Preparing for a compliance audit can easily drain six figures in time and resources, and still fail. Most companies spend 6–9 months chasing spreadsheets, policies, and screenshots, only to discover too late that their evidence is incomplete or inaccurate.

A startup spent three intense months preparing for SOC 2, only to fail because 62% of their evidence was error-ridden, a painful but common story.

The six “Deadly Sins” of compliance preparation

Far from dramatic breaches or blatant negligence, most audit failures come down to preventable missteps in preparation.

Here are six common failure points that derail first-time audits:

-

Poor management buy-in

Senior leadership sets the tone for compliance success or failure. If top management isn’t fully invested in the compliance program, audits can unravel quickly.

ISO 27001 auditors, for instance, interview executives to gauge their engagement and have ended audits early due to inattentive or poor management buy-in.

Lackluster support from the C-suite leads to insufficient resources, low employee participation, and an overall culture that doesn’t take compliance seriously.

Get leaders on board early. Successful companies kick off initiatives with leadership defining clear compliance objectives, allocating budget, and championing the effort so that everyone knows it’s a priority.

-

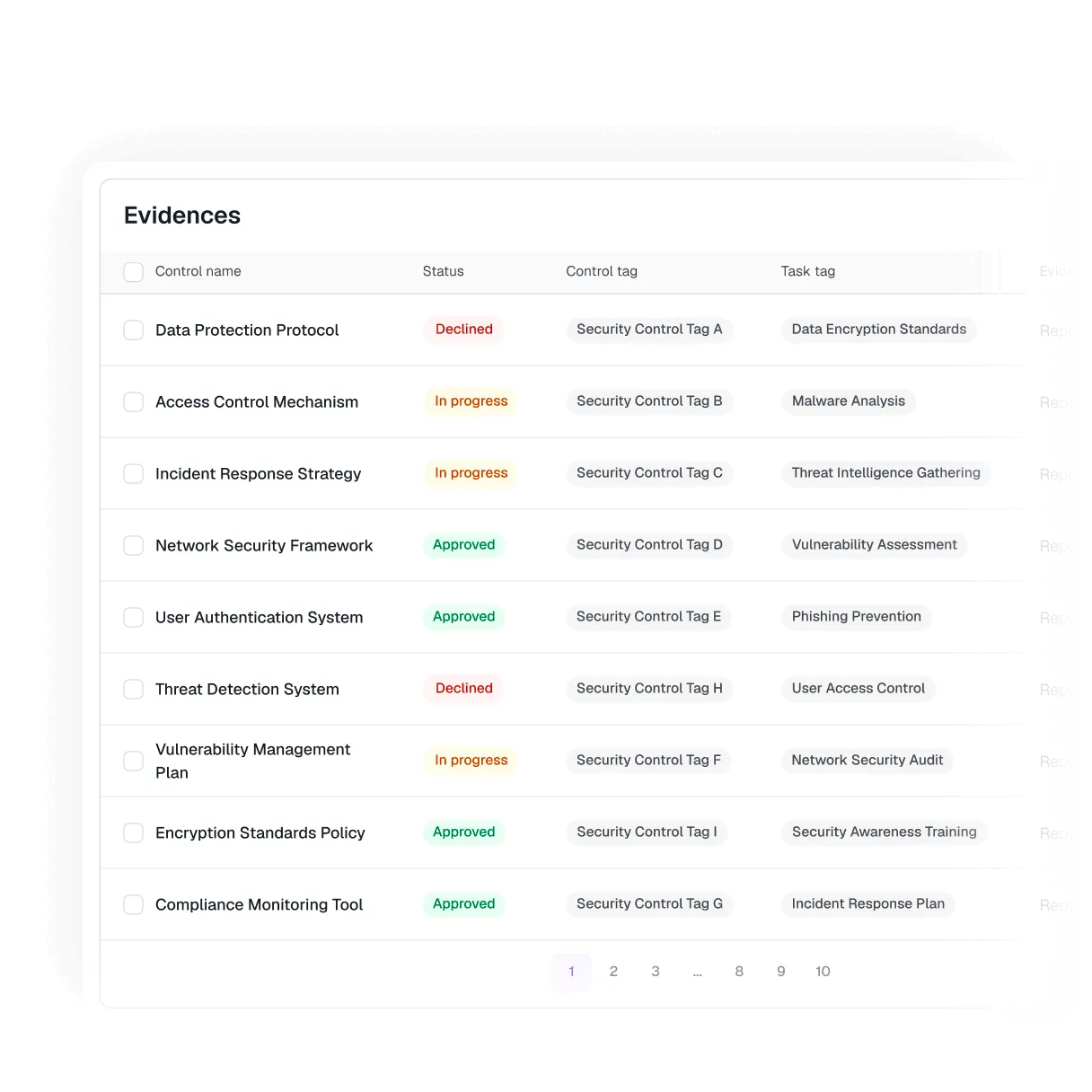

Incomplete or missing documentation

“If it isn’t documented, it doesn’t exist.” This auditor mantra underscores how vital documentation is to any audit. A common rookie mistake is underestimating the sheer volume of policies, procedures, and records needed.

You might have strong security practices, but without evidence on paper (or a digital file), an auditor cannot give you credit. Missing documents are such a showstopper that an ISO 27001 audit can effectively end on the spot if the required artifacts aren’t produced.

In fact, stage one of an ISO 27001 audit is essentially a thorough document review – and more than one company has failed at this stage for having documentation gaps.

-

Manual process errors

Human error is the bane of audit preparation. Relying on spreadsheets, email reminders, and ad-hoc efforts to collect evidence often leads to inconsistencies and mistakes.

In fact, “errors and inconsistencies resulting from repetitive manual processes” are cited as the #1 compliance challenge businesses face. Evidence might be collected from the wrong system, recorded incorrectly, or not collected at all.

By the time the audit starts, teams discover gaps or inaccuracies in their evidence that can’t be fixed in time. All it takes is one missed screenshot or a misconfigured spreadsheet formula to undermine months of work.

-

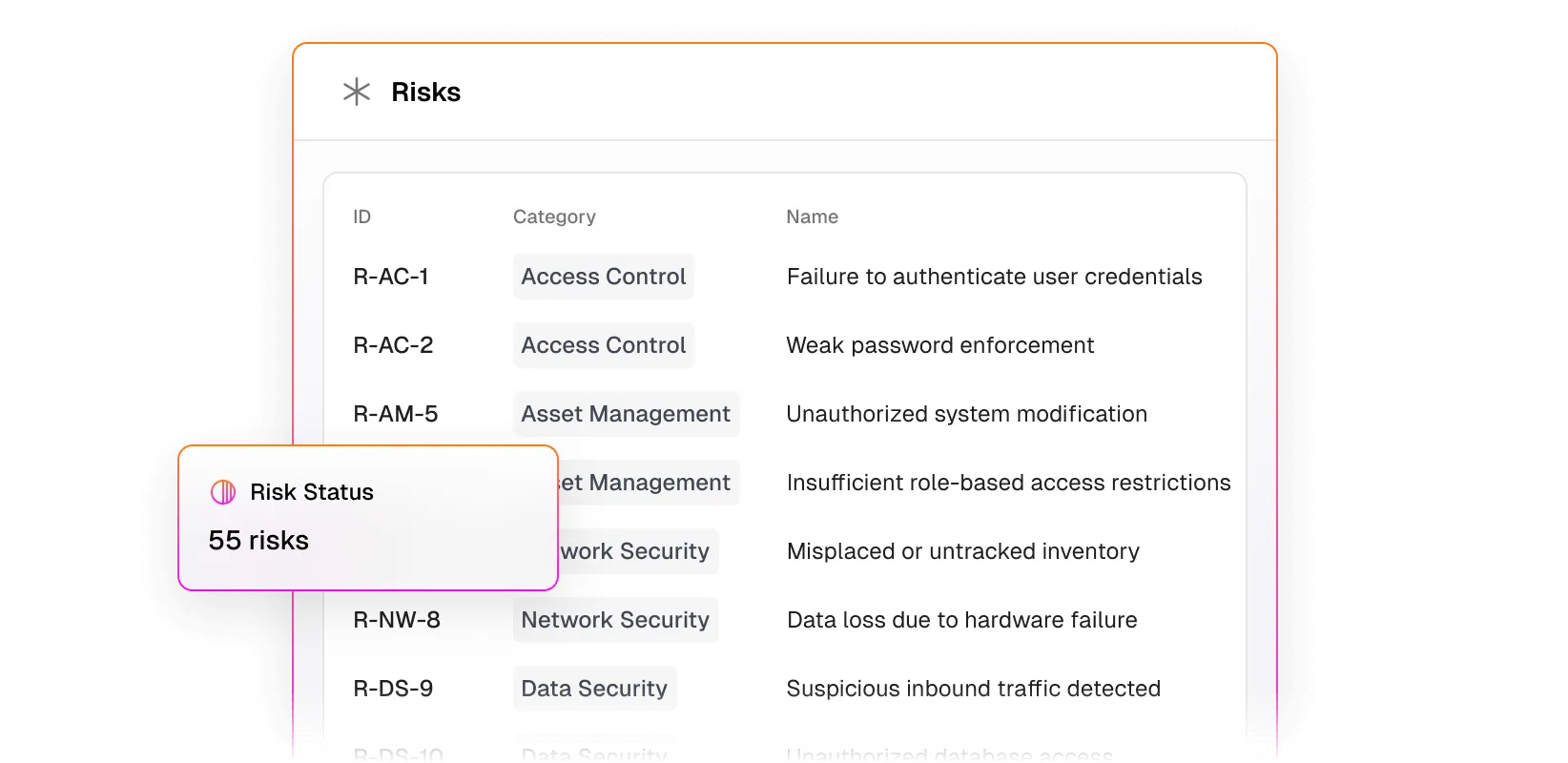

Inadequate risk assessment

Compliance isn’t just about ticking boxes; auditors want to see that you understand and manage your specific risks. Yet risk assessment is often an afterthought. Perhaps it’s rushed to completion, treated as a one-time checkbox, or even avoided altogether out of fear it will surface problems.

This is dangerous territory.

Risk management is a cornerstone of every major framework, from SOC 2 to ISO 27001, and failing to do it properly can sink your audit. Common pitfalls include not maintaining a risk register, neglecting to update risk analyses when the business changes, or ignoring obvious threats in documentation.

Without a structured, up-to-date risk assessment, you can’t prove to an auditor that your controls align with your biggest vulnerabilities.

-

Weak access controls

One of the easiest ways to fail an audit is with weak access controls. If your team still shares admin passwords, skips multi-factor authentication, or never reviews user permissions, auditors will flag it instantly.

These gaps violate core SOC 2 and ISO 27001 principles like least privilege and access management. The fix is simple but often ignored: limit access, enforce MFA, and review permissions regularly.

The best teams centralize everything with IAM or SSO tools, so every login and role change is tracked, creating both stronger security and clean, ready-to-show audit evidence.

-

Lack of continuous monitoring

Compliance isn’t a one-time project; it’s an ongoing process. Many teams treat it like a yearly sprint, scrambling before the audit only to discover missing proof that controls worked over the past 6–12 months.

Maybe encryption was turned on last week, but there’s no evidence it was active all year, a classic “incomplete evidence” failure. Without continuous monitoring, gaps go unnoticed until it’s too late. Modern frameworks now expect real-time, ongoing compliance, not a one-day snapshot.

What successful companies do differently

If the above are the six deadly sins, how do compliance “saints” operate? Organizations that consistently pass audits (or even avoid needing a redo) tend to flip each of those failure points on its head:

-

Top-down commitment

Compliance isn’t relegated to an intern or ignored by busy founders; it’s driven by leadership. Successful teams secure management buy-in early, often by educating executives on the stakes (e.g., lost deals, fines, breaches) and presenting compliance as a competitive advantage.

-

Thorough documentation & Internal audits

Winners in the compliance game maintain an exhaustive paper trail. They leverage templates and checklists to make sure every required policy and procedure is documented well before the auditor asks.

Many conduct a readiness assessment (internal audit) before the real audit, essentially a dress rehearsal to catch missing documentation or control gaps in advance.

Turn audit chaos into clarity. Book Copla’s free demo.

Skipping this step is “arguably the most avoidable (and costly) mistake” a company can make, so successful firms never skip it.

By conducting an internal check (or using a compliance consultant to do so), they surface and fix issues proactively, rather than discovering them during the official audit.

-

Automation of repetitive tasks

The biggest difference between teams that pass and those that panic? Automation.

Instead of engineers wasting weeks chasing screenshots and logs, smart companies use platforms that automatically collect evidence from cloud tools, HR systems, and code repos in real time.

A task that once took hours is now handled in seconds by an API. This shift doesn’t just save time; it removes human error.

Reports show automation can cut audit prep by up to 75%, speeding up certification, reducing costs, and keeping compliance consistent year-round.

-

Continuous control monitoring

Successful companies don’t wait for audit season to see if controls work; they monitor them constantly. From weekly access reviews to automated dashboards that test controls hourly, the focus is on real-time visibility.

Continuous monitoring catches issues like misconfigurations or unpatched servers before they turn into audit findings.

Platforms like Copla take this further with built-in alerts and control testing, keeping teams audit-ready 24/7, not just during crunch time.

-

Expert guidance & Fractional CISO

Even with great tools, having experienced compliance leadership is invaluable. Many startups can’t afford a full-time Chief Information Security Officer (CISO), so they turn to fractional CISO services or consultants for strategic guidance. This has become a secret weapon for audit success.

Platforms like Copla combine automation with human expertise by pairing each customer with a seasoned CISO who provides ongoing coaching.

Essentially, it’s an insurance policy against blind spots – the fractional CISO has seen many audits and knows common pitfalls to avoid. Companies that succeed often credit this mix of smart software and savvy advisors for their smooth audit experiences.

-

Culture of security and compliance

Finally, companies that ace audits tend to foster a culture where security and compliance are part of everyone’s job. Regular training and awareness programs mean employees understand why compliance matters, not just what forms to fill out. Teams practice incident response drills, uphold security policies in daily work, and treat audits as validating their security posture rather than as a nuisance.

Manual vs. Automated Compliance

The gap between manual and automated compliance isn’t just about effort; it’s about money. Manual compliance means long hours, spreadsheets, and consultants billing by the hour.

A mid-sized company can easily spend $60,000+ a year just managing documentation and evidence by hand, not counting the hidden cost of pulling engineers off product work.

And if the audit fails, that bill doubles, with remediation, delays, and another audit on the horizon.

Automation changes the equation. Modern compliance platforms cut prep time by up to 75%, turning six-month audit sprints into a few organized weeks. Instead of chasing screenshots, evidence is collected automatically from your systems, updated in real time, and monitored year-round.

Tools like Copla go further: automating up to 80% of compliance tasks and saving companies over €60,000 annually by replacing manual work with smart integrations and continuous monitoring.

The Result:

90-Day compliance transformation roadmap with Copla

Facing your first compliance audit can feel overwhelming, but with the right system in place, you can go from zero to audit-ready in just 90 days.

Copla was built for this exact journey, combining automation, continuous monitoring, and fractional CISO guidance to help companies pass audits faster and with confidence.

Here’s how a typical 90-day transformation looks when powered by Copla:

-

Days 1–30: Lay the foundation with visibility

Start by running Copla’s automated gap assessment, which scans your tech stack and policies to reveal what’s missing, from untracked assets to outdated security documents. Within days, you’ll see a live dashboard of compliance risks and priority actions.

At this stage, Copla’s fractional CISO team helps align leadership, define scope, and create a practical roadmap based on your target framework (SOC 2, ISO 27001, or DORA).

While most companies spend weeks organizing documents manually, Copla centralizes everything into one workspace, automatically mapping your existing policies and evidence to each control.

By the end of the first month, you’ll have a clear view of what needs fixing and a guided plan to get there.

-

Days 31–60: Automate, Implement, and Monitor

Next comes execution, where Copla’s automation does the heavy lifting. Instead of chasing screenshots or exporting logs, Copla connects directly to your systems (Slack, Teams, AWS, Google Workspace, HR tools, and more) to collect and verify evidence automatically.

Each control’s status updates in real time, and alerts flag any gaps as they appear. During this phase, Copla helps roll out missing security measures like MFA, access control reviews, or risk assessments, ensuring each step is tracked and documented.

By day 60, your major gaps are closed, your environment is continuously monitored, and every piece of evidence is audit-ready, without the manual chaos.

-

Days 61–90: Validate, Review, and Stay Audit-Ready

In the final stretch, Copla’s fractional CISO and built-in readiness reports guide you through a pre-audit simulation. The system reviews every control, highlights weak points, and generates the same kind of evidence packs auditors request. No guesswork, just a clear checklist of what’s ready and what needs polishing.

You can run a mock audit, validate logs, and even share Copla’s dashboard with your external auditor for transparency.

By day 90, your compliance posture isn’t just ready for review, it’s sustainable. Because Copla’s continuous monitoring never stops, your organization remains audit-ready 24/7, not just once a year.

The result? You pass your first audit faster, cheaper, and with far less stress, and you stay compliant every day after.

Final Verdict

At the end of the day, the goal isn’t just to pass a single audit; it’s to build a sustainable compliance posture that keeps you ready 24/7. By avoiding the six common failure points and investing in the right mix of automation and expertise, you can turn compliance from a scramble into a strategic advantage.

Think of platforms like Copla as an insurance policy against audit failure: they combine intelligent automation (to handle the busywork and reduce human error) with seasoned experts (to steer you in the right direction), effectively closing the gap between point-in-time audits and continuous compliance.

The companies that win in this arena are those that treat compliance as an ongoing business function, one that actually strengthens security and trust day by day, rather than a one-off project.

With the roadmap and tools outlined above, you can confidently join their ranks, skip the expensive “fail first” lesson, and ace your audits on the first go.