Modern companies are facing an ever-expanding landscape of regulations and security standards. Keeping up with compliance is no longer a once-a-year checklist exercise; it’s now a continuous effort woven into daily operations.

This shift toward continuous compliance means organizations aim to be “audit-ready” at any given moment, rather than scrambling at the last minute before an annual audit.

By adopting continuous compliance practices, businesses reduce the stress of audit season and build stronger security postures year-round.

Traditional compliance methods often involved periodic audits and reactive fixes. Teams would rush to gather documents and patch gaps right before an audit, leading to stressful crunch times.

In contrast, continuous compliance is proactive and ongoing: companies monitor their controls and address issues in real time.

This approach ensures that compliance requirements are met consistently, and it turns compliance from a periodic project into a fundamental part of everyday business processes.

What is continuous compliance?

Continuous compliance is the practice of monitoring and maintaining adherence to regulatory requirements, industry standards, and internal policies on an ongoing basis.

In simple terms, it means staying compliant 24/7, not just during an annual audit or a quarterly check.

Instead of relying on one-off audits, organizations practicing continuous compliance are always up-to-date on their compliance status and can quickly fix any issues as they arise.

With continuous compliance, all departments, from IT and security to HR and finance, stay aligned on compliance obligations.

Automate your compliance journey with Copla!

This means no more huge last-minute efforts to assemble paperwork; evidence is collected and stored continuously, and everyone knows their role in keeping the organization compliant.

The result is a company that is always prepared for an audit or assessment, with far less operational disruption.

Why modern companies embrace continuous compliance

Modern businesses are turning to continuous compliance because it offers significant benefits over traditional compliance approaches. Some key advantages include:

- Proactive issue detection: Continuous compliance helps catch and fix compliance problems early, before they snowball into serious incidents or audit findings.

- Reduced manual workload: Automating compliance tasks relieves the burden on small teams. Continuous compliance programs use tools to collect evidence, track controls, and enforce policies automatically.

- Always audit-ready (less stress and cost): When compliance is continuous, audit preparation becomes much easier. Companies that perform regular internal compliance checks throughout the year tend to have lower compliance costs.

- Stronger security posture: Continuous monitoring of compliance often translates to better security. By detecting violations or control failures faster, organizations can strengthen their security controls and reduce the risk of breaches.

- Credibility and trust: A business that can demonstrate ongoing compliance builds more trust with customers, partners, and regulators. Rather than just claiming to be secure, continuous compliance provides evidence at any time that data is handled properly and controls are in place.

Challenges in achieving continuous compliance

Implementing continuous compliance is beneficial but not without challenges. Many organizations struggle with issues like:

-

Siloed data and tools

Compliance information often lives in many disconnected systems (security tools, HR databases, cloud platforms, etc.). If these tools don’t integrate or provide a unified dashboard, teams waste time gathering data and may miss real-time visibility into their compliance status.

-

Manual processes that don’t scale

Running a compliance program on spreadsheets, email threads, and shared folders becomes unsustainable as an organization grows. Manual processes are error-prone and can turn into bottlenecks, making it hard to respond quickly to issues.

-

Resource and skill gaps

Not every company has a dedicated compliance officer or team. Often, compliance is an added responsibility for someone with another full-time role. Continuous compliance requires a mix of legal, security, and technical expertise, which can be tough for small teams to maintain.

In many cases, compliance ends up becoming “someone’s side job” for an overburdened employee.

-

Evolving requirements and resistance to change

Regulations and standards are continuously changing – new laws take effect, and frameworks get updated regularly. Shifting from a reactive, annual audit mindset to continuous compliance can also meet internal resistance from teams accustomed to old processes or wary of new automation.

-

Third-party risks

Modern businesses rely heavily on vendors and service providers, each of which may introduce compliance risks. Managing compliance across a diverse vendor network adds complexity.

Without centralized oversight of third-party security practices and data handling, it’s easy to overlook a vendor-related gap that could impact your compliance standing.

How to implement continuous compliance

Transitioning from periodic compliance checks to a continuous model requires a strategic approach.

Here are some best practices and steps that modern companies use to embed continuous compliance into their operations:

1. Establish a baseline

Begin by understanding your starting point. Identify all the regulatory frameworks, standards, and internal policies that apply to your business (e.g., SOC 2, ISO 27001, GDPR, HIPAA).

Assess your current compliance posture against these requirements – which controls do you already have in place, and where are the gaps?

This baseline assessment will guide your continuous compliance plan.

2. Automate wherever possible

Manual work can slow down and hinder continuous compliance. Leverage technology to automate compliance processes such as tracking policy updates, collecting evidence, and monitoring controls across your IT and cloud environments.

Automation might include using scripts or tools to run security configuration checks, gather system logs for evidence, or flag non-conformities in real time.

3. Define ownership and accountability

Compliance is a team sport, not just the responsibility of a single department. Assign clear owners for controls and policies throughout the organization.

When everyone knows their role, and there are structured workflows for accountability, it’s easier to maintain compliance continuously.

4. Monitor continuously and respond fast

Set up continuous monitoring of your controls and key risk indicators, with alerts for any deviations. This could involve automated control tests, continuous vulnerability scanning, or real-time compliance dashboards.

The key is to get immediate visibility into any compliance drift or security issue so you can remediate it quickly. A fast response to identified issues prevents small problems from becoming major violations.

5. Review and improve regularly

Continuous compliance isn’t a “set and forget” effort; it requires periodic review and adaptation. Establish a cadence for reviewing compliance status (e.g., monthly risk assessments or quarterly compliance meetings).

Use these reviews to update your risk register, adjust controls or policies as the business evolves, and incorporate any new regulatory changes.

Essentially, build a feedback loop so that your compliance program gets continuously refined and strengthened over time.

Think of it as moving up a maturity curve: starting with understanding requirements and gradually layering in more automation, better processes, and regular improvements.

How Copla powers continuous compliance

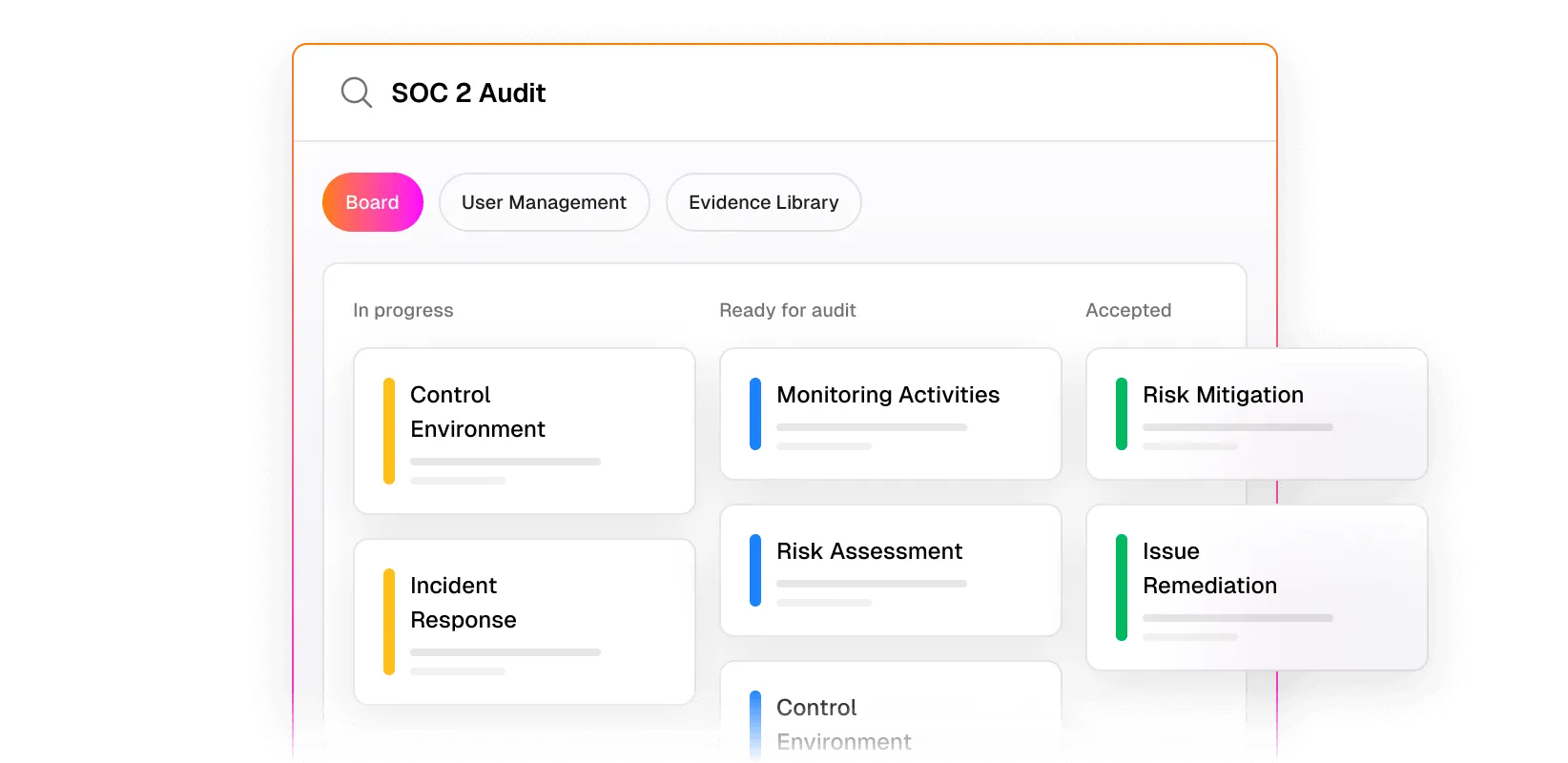

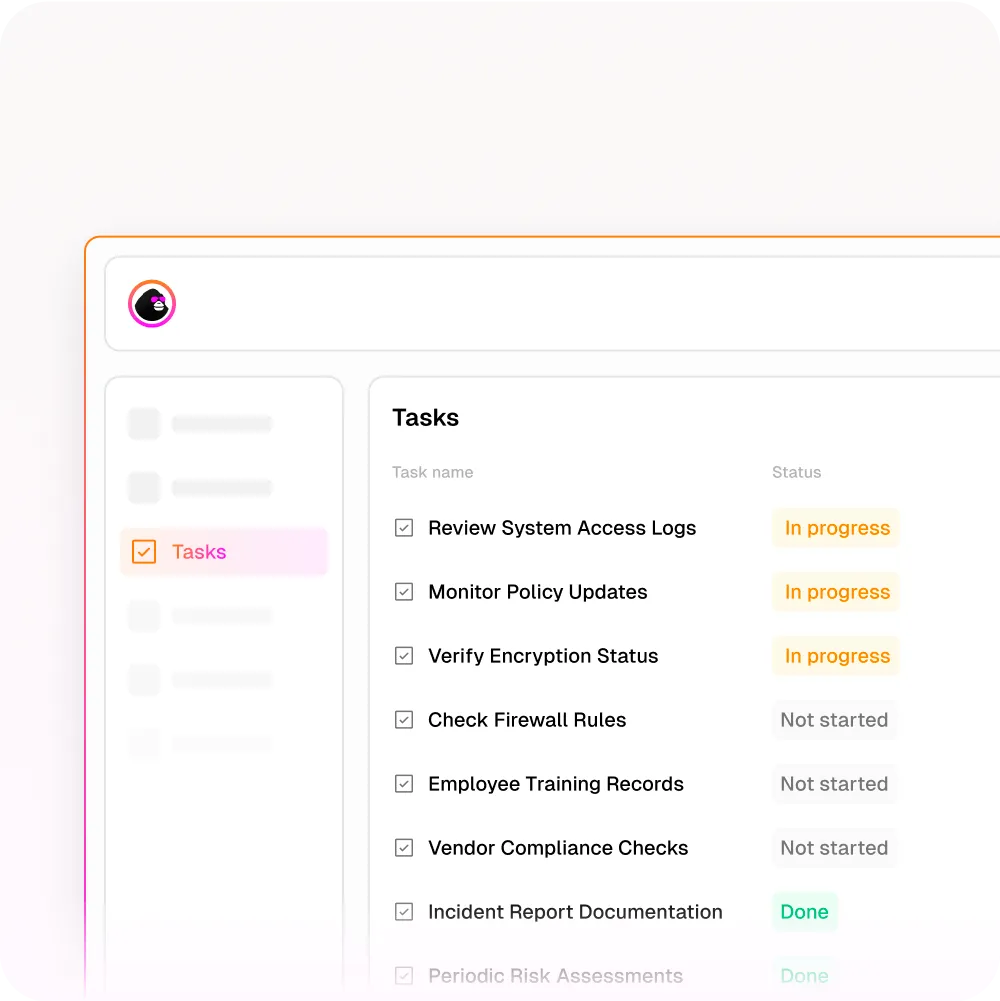

Continuous compliance depends on automation and integrated technology. Manual processes slow teams down and make audit readiness a quarterly sprint. Copla changes that by turning compliance into an ongoing, automated activity.

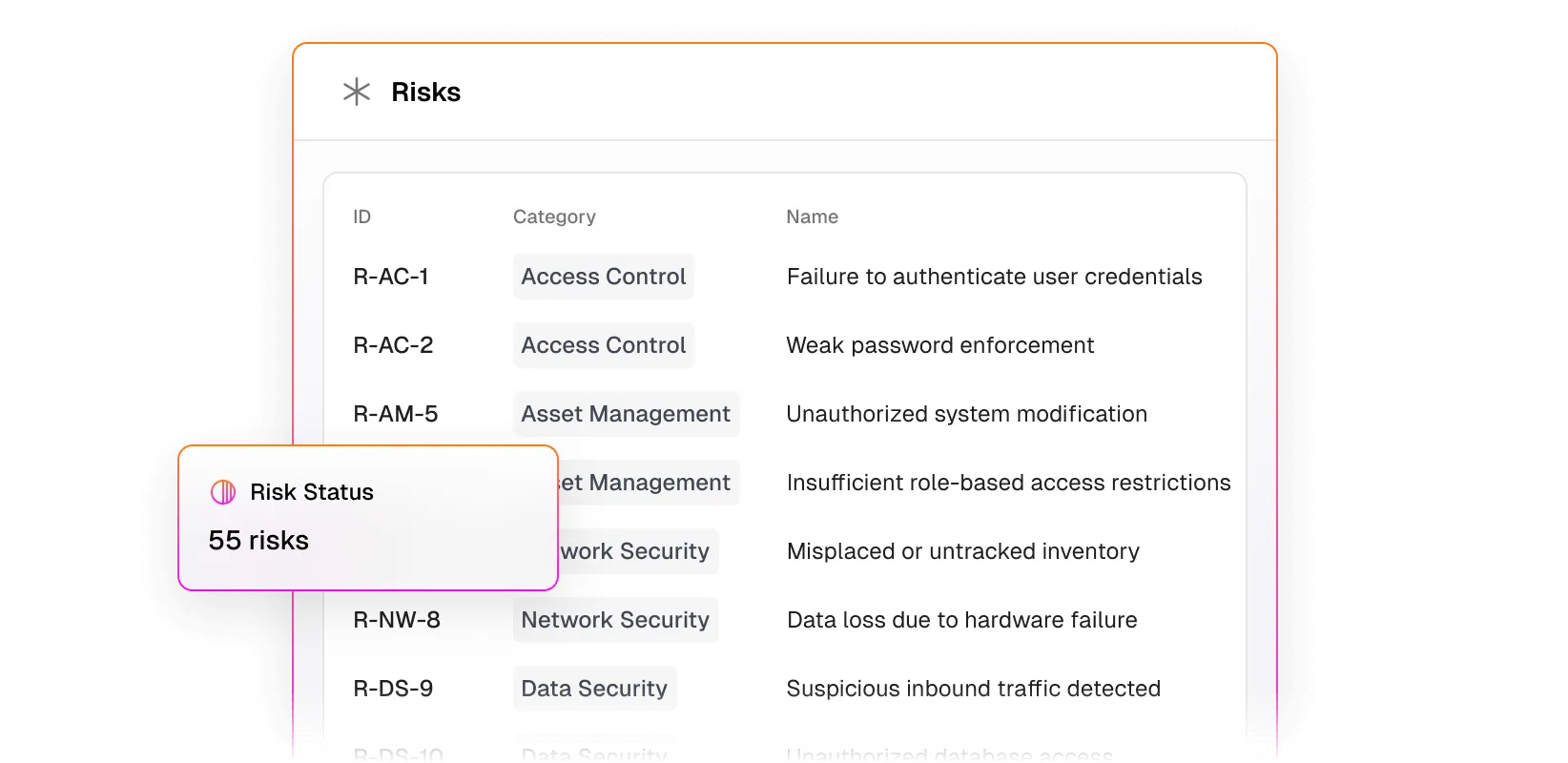

Copla acts as a central compliance hub where workflows, controls, evidence, and risk data live together. It continuously collects audit-ready evidence from cloud environments, collaboration tools, identity systems, and security scans.

This automated evidence-collection engine means documentation is always up to date without manual pulling of logs, screenshots, or spreadsheets.

Copla stores evidence in a structured repository that auditors can access directly, cutting hours of prep work.

Real-time monitoring is built into Copla.The platform tracks control status and flags deviations as they happen. If a configuration drifts from policy or a periodic access review is overdue, Copla sends alerts and assigns tasks so teams can fix issues early, not weeks after they occur. Alerts integrate with workflows to ensure accountability and faster remediation.

See Copla do the work!

Instead of separate point tools, Copla bundles continuous compliance capabilities into one platform. It maps controls automatically to frameworks such as SOC 2, ISO 27001, DORA, GDPR, and NIS2, saving time on cross-framework correlation and evidence reuse.

Prebuilt, customizable workflows guide teams through required actions, and Slack or Teams integrations bring compliance nudges directly into daily workstreams.

Copla also pairs intelligent automation with expert guidance. Fractional CISOs help shape compliance strategy, prioritize risks, and refine controls.

This hybrid model ensures that automation doesn’t just run tasks; it reinforces best practices and reduces up to 80 % of manual compliance effort, freeing teams to focus on core business goals.

Final conclusions

Continuous compliance is rapidly becoming the standard for how modern companies approach regulatory and security requirements.

It’s not just a trend but a response to a world where threats and rules are constantly evolving. In fact, continuous compliance isn’t just a better way to manage audits; it’s how leading teams remain resilient and earn trust from their customers.

The journey to continuous compliance may seem daunting, but it pays off in resilience and peace of mind. With the right mindset, processes, and supporting tools (like automated compliance platforms such as Copla), any company can transform compliance from a burden into a strength.

Modern companies that embrace continuous compliance find that they can adapt faster to change, reduce risk, and confidently prove their security posture at any moment, all while saving time and resources in the long run.