Novo Reviews

& Product DetailsWhat is Novo?

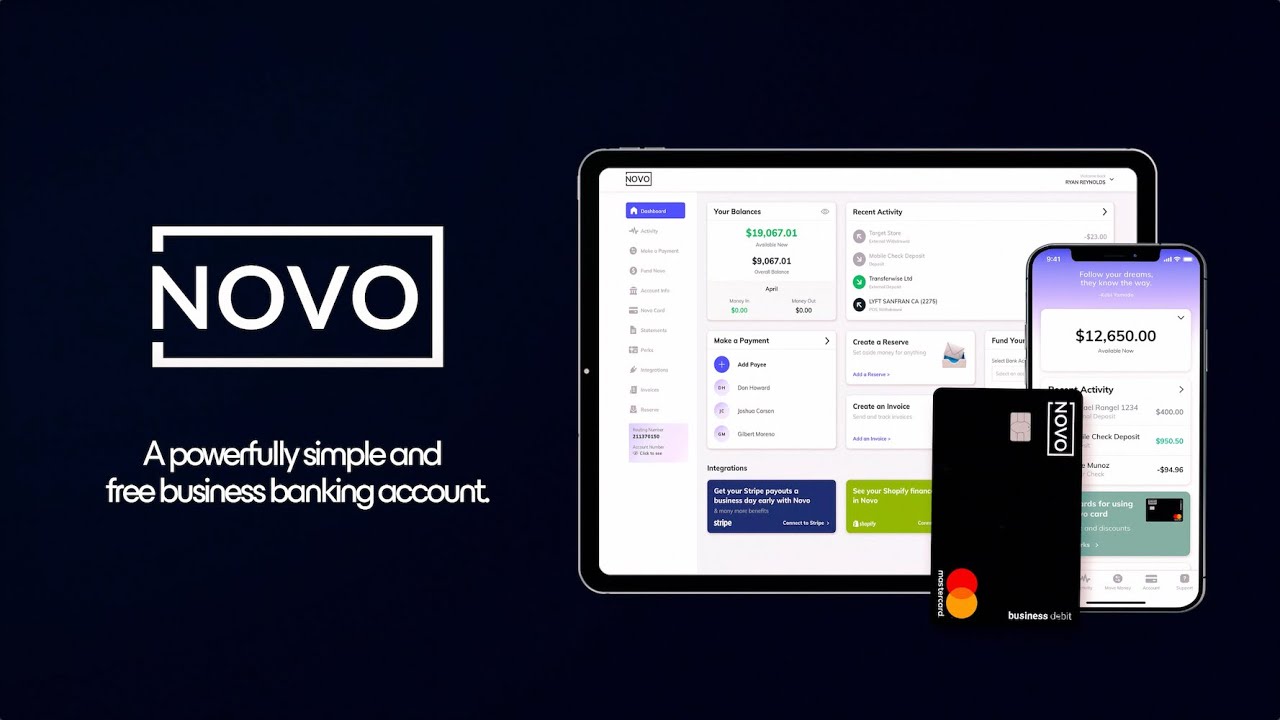

Novo is a modern, digital banking platform tailored specifically for small businesses and entrepreneurs. Designed to simplify business banking, Novo offers a suite of tools and features that cater to the unique financial needs of startups and growing enterprises.

From its seamless business banking services, which include no hidden fees and FDIC-insured accounts, to its efficient invoice management system, Novo ensures smooth financial operations for its users.

The platform also offers integrations with other business tools through Novo Apps, enhancing its functionality and ensuring businesses have everything they need in one place. Additionally, Novo provides exclusive perks and discounts on various business tools and services, further supporting businesses in their growth journey.

With its user-friendly interface and comprehensive features, Novo emerges as a top choice for modern businesses seeking efficient banking solutions.

Best For

- StartUps

- Freelancers

- Small Business

- Medium Business

- Large Enterprise

- Non-profit Organization

- Personal

- Cloud, SaaS, Web-Based

- Mobile - Android

- Mobile - iPhone

- Mobile - iPad

- Desktop - Mac

- Desktop - Windows

- Desktop - Linux

- Desktop - Chromebook

- On-Premise - Windows

- On-Premise - Linux

-

Company Name

Novo Platform Inc.

-

Located In

United States

-

Website

novo.co

Starting from:

FREE

Pricing Model: Subscription

- Free Trial

- Free Version

Pricing Details:

Novo does not charge any fees for any reason on your account - including international ATM fees.

- ACH Payment Processing

- Accounts Receivable

- Accounts Payable

- Biometric Sign-In

- Billing & Invoicing

- Debit/Credit Card Processing

- Transaction History

- Streamlined Onboarding

- Security

- Personalized UI/UX

- Payment Processing

- Payment Gateway

- Online Invoicing

- Mobile Payments

-

User-Friendly Interface

Many users appreciate Novo.co’s clean, intuitive, and user-friendly interface. The platform is designed to make it easy for small business owners to manage their finances, track expenses, and monitor transactions, even if they aren’t financial experts. The mobile app is often highlighted for its seamless functionality and ease of navigation.

-

No Fees for Basic Services

Novo.co is praised for offering free banking services without many of the fees associated with traditional banks. Users enjoy features such as no minimum balance requirements, no monthly fees, and free ACH transfers, which make it cost-effective for small businesses to use the platform.

-

Integrations with Business Tools

One of Novo.co’s standout features is its integration with popular business tools such as Stripe, QuickBooks, Shopify, and PayPal. This makes it easy for small businesses to sync their banking with their accounting or eCommerce systems, helping them streamline operations and reduce manual data entry.

-

Fast and Easy Account Setup

Users often comment on how quick and straightforward it is to open a business checking account with Novo.co. The entire process is done online, and users report being able to set up their accounts within minutes without the need for long paperwork or visiting a physical bank branch.

-

Customer Support

Novo.co’s customer service team receives positive feedback for being responsive and helpful. Many users mention that when they encounter issues or have questions, the support team is quick to provide assistance, whether through chat or email.

-

Limited Banking Features

While Novo.co offers essential banking services, some users find its feature set limited compared to traditional banks. For example, Novo does not offer lending options, credit cards, or interest-bearing accounts. Businesses looking for more comprehensive banking services may need to supplement Novo with additional financial products.

-

No Cash Deposits

One significant limitation users mention is Novo.co’s inability to handle cash deposits. Since Novo operates entirely online, users cannot deposit physical cash into their accounts. This can be inconvenient for businesses that frequently deal with cash, requiring them to use other services to handle those transactions.

-

Mobile Check Deposits Can Be Slow

Several users report that mobile check deposits can be slow, sometimes taking longer than expected to clear. While Novo supports mobile check deposits, the processing time can be a pain point for businesses that need quicker access to funds.

-

No Branch Access

As an online-only bank, Novo lacks physical branches, which can be a downside for users who prefer in-person banking or need certain services that can only be handled in person. While the digital-first approach is convenient for many, it may not suit every business owner’s preferences.

Disclaimer

Here at Tekpon's Global Buzz, we blend AI smarts with a human touch to offer a snapshot of user reviews from the web. While we carefully craft these summaries, please remember they reflect diverse user views and experiences, not Tekpon’s own opinions.

-

QuickBooks Online

Accounting Software

-

WooCommerce

eCommerce Software

-

Slack

Team Collaboration Software

Looking to buy Novo for your business?

Tekpon’s procurement team can help you negotiate a better deal, or suggest more cost-effective alternatives.

Save time and money—starting at just $3,000/year.

Request a Custom OfferIncludes expert support and direct vendor negotiation.

Tell us your opinion about Novo and help others.

Table of Contents

In today’s world, speed is crucial, even in the banking sector. This industry is constantly evolving, and fintech products like Novo are becoming more prevalent, pushing the entire sector towards innovation. In this Novo review, you will discover everything you need to know about this new financial technology.

Novo is an online fintech startup that comes with no monthly account fees and offers free ATM access. Additionally, Novo integrates with several top payment processing and accounting platforms available on the market.

About Novo

Novo was developed in New York back in 2016 by Novo Platform INC. Today the company is based in Miami and has a business partner Middlesex Federal Savings. Furthermore, Novo aims to bring small business checking into the new age. Since 2016 the company has convinced 100,000 small business owners to use its services and received an investment of $41 million to further develop and innovate in the sector.

How to use Novo Startup Banking?

The easy sign-up is sure of the perks of creating an account with Novo for small business owners. Thus, all you have to do to become one of their customers is to:

- Tell them about yourself

- Share your business information

- Get your Novo Account

Reach out to them from any device and create an account.

Above all, if you are a startup or small business owner, we know every penny counts, and flexibility is of great importance to you; this is one of the reasons why several other business owners are in a similar stage of their business.

Benefits of using Novo

- Easily accessible from any device

- Customer service that answers questions in under one h

- No fees on Automated Clearing House Transfers

- Apply in under 10 minutes

Details of Novo Features

Let’s move forward with our Novo review and talk about its features.

Invoicing

Novo allows you to accept debit and credit card payments on invoices through its integration with Stripe. Moreover, the fintech company is also testing a beta version of accepting invoice payments with Square.

Last, Novo will ensure that you are up to date with the invoices that have been paid, and it will automatically send you a notification via email.

Novo Stripe Integration

Now, while you are keen to think that it’s usual and all financial technology companies offer these services, keep in mind that Novo has a deep integration with Stripe and is a verified partner. Some even go as far as saying that they have the best integration available on the market.

Furthermore, when you sign up, you can check your Stripe balance straight from your Novo account while enjoying $20.000 in fee-free processing.

Plan and Budget

Novo has the option of creating five reserves to help you set money aside. For example, you might set money aside for taxes, payroll, and other large business expenses.

Furthermore, it offers the option of instantly moving funds in and out of a reserve. In the future, the financial technology startup will also offer the option to automate funds from your income.

Transfers

Novo offers an innovative feature related to funding your business. So, you can do that straight from your bank account seamlessly. Moreover, the transfer comes with no minimum and no transfer fees.

Checks Deposits

The Novo fintech system allows you to deposit a check straight from your phone.

What is the benefit of doing that? Well, it will save you time and money. So how do you do that? As simple as it can be. All you have to do is take a picture of the check and upload it.

Send Payments

You can easily send payments in the US and internationally from your Novo account powered by its bank sponsor Middlesex Federal Savings F.A.

- Send via ACH & paper checks free of fees

- Send internationally via Wise

- Unlimited transactions free in the US

Card Payments

Novo cards are accepted worldwide and support GPay and Apple Pay. Furthermore, your account is always monitored for suspicious transactions.

Novo, the small business fintech, enables you to withdraw money at any ATM, and they will refund you the fees. Last, you will also receive instant notifications for any transactions the card is used for.

Integrations

While moderate in number, Novo Integrations shine in terms of solutions and functionality. Thus, the platform has other than the best integrations on the market with Stripe integrations with other accounting, e-commerce, and CRM tools.

- Wise

- Slack

- Xero

- Stripe

- Shopify

- QuickBooks

- Etsy

- eBay

Customer Service at Novo

In contrast to other financial technology services, Novo has a great reputation for customer service. In addition, the fintech platform, in contrast to others, offers human-powered customer service and avoids robots. Why is this important?

Above all, you will be able to solve all your problems faster and without an ad of frustration for small business owners.

Novo Review Conclusion

To sum up, Novo is an easy-to-use fintech that truly innovated and made it easier for startups and small businesses to fund and manage their transactions. While the app is focused on SMEs for now, we are an optimist. In a couple of years, larger companies will turn towards these services as they increase productivity and automatization, making processes more scalable.