Involuntary churn – the loss of subscribers due to failed payments or technical issues – is a silent killer of subscription revenue.

Many SaaS and subscription businesses focus heavily on product improvements and customer service to reduce voluntary churn. Yet, up to 40% of customer churn can happen involuntarily, without the customer ever intending to leave.

This hidden leak can cost companies an estimated 9% of their annual recurring revenue on average. In other words, you could be losing a full month’s worth of growth each year to failed payment issues.

Even worse, once a customer is lost to a payment failure, only about 5% ever resubscribe.

The good news? Involuntary churn is highly preventable with the right approach and tools.

What is involuntary churn?

Involuntary churn occurs when a customer’s subscription ends unintentionally, usually due to payment failures or other issues outside the customer’s control. In contrast to voluntary churn (when customers actively cancel their subscriptions), involuntary churn happens even when customers want to continue their service.

Essentially, these are happy customers who get cut off from your product because the payment couldn’t go through.

Common causes of involuntary churn include:

- Expired credit cards: The customer’s card has expired, and they haven’t updated the details.

- Insufficient funds: The charge was declined because the customer’s account didn’t have enough funds at the time.

- Declined transactions: The bank or card issuer rejects the charge due to suspected fraud, regional restrictions, or other processing errors.

- Technical issues: Payment gateway errors or integration glitches that cause a valid payment to fail.

- Communication breakdowns: The customer wasn’t aware their payment failed (missed emails or notifications), so they didn’t resolve it in time.

This is why involuntary churn is often called the “silent” or “hidden” revenue killer: it silently erodes your customer base and revenue without the usual red flags of dissatisfaction.

Why involuntary churn hurts your revenue

Losing customers who actually want to stay is painful for several reasons:

- Revenue loss: Involuntary churn directly cuts into your recurring revenue. Industry research shows failed payment churn can make up 20–40% of total churn for many subscription businesses.

- High customer acquisition cost (CAC) wasted: You’ve already spent resources to acquire and onboard these customers. When they churn involuntarily, that acquisition investment is wasted.

- Low reactivation rates: Unlike a voluntary cancellation (where you might win a customer back with improvements or incentives), involuntary churn often goes unresolved. Only ~15% of failed payments get recovered with basic retry and email attempts, and a mere 5% of customers will proactively resubscribe later if you do nothing.

- Customer experience damage: Involuntary churn can catch customers by surprise – suddenly losing access to a service they rely on. This can frustrate customers and erode trust.

- Hidden growth impediment: Because involuntary churn is less visible (customers aren’t explicitly contacting you to cancel), companies often overlook this “leak” in the bucket. They focus on acquiring new customers and reducing voluntary cancellations, while unknowingly losing a chunk of subscribers silently.

Strategies to reduce involuntary churn

Preventing involuntary churn requires focusing on payments and processes: making sure customer payments go through successfully, and intervening quickly when they don’t.

Smart payment retry logic

Retrying payments at better times often succeeds. Intelligent retry rules adjust attempts based on failure reason, card type, or timing, which can lift recovery rates by 15–25%.

2Checkout (now Verifone) automatically retries soft declines up to six times and recovers about 20% of transactions that would otherwise be lost. Varying intervals and times help capture even more revenue.

Account updater services

Expired or replaced cards drive much of involuntary churn. Account updater tools automatically refresh card details and can cut these failures by roughly 30%.

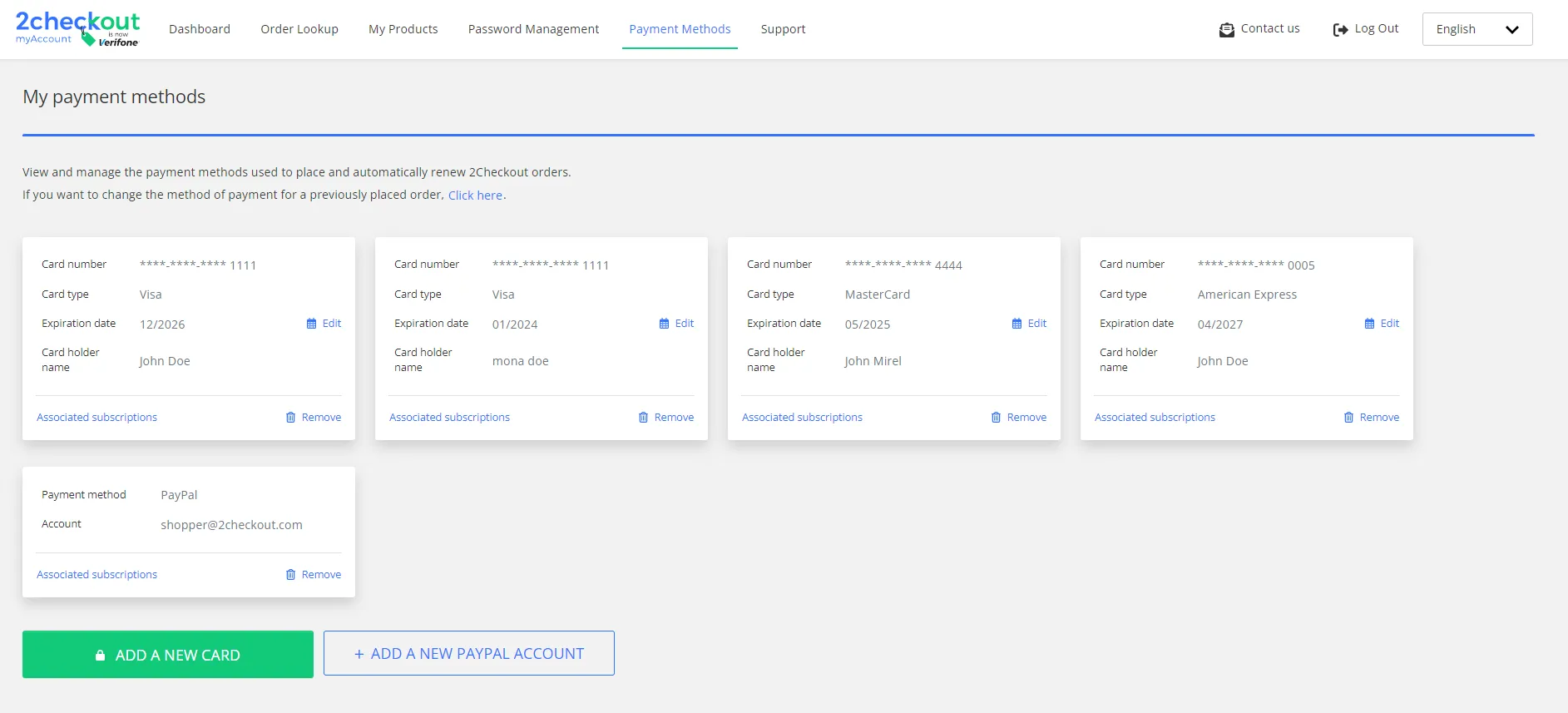

2Checkout’s account updater handles this behind the scenes and can lift retention by up to 40%, even identifying and updating expiring cards before the charge fails.

Multiple payment methods and currencies

Offering alternatives like debit, direct debit, PayPal, or digital wallets reduces friction when a card fails. Billing in the customer’s local currency also boosts approval rates.

2Checkout now Verifone supports 45+ currencies and local methods, which can raise authorization success by up to 25% and lower abandonment tied to unexpected currency issues.

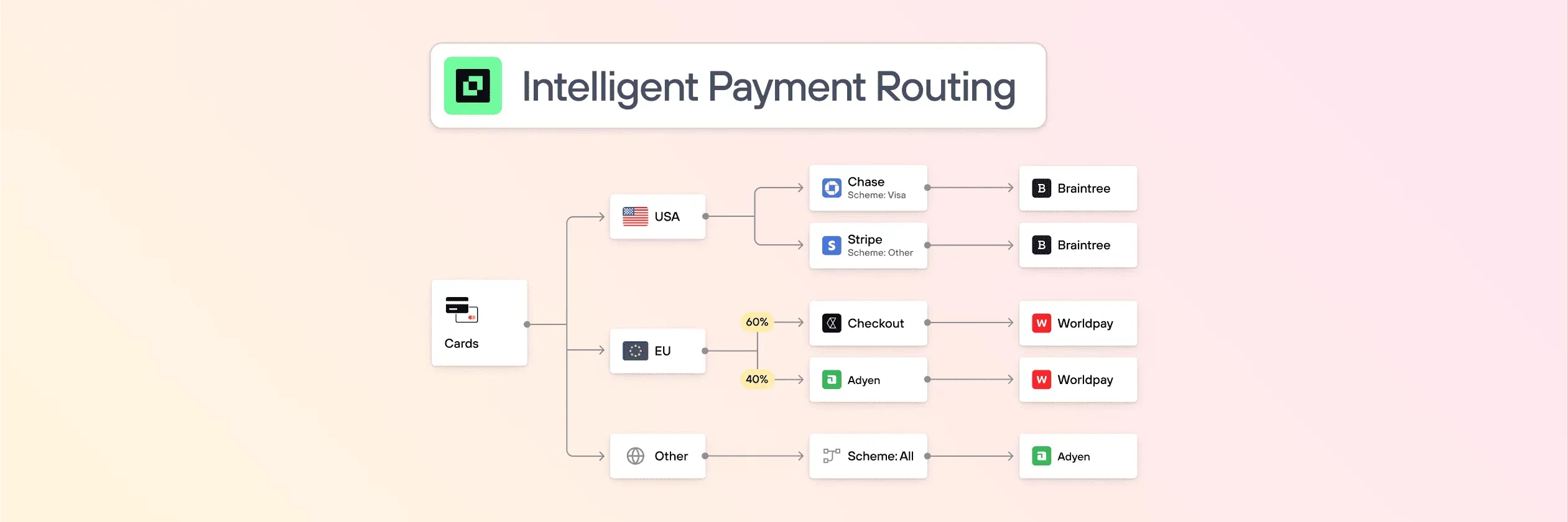

Intelligent payment routing

Some processors perform better for specific regions or card types. Routing transactions through the most suitable gateway improves approvals, and using backup gateways on retries salvages additional sales. 2Checkout routes transactions dynamically and can add 2–5% to global approval rates, with far higher gains in markets that benefit from local routing.

Dynamic 3D secure

3D Secure helps where fraud risk or regulation requires it, but using it selectively avoids unnecessary friction. Dynamic application increases approvals in high-risk regions without hurting clean transactions. 2Checkout’s adaptive 3DS reduces false declines and the churn they create.

Proactive dunning & customer communication

Most customers do not notice a failed payment unless you tell them. Automated reminders via email, sms, or in-app messages, paired with a quick link to update payment details, significantly raise recovery.

2Checkout sends automated notices for hard declines, adding about a 1% uplift in renewals. Strong dunning processes can reach 85%+ recovery, far above the 15% achieved by simple single-email attempts.

Monitor, measure, optimize

Track your involuntary churn rate and payment recovery rate. Look for patterns by region, card type, or timing, then refine your retry schedule or add missing payment methods. 2Checkout’s reporting tools, including an authorization rate dashboard, give merchants visibility into what works and where to adjust.

Overall impact

How 2Checkout can help as an all-in-one solution

You might be thinking, “These strategies sound great, but implementing them seems complex.” This is where a platform like 2Checkout (now Verifone) can be a game-changer.

Try 2Checkout free and stop involuntary churn now!

2Checkout provides an out-of-the-box suite of revenue recovery tools designed specifically to combat involuntary churn. Rather than building your own dunning emails, integrating multiple gateways, or contracting with card networks individually,

2Checkout’s 2Recover solution (part of their subscription billing platform) has these features built in for you:

Global payment localization

2Checkout supports 100+ currencies and many local payment methods, with multi-currency pricing and local processors to boost approval rates. In Europe, you can use SEPA and local card processing; in Brazil, routing via a local acquirer can raise approvals by up to 40%. This broad coverage cuts declines caused by currency or payment method mismatch.

Intelligent retries and routing

The platform automatically retries failed payments on an optimized schedule, up to six times, and can reroute transactions through a backup gateway if the first one fails. This smart retry and failover logic increases recovered payments without manual work from your team.

Card updater & Expiry management

2Checkout’s account updater pulls fresh card data from networks and proactively handles expired cards. It identifies cards that are about to fail and updates them so renewals still go through. Subscriptions continue without interruption, leading to visibly higher retention.

Dynamic 3D secure & fraud tools

2Checkout applies 3D Secure dynamically, using extra authentication only when it reduces risk or is legally required. This approach controls fraud and regulatory compliance while avoiding unnecessary friction, which helps keep legitimate payments from turning into involuntary churn.

Automated dunning emails

After a failed payment, 2Checkout sends branded, configurable emails with direct links to a secure self-service page where customers can update their details. You control timing and messaging, and the platform handles delivery. This proactive outreach is crucial for recovering from hard declines.

Analytics and expert guidance

With advanced authorization reports and other analytics, 2checkout shows decline rates, recovery performance, and the impact of its tools so you can optimize your strategy. As a merchant-of-record, it also brings best practices to help you reach higher-than-average recovery rates.

Final verdict on involuntary churn

Involuntary churn is often referred to as “the hidden revenue killer” for subscription businesses, but it doesn’t have to remain hidden. By understanding its causes and implementing smart, automated strategies, you can dramatically reduce involuntary churn and boost your subscription revenue.

The easiest way to get these capabilities is to use a complex subscription billing platform like 2Checkout, which has all the tools to combat involuntary churn built in.

Claim your free 2Checkout deal and boost retention!

With 2Checkout handling your payment recovery – from updating expired cards to smart routing and customer outreach, you can stop involuntary churn in its tracks and keep more of your hard-earned recurring revenue.

The result is happier customers, steadier cash flow, and a healthier subscription business overall.Don’t let involuntary churn sneak up on your business. Shine a light on this silent killer, equip yourself with the right tools, and turn those “lost” renewals into retained customers. Your subscribers (and your bottom line) will thank you for this.