-the-fly pivot dimensions) but supports built-in global consolidation and reporting.

For many companies, NetSuite’s finance tools are sufficient and are tightly integrated with its other modules. However, in head-to-head terms, Sage Intacct tends to offer deeper finance-focused features (like more robust outlier analytics and a truly flexible chart of accounts) than NetSuite’s standard accounting module.

- Accounting focus: Sage Intacct is built for finance, with deep accounting, reporting, and automation capabilities. NetSuite includes these, too, but as part of its larger ERP suite.

- Reporting: Intacct’s reporting engine is built on its GL dimensions, giving finance teams flexible, real-time views of the business. NetSuite provides hundreds of standard reports and dashboards, but combining financial and operational data may require more configuration.

- Audit & Compliance: Sage Intacct has continuous close processes and audit trails tailored for accountants. NetSuite offers strong compliance features as well, but Sage’s partnership with AICPA highlights its finance pedigree.

Verdict

Sage Intacct vs NetSuite – operational scope & integrations

The next consideration is what other business functions you need to support. NetSuite is a full ERP – it includes native modules for inventory, manufacturing, CRM, HR, e-commerce, and more.

Sage Intacct, by contrast, is finance-first and relies on partnerships or add-ons for non-financial functions.

Here’s how they compare:-

CRM

Sage Intacct has no built-in CRM. Companies usually integrate it with Salesforce or another CRM system. NetSuite, on the other hand, includes a native CRM (with sales automation, customer service, and marketing) that is fully integrated into the ERP.

-

HR & Payroll

Sage Intacct integrates with leading payroll and HR solutions to give finance and HR leaders a unified view of their workforce. You can streamline payroll, manage employee data, handle benefits, and maintain compliance. NetSuite offers SuitePeople as a built-in HR/payroll module, so payroll and employee data flow directly within the platform.

-

Inventory and Supply Chain

Sage Intacct includes basic inventory tracking (suitable for simple stock management) but lacks a full warehouse or manufacturing module. Advanced supply-chain features (e.g., MRP, barcode scanning, lot tracking) require third-party integrations.

NetSuite natively covers inventory management, order processing, procurement, and warehouse management.

-

E-commerce and POS

NetSuite offers SuiteCommerce for B2B/B2C online sales and has built-in POS. Sage Intacct has no native e-commerce; integrations with platforms like Shopify are possible but require connectors.

-

Integrations

Both systems offer open APIs and marketplaces. NetSuite’s SuiteApp marketplace has hundreds of prebuilt apps (600+), while Sage Intacct’s marketplace is smaller (~50). In practice, this means NetSuite often has a ready-made solution for specific needs, whereas with Sage Intacct, you may need to build or buy an integration.

Verdict

Multicurrency, multi-entity, and global operations

For companies operating in multiple geographies or with many legal entities, NetSuite’s global ERP functionality is notably stronger out of the box.

NetSuite OneWorld provides real-time consolidation, roll-ups, and currency translation for multiple subsidiaries. It supports 27 languages, over 190 currencies, and compliance with tax rules in 100+ countries. For an expanding company, this can eliminate a lot of manual effort.

Sage Intacct also supports multi-entity accounting, but its global features are more limited. It typically requires separate modules or licenses for international consolidation and currency management.

For example, Intacct’s base offering handles multiple U.S. entities, but adding VAT/GST or doing automatic intercompany eliminations across countries may require additional subscriptions. In practice, Sage Intacct can manage multi-entity accounting well on a national level (especially within the U.S.), but multi-national operations may be more complex to set up.

Features

- Consolidation: NetSuite consolidates in real time across all entities. Sage Intacct requires a separate consolidation module for multi-entity reporting.

- Currencies: NetSuite handles any currency natively (190+ supported). Sage Intacct’s multi-currency support exists but is more limited and may involve manual steps.

- Legal Entities: NetSuite includes subsidiary management in its core product. In Sage Intacct, each additional company or subsidiary often carries its own license fee. Sage’s pricing and licensing model means each legal entity can add to the cost.

Verdict

Mid-sized U.S. companies with straightforward entity structures can use Intacct effectively, but those with complex global footprints tend to favor NetSuite’s built-in international support.

Implementation, usability, and support

Another factor is how quickly and easily each system can be adopted.

Sage Intacct’s finance-centric design usually makes it simpler for accounting teams. Its modern interface and focus on ease-of-use have led to strong user satisfaction.

In my experience, this means finance staff often learn Sage Intacct faster. Sage releases updates four times a year, frequently adding improvements requested by customers, which keeps the system fresh for financial users.

NetSuite implementations tend to be more involved because of the platform’s breadth. NetSuite has many global VARs and consulting partners, whereas Sage Intacct has a slightly smaller but focused partner network.

Sage’s own professional services team is limited, so Sage Intacct projects usually rely on specialist integrators; NetSuite also typically goes through a partner for implementation.

Verdict

Sage Intacct vs NetSuite – pricing and total cost of ownership

Pricing varies greatly based on company size, modules, and contracts. So, there is not much to say about their pricing as it’s custom for both companies, and you have to request a custom quota.

Yet, both systems charge additional fees for modules and services. NetSuite includes more functionality in its base, but each extra user and suite (OneWorld, SuiteCommerce, etc.) adds cost.

Sage Intacct may seem cheaper at first, but costs can escalate: every extra legal entity, module (like revenue recognition), or integration may incur another license fee.

Implementation and customization are also costs. NetSuite’s SuiteSuccess program promises a fixed-cost approach, giving predictable implementation fees. Sage Intacct does not have an equivalent flat-fee rollout package; consulting costs depend on the system complexity and third-party tools needed. In general:

Verdict

Learn more about Sage Intacct pricing with our editorial review.

Final verdict on Sage Intacct vs NetSuite

In the end, the best fit depends on your priorities. For a finance-led mid-market company, I often conclude that Sage Intacct is the better match. Its specialist focus means your accounting and reporting will be world-class, and you can integrate other functions as needed.

Sage Intacct’s strong usability and AICPA-backed accounting framework mean less “clutter” and a more controlled upgrade path for finance teams.

On the other hand, if your business must have built-in CRM, inventory/warehousing, global tax, and other operational modules under one roof, NetSuite is designed for that scenario.