If you’re a business owner juggling vendor bills, you’ve likely encountered BILL and Melio. Both promise to replace clunky, manual bill-paying with streamlined, digital workflows.

But which platform fits your company’s needs?

I’ll break down BILL vs. Melio in terms of pricing, features, integrations, support, mobile access, and international payments – all updated with the latest information.

By the end, you’ll have a clear sense of whether the feature-rich but pricier BILL or the user-friendly, cost-effective Melio is the better choice to automate your accounts payable and keep your cash flow under control.

Overview of BILL vs. Melio

Before going to the star points of this comparison, it is better to understand a short definition for each platform and some clues that will help you understand why not all tools are for every business.

Ideal business use cases for BILL and Melio

If you are deciding between BILL vs Melio, start by thinking about what your business really needs. Both tools have unique strengths that suit different kinds of companies.

Here, I look at which businesses are a good fit for each platform and the reasons they might choose one over the other.

BILL: from medium to large businesses

BILL is designed for medium to large enterprises that require detailed financial management and complex functionality to handle a high volume of transactions across multiple channels.

Here’s why:- Complex financial operations: BILL is a great fit for companies with multiple locations or more complex workflows. It handles high invoice volume and detailed approval chains smoothly, helping teams stay organized and cut down on mistakes

- Integration needs: BILL shines with its ability to integrate with various ERP and accounting systems. This is essential if you need easy data flow between different systems.

- Global transactions: BILL supports multiple currencies and international payments for businesses engaged in international trade, if you are managing global suppliers and customers.

- Security & compliance: BILL’s advanced security features and compliance with standards like PCI DSS make it a reliable choice for businesses that prioritize data security.

Melio: from small to medium-sized businesses

Melio is ideal for small and mid-sized businesses that want a simple, easy-to-use way to handle payments without the complexity of a large finance system.

Here’s why it stands out for them:- Ease of use: With an intuitive interface and simple setup process, Melio is accessible even to those without a deep background in finance or accounting.

- Cost efficiency: Melio’s free entry-level service model allows businesses to manage payments without a monthly subscription fee, which is a significant advantage for businesses with limited budgets.

- Flexible payment options: Melio’s ability to send checks and make credit card payments even to vendors who don’t accept cards directly can help small businesses manage cash flow more effectively.

- Direct QuickBooks integration: For businesses using QuickBooks, Melio offers a highly optimized integration, ensuring that financial data is synchronized without manual input, reducing the likelihood of errors and saving time.

Again, choosing between BILL vs Melio really comes down to business size and complexity. BILL is better for larger companies that need advanced workflows and deep integrations, while Melio is a good fit for smaller teams that want a simple, affordable tool that ‘just works.

BILL vs Melio – pricing and fees

I will cut the cord and start with one of the most important factors when choosing a platform: pricing. This is also one of the biggest differences between BILL vs Melio: their pricing models.

Melio pricing

Offers a free plan (Melio Go) for one user and operates largely on a pay-as-you-go basis.

- Standard ACH bank transfers cost $0.50 (after a few free ACH per month), and credit card payments incur a 2.9% fee. Sending paper checks starts at around $1.50 each.

- Melio’s base features can be used without a monthly fee, but it also has premium plans (Core, Boost, Unlimited) if you need more users or advanced features.

- Melio Core is about $25/user per month for added workflow tools (20 free ACH transfers/month, multi-user permissions, etc.).

- Boost plan, priced at $55/month (or $44/month billed annually), adds QuickBooks Desktop sync, custom approval routing, and vendor credits.

- Unlimited at $80/user (unlimited ACH, unlimited users) – with a 30-day free trial for any plan.

- There’s also an invite-only Platinum tier for very high payment volumes (custom-priced).

In short, small firms can start on Melio for free and only pay transaction fees, keeping costs low.

Level up your payment game: Get Melio’s premium features free for 30 days.

BILL pricing

BILL uses a subscription pricing model. There’s no free tier; instead, you pay a monthly per-user fee plus small fees per transaction.

- Plans start at $45 per user per month for the basic “Essentials” AP/AR package.

- Higher tiers (Team, Corporate) cost $55 and $79 per user, respectively, unlocking more automation and integrations.

- On top of the subscription, BILL charges about $0.59 per ACH payment and around $1.99 per mailed check. (Virtual card payments are free if the vendor accepts them.)

- International wires via BILL are $0 when sent in local currency (currency conversion rate applies) or about $19.99 for USD wires.

Automate AP, cut manual work, and control every payment.

Melio’s no-monthly-fee option and lower base fees can save money for low-volume users, while its complex automation and enterprise-level capabilities justify BILL’s higher cost.

Pricing takeaways

BILL vs Melio core features & automation capabilities

Both platforms digitize the payables process, but BILL offers a more extensive feature set beyond basic bill payment.

Melio’s key features

Melio focuses on simple, efficient bill pay for small businesses. You can pay vendors by ACH bank transfer, debit card, or credit card – even if the vendor doesn’t accept cards (Melio will cut a check or deposit an ACH on your behalf).

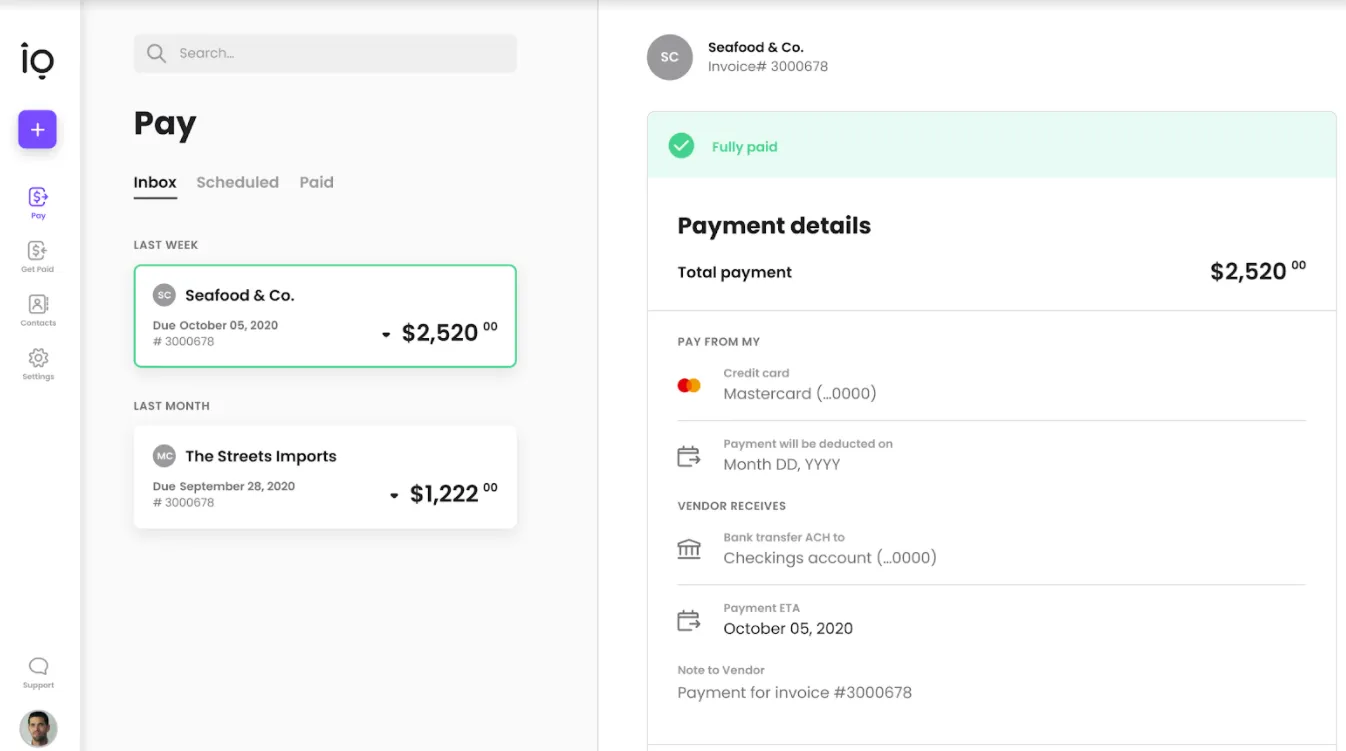

The platform provides a clean dashboard to schedule one-time or recurring payments and to see upcoming bills. It supports basic accounts receivable functions too – you can create and send invoices to request payments, and even share a payment link so customers can pay you online.

Melio’s strength is in its ease of use: minimal setup, no heavy training required, and an intuitive interface to review and approve bills quickly.

For example, you can upload or snap a photo of an invoice, then schedule a payment in a few clicks. The system also offers approval workflows (on paid plans) to let multiple team members review/approve bills, plus tools to collect W-9s and prepare 1099s for contractors.

BILL’s key features

BILL is designed as an end-to-end financial operations platform. It handles accounts payable (AP) and accounts receivable (AR) in one system.

On the AP side, BILL offers powerful automation:

Also, BILL supports multiple payment methods – ACH, paper checks (they’ll mail them for you), domestic & international wires, and even Virtual Card payments.

In fact, BILL introduced a “Pay By Card” feature, allowing you to fund vendor payments via credit card (similar to Melio’s card funding option).

On the AR side, BILL lets you create branded invoices, send them to customers, and accept online payments (ACH or card) against those invoices.

Additional features include automatic payment reminders to reduce late payments, and a real-time cash flow dashboard that shows incoming and outgoing funds to help you forecast finances.

For companies dealing with higher volumes, BILL’s automation (like auto-matching of purchase orders or syncing to ERP systems) can save significant time.

Essentially, BILL offers a more complex toolkit for financial workflow management, going beyond what Melio’s straightforward bill-pay system provides.

Feature comparison highlights

Integrations & Scalability

How each platform connects with your accounting software, and whether it can scale with you is a major difference between Melio and BILL.

Melio integrations

Melio integrates smoothly with QuickBooks Online and Xero, syncing bills and vendor data automatically so you don’t have to re-enter anything. It was even selected by Intuit as its QuickBooks bill pay partner.

There’s also support for QuickBooks Desktop, but only on the higher Boost plan. Beyond accounting tools, Melio connects with Amazon Business to pull in purchase bills and offers an API for light custom use.

Overall, it covers everything small businesses need, but the ecosystem is narrower compared to BILL.

BILL integrations

BILL goes much deeper on integrations and is designed for businesses that may outgrow entry-level accounting systems. In addition to QuickBooks and Xero, it connects with mid-market ERPs like NetSuite, Sage Intacct, and Microsoft Dynamics.

BILL also supports two-way syncing, has a network of 4M+ vendors (so you often don’t need bank details to pay them), and includes features built for multi-entity accounting.

It’s designed to handle higher volume and more layered approvals without falling over.

Integrations summary

Customer Support & Service

MelioMelio offers email and chat support for all users, with faster response times and phone callbacks on the Boost plan and dedicated onboarding on the Unlimited plan. It’s designed for small businesses, so the support team is used to helping users who aren’t accounting pros and need guidance setting things up.

BILLBILL provides chat and phone support for all paying plans, plus priority support and success managers for larger accounts. Their team is more experienced with complex setups and ERP integrations, which is helpful if your workflows go beyond basic bill pay.

BILL vs Melio international payments

Melio paymentsMelio supports international payments, but on a smaller scale. You can pay vendors in around 15 major currencies (like EUR, GBP, CAD) and send funds to a select list of countries. You can pay in local currency or USD, with a $20 fee for USD wires and standard card fees if funded by credit card.

It works fine for occasional cross-border invoices, but it’s not built for heavy international use, and payments can be slow.

BILL paymentsBILL is built for global payments at scale. You can send money to 130+ countries in 100+ currencies, often using local rails instead of SWIFT — which means faster delivery and fewer fees.

Local-currency transfers have no wire fee, just the FX rate, and the platform syncs multi-currency payments cleanly back into your accounting system.

Payments summary

Security & Compliance

Both platforms take security seriously, but they emphasize it in slightly different ways.

Melio holds SOC 2 Type II and multiple ISO security certifications, which means its systems are regularly audited for data protection and cloud security. It’s registered as a Money Service Business in the U.S., encrypts all sensitive data, and is designed to meet strict privacy and regulatory standards.

BILL also meets SOC 1 and SOC 2 Type II standards and uses bank-level protections, including advanced fraud detection, role-based permissions, and PCI compliance for card data. It’s built with stronger internal controls, like dual approvals, which help prevent mistakes or internal fraud.

Mobile app & Ease of use

Melio’s mobile app is simple, clean, and very beginner-friendly. You can scan invoices with your phone, schedule or approve payments, and get reminders about due dates. It’s ideal for small business owners who just want to snap, pay, and move on — low learning curve, quick setup.

BILL’s mobile app is more powerful, offering approvals, payments, invoicing, cash-flow alerts, and full access to bill details and audit trails. It’s great for teams and managers who need more control on the go, though the interface is a bit more complex because there’s more functionality packed in.

Final verdict

Both BILL and Melio are capable accounts payable solutions – the best choice depends on your business’s size, budget, and feature needs. Here’s a quick summary to guide your decision:

Choose BILL if:- You want a full AP/AR solution (not just bill pay), with invoicing, approvals, and expense workflows in one place.

- Your company is mid-sized or scaling quickly, and you have multiple finance users or layered approvals.

- You need integrations beyond QuickBooks/Xero — like NetSuite, Intacct, or multi-entity accounting.

- You regularly pay international vendors and need fast, reliable global payments in many currencies.

- You want stronger onboarding and support from day one, even if it comes with a higher price tag.

- You’re a small business or solo operator and just need a simple, low-cost way to pay bills.

- You don’t want a monthly subscription — pay-as-you-go pricing fits your budget better.

- You’re using QuickBooks or Xero and want everything to sync automatically without extra setup.

- You have a small or no finance team and prefer a tool that works “out of the box” with little training.

- You only make occasional international payments (or mostly pay domestic vendors).

BILL is like a Swiss army knife for financial operations, whereas Melio is a lean, focused tool for straightforward bill payments. There’s even a scenario where some companies use both – for example, using Melio’s free service for certain payments while leveraging BILL for its invoicing or advanced features.

But for most, it will be one or the other.

BILL vs Melio: Which is better?