Raise your hand if you’ve never dealt with money management issues. I don’t see anyone with their hands fluttering in the air. But, yes, my hands are likewise tied. Managing your money is a major undertaking, particularly in today’s consumer-driven culture.

How many times have we realized at the end of the week that we have no idea what we spent our money on since the fridge is empty, the wardrobe did not receive any new clothing items, we own the same digital devices in our house, and we can’t remember if we paid our utilities? This has happened to me too many times.

As a result, how to manage personal finances continues to be a significant issue in our lives. In the meantime, I’ve discovered a solution that appears to be effective. I’ve encountered a few financial management applications that claim to assist individuals with their finances. You can take control of your spending and stay on top of your finances using a budgeting tool like this. In other words, personal finance budgeting applications help you understand your income and cash flows to stay in total charge of your money.

Furthermore, a personal finance program is linked to your credit cards, allowing you to create a budget planner and spend money accordingly.

Best fintech software to keep your money safe

According to our empirical approach, keeping track of your spending and income is challenging. As a result, some of the top personal finance applications are available to assist us with an easy-to-use interface and functionality geared to each budget and requirement. So all we have to do now is thank these fintech companies for managing our cash flow to keep track of our money. This way, we can save money since we have a clearer view and a bigger picture of our finances. Who knows? Let’s look at two of the most useful personal financial tools available.

-

Truebill

Financial technology is a good way to start improving your financial situation. With a program for personal finances like Truebill, managing and saving money becomes easier for everyone. So how can an app like Truebill be more careful with your financial resources?

Think about the streaming, music, and other app platforms you’ve signed up for but haven’t used in a while. But, even if you forgot about them, these sites know that you must withdraw funds from your card every month. If you look at your financial transactions, you’d be surprised at how many useless subscriptions are still on account. As a result, Truebill helps you manage your subscriptions and regain control over your spending.

It’s simple to get started with Truebill. First, you have to give it access to your monthly invoices or connect it to your bank accounts. It’s a straightforward approach to keeping track of your spending because it eliminates the hassle of manually looking through statements to review or cancel subscriptions. Furthermore, Truebill may negotiate lower rates with various service providers, including cable, Internet, and mobile services. Finally, you can acquire promotional programs to help you save money on your payments.

-

Simplifi

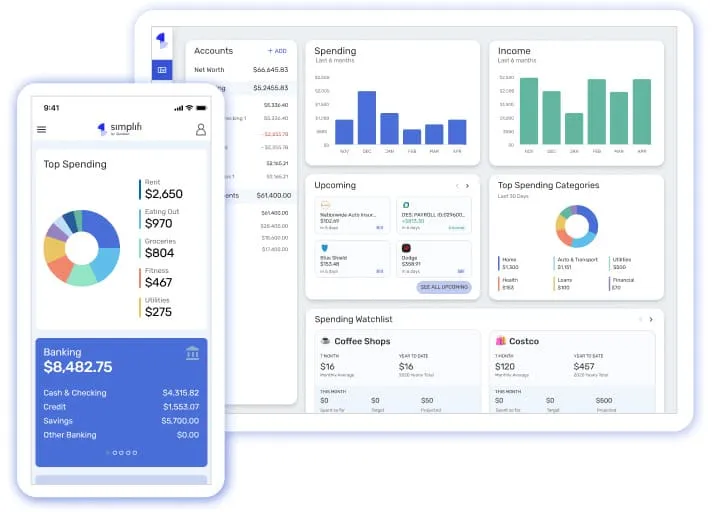

Simplifi is a budgeting app that helps users understand the overall picture of their spending and better manage personal finances. This budget planner defines financial constraints, generates categories, makes watch lists, and creates budgetary plans. In addition, Simplifi connects all of your bank accounts and allows you to monitor activity and balances in real time.

Simplifi is a monitoring tool with various functions to help you preserve your cash flow and savings. As a result, you’ll be able to keep track of your income and fixed payments. It also divides transactions and keeps detailed expenditure logs.

It is a great solution to get a better grasp of your finances. For example, this app can show if anyone else has accessed your account or your balances are unusually high. Additionally, if you forget to make a money transfer, Simplifi will send you reminders of the transactions you’ve forgotten about.

In conclusion, effectively managing your finances is a fundamental skill that empowers you to achieve financial stability and meet your long-term goals. By implementing key strategies such as creating a budget, tracking expenses, saving consistently, and minimizing debt, you can take control of your financial situation and pave the way for a secure future.

Remember, managing personal finances is an ongoing process that requires discipline, awareness, and informed decision-making. Staying informed about financial literacy is crucial, as seeking professional advice when needed and adapting your financial plan as circumstances change.

By taking the necessary steps to manage your finances wisely, you can reduce financial stress, build a solid foundation, and enjoy greater financial freedom in the coming years. Managing your finances is simpler than ever. Try some of the best investment tracking software and keep up with your expenses!