Melio Reviews for 2026

Save 40% on your SaaS stack with expert guidance

Free Consultation

What is Melio?

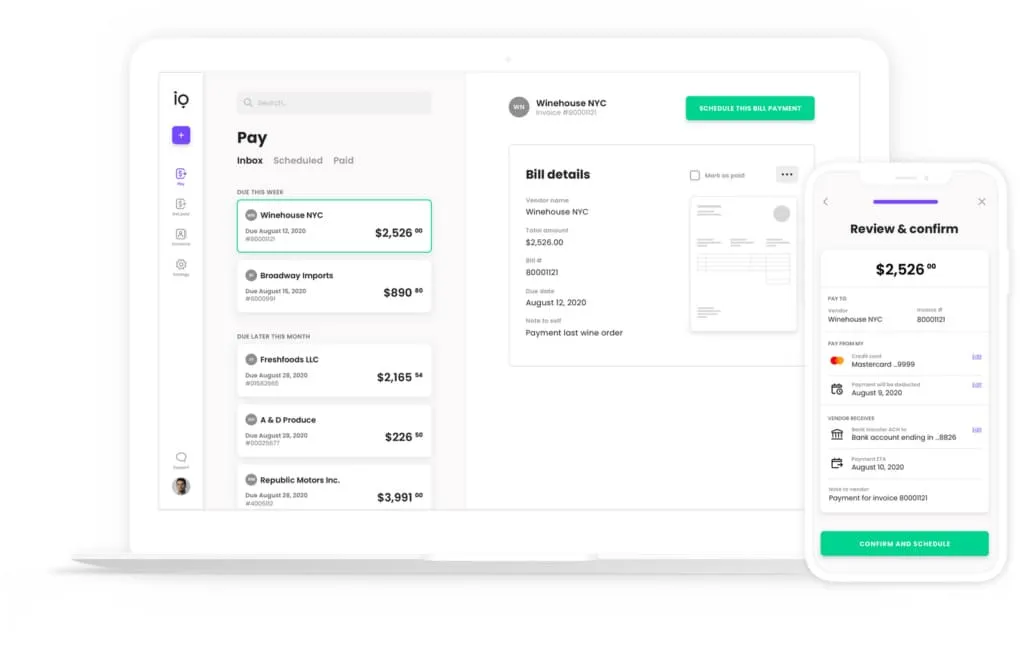

Melio is a business payments platform designed to help small and medium-sized businesses (SMBs) send and receive payments easily. It enables users to pay vendors, contractors, and suppliers with bank transfers or credit cards, even if the recipient only accepts checks. Melio automates bill payments, allowing users to schedule, track, and manage all their outgoing payments in one centralized dashboard.

The platform integrates with accounting software like QuickBooks, ensuring seamless synchronization of bills and payments for simplified bookkeeping. Melio also allows teams to collaborate by assigning roles and approvals, making payment workflows secure and transparent. Vendors don’t need to sign up to receive payments, removing friction from transactions.

With its focus on flexibility, Melio lets businesses use credit cards to pay expenses, optimizing cash flow while earning card rewards. It offers tools for both accounts payable and receivable, helping SMBs manage cash efficiently and stay on top of due dates with smart reminders and reporting.

Awards

-

Top Payment Processing Software

-

Top Accounts Payable Automation Software

Found in these Categories

Best For

- StartUps

- Small Business

- Medium Business

Melio Pricing

Go Plan

Core Plan

Boost Plan

Looking to Save Time & Money

Audit, consolidate, and save—powered by our internal buying team. Let our experts analyze your current software stack and identify opportunities for cost savings and efficiency improvements.

- Stack Audit

- Cost Reduction

- Expert Team

Melio Features

- Accounting Integration

- ACH Payment Processing

- Activity Dashboard

- Artificial Intelligence (AI)

- Billing & Invoicing

- Client Portal

- Compliance Management

- Data Import/Export

- Data Security

- Debit/Credit Card Processing

- Electronic Payments

- Invoice Management

- Invoice Processing

- Mobile Access

- Mobile Payments

- Multiple Payment Options

- Online Payments

- Partial Payments

- Payment Fraud Prevention

- Payment Processing

- Payment Processing Services Integration

- PCI Compliance

- Real Time Data

- Real Time Reporting

- Receipt Management

- Reminders

- Reporting/Analytics

- Search/Filter

- Self Service Portal

- Status Tracking

- Third Party Integrations

- Transaction History

- Transaction Monitoring

- 1099 Preparation

- Accounts Payable

- Accounts Receivable

- Approval Process Control

- Approval Workflow

- Billing Portal

- Check Processing

- Check Writing

- Client Management

- Contact Database

- Due Date Tracking

- Duplicate Payment Alert

- Electronic Funds Transfer

- Fraud Detection

- Invoice Creation

- Invoice History

- QuickBooks Integration

- Vendor Management

Melio Integrations

User Sentiment - Melio Reviews

-

Simple and clean interface

Users love Melio’s intuitive dashboard that makes it easy to send, receive, and track payments without training. It’s praised as a time-saver for small teams that want quick adoption.

-

Free and fast bank transfers

ACH payments are completely free and usually process in 1–3 days. Many reviewers highlight this as a rare advantage compared with other AP tools that charge per transaction.

-

Pay vendors by credit card

Melio lets you use your business credit card even when vendors only take checks or ACH. Users call this feature a “lifesaver” for managing cash flow and earning card rewards.

-

QuickBooks and Xero sync

Seamless integration with QuickBooks and Xero simplifies bookkeeping. Reviewers say this automation eliminates double data entry and keeps ledgers up to date in real time.

-

Easy approval workflows

Team-based approval rules let owners or managers review payments before they’re sent. Small firms note that this adds control without adding complexity or slowing the process.

-

Reliable vendor flexibility

Melio can mail paper checks or deposit funds electronically, depending on the vendor’s preference. This flexibility is frequently cited as a reason to switch from manual AP processes.

-

Solid value for small businesses

For SMBs handling recurring bills, Melio is described as “the best free tool” to manage payments. Many users mention it replaced multiple spreadsheets and manual bank transfers.

-

Customer support response times

Several users report slow replies or unhelpful escalation loops from support. While some praise individual reps, overall responsiveness is seen as inconsistent during urgent cases.

-

Delays with mailed checks

Mailed checks occasionally arrive late or go missing, especially around holidays. Users suggest more tracking visibility or faster delivery options to build confidence.

-

Account holds and verifications

A portion of users experienced unexpected holds on large transactions. These reviews mention frustration with unclear communication during compliance or risk reviews.

-

Mobile app performance issues

Some Google Play reviewers note crashes or failed uploads in the mobile app. They want better error messages and faster sync for managing payments on the go.

-

International Payment Limitations

Challenges with international payments, including high fees or limited currency options, are common areas for improvement.

-

Fees on card payments

While ACH is free, card-based transactions incur about a 2.9% fee. High-volume users say these costs add up and can offset the convenience of paying by credit card.

-

Refund and dispute process

When payments fail or vendors refund, resolution can take several days. Users ask for clearer refund timelines and real-time status updates within the dashboard.

Leave a Review

Melio Company Details

Questions about Melio?

Get in touch with the vendor for more information.

Own this Software?

Melio vs. Similar Products

Select up to 3 Software, to enable Comparison

Compare Selected SoftwareEditorial Review: Melio Deep Dive

Table of Contents

Do you have a small business struggling to manage payments or invoices efficiently? Have you tried accounting tools that felt too complex or expensive? Handling bills can be stressful for any entrepreneur, especially when every payment affects your cash flow. That’s why today we’re looking at Melio Payments, a simple yet powerful fintech solution that helps U.S. businesses pay and get paid, all from one platform.

Melio is a modern U.S.-based platform designed for small businesses, accountants, and contractors to send and receive digital payments. It replaces outdated methods like paper checks with an easy online system that improves visibility, saves time, and keeps your business running smoothly.

- Vendors & Contractors

- Small Businesses

- Accountants & Bookkeepers

- Pay your bills online, store receipts, and receive payments instantly

- Upload invoices automatically or snap a photo to digitize them

- Automate payment workflows with approval layers and reminders

- Track every transaction in real time through your Melio login dashboard

Melio is not just about sending money. It’s about simplifying your entire payment process. Whether you’re paying suppliers, contractors, or collecting payments from clients, everything happens in one clean interface accessible from any browser or the Melio app (available for iOS and Android).

Melio is widely recognized for its simplicity. You can transfer and receive payments faster than traditional methods and reduce manual accounting work. The platform is built with U.S. businesses in mind, ensuring secure ACH transfers, card payments, and now even international payments in USD.

If you’re looking for a flexible and intuitive accounts payable solution for your growing business, Melio Payments is a great place to start.

Melio Payments

Founded in 2018 in New York, Melio has grown into one of the most trusted names in B2B fintech. The company focuses on helping small and mid-sized businesses take control of their payments, invoices, and cash flow, without needing complex accounting software. With Melio, you can focus more on your clients and less on administrative tasks.

Today, Melio processes billions in payments annually and has partnerships with major financial and accounting platforms, including QuickBooks, Xero, and several U.S. banks. Its easy Melio login system lets you access your account anywhere, while its mobile Melio app keeps you updated on payments in real time.

So, let’s see exactly how Melio works and what makes it one of the most practical solutions for business payments today.

How does Melio work?

One of the things users love most about Melio Payments is its simplicity. You don’t need to be a financial expert or watch endless tutorials to figure it out. Everything happens online, from adding vendors to scheduling payments, and setup takes only a few minutes.

Melio is a web-based and mobile-friendly platform, so you can access your account from any device. Once logged in through your Melio login, you can start adding vendors, uploading invoices, and tracking payments.

Simplify how you pay and get paid with Melio. Enjoy 30 days of unlimited ACH payments, invoice creation, and smart automation tools, no credit card required.

While Melio originally supported only U.S.-to-U.S. business payments, the platform now also offers international USD payments, allowing U.S. businesses to pay overseas vendors in dollars. This update gives small businesses more flexibility in managing global suppliers without switching to another platform.

- Add vendor details securely using Melio’s encrypted environment

- Upload invoices manually, attach files, or use your phone camera to capture a bill instantly

- Sync your QuickBooks Online or Xero account for automatic invoice import

- Set custom approval workflows for different team members

- Access everything from your browser or through the Melio app on iOS and Android

How to pay by credit card or bank transfer payments with Melio?

With Melio, you decide how you want to pay, and your vendor doesn’t need to do anything special to get the funds. Whether it’s ACH bank transfer, credit card, or mailed check, the process is automated end-to-end.

All you have to do is:

- Choose your vendor and enter or confirm the invoice amount.

- Pick your preferred payment method.

- Schedule the date when you want the funds to leave your account.

Melio handles the rest, securely sending the payment on your behalf. Even if your vendor isn’t using Melio, they can still receive funds directly in their bank account or by mailed check.

You can also use your credit card to pay vendors who don’t normally accept cards, helping extend your cash flow and earn potential rewards. Each transaction can be tracked in real time within your Melio dashboard.

Through the Melio app, you’ll receive push notifications for payment confirmations, due dates, and approval requests.

Another practical feature is Melio’s AI bill capture, which automatically extracts data from uploaded invoices. This eliminates manual entry errors and keeps your bookkeeping precise.

Details of Melio Features

The platform offers a lot of great features for small businesses and accountants who need simplicity and automation. So, let’s dive into them and discover how many things you can automatize regarding payments.

- ACH payment processing

- Billing & invoicing

- Approval process control and custom workflows

- Online payment tracking and reminders

- Check processing and delivery

- Debit/credit card payments

- Duplicate payment alerts

- Fraud and error detection

- Vendor management tools (W-9 and 1099 tracking)

- Accounting sync with QuickBooks and Xero

- Real-time reporting dashboard

- Instant or scheduled payments

- Mobile access

Each of these features helps streamline your daily payment operations, reducing manual work and ensuring every invoice and payment is recorded automatically in your accounting system.

Melio Payments Benefits

-

Payment Options

With Melio Payments, you can send and receive money through multiple methods, including ACH bank transfers, debit cards, credit cards, and mailed checks. Vendors don’t need a Melio account to receive funds, which makes it one of the easiest platforms for cross-vendor transactions.

Melio also supports international vendor payments in USD, allowing you to pay suppliers outside the U.S. without switching tools.

You can even pay vendors who normally don’t accept credit cards by charging your card through Melio and having it deliver the funds via ACH or check. This flexibility helps improve cash flow and can let you earn cashback or rewards from your credit card program.

-

Payment schedule

With Melio’s scheduling and automation tools, you can plan payments in advance and never worry about late fees again. Choose the exact date you want funds to leave your account, and Melio automatically sends payments on time.

This feature is especially helpful for recurring expenses like rent, utilities, insurance, or taxes. You can manage everything from the Melio dashboard or mobile Melio app and track payment statuses in real time.

Businesses can also set approval workflows, ensuring large payments require review before being processed, an extra layer of security for teams and accountants.

-

No maintenance costs

Melio makes it easy for your clients or customers to pay you by bank transfer or card, without monthly account fees or complex setup. You can create your own custom payment link, which your clients use to send money directly into your connected business account.

Customers don’t need to sign up for Melio to make payments. Once they pay, the money arrives in your bank account within a few business days.

You’ll also receive email and mobile notifications confirming when a payment is sent, cleared, or delayed, keeping you informed every step of the way.

-

Free platform

Built for small businesses and freelancers, Melio offers its accounts payable and receivable tools with no subscription costs. You don’t have to worry about maintaining multiple tools for payments, tracking, and accounting, everything happens in one platform.

The Melio app extends this functionality on mobile, letting you pay bills, approve requests, and view history anywhere.

Melio is also popular among accountants and bookkeepers who manage multiple clients. The platform’s multi-client dashboard allows switching between business accounts easily.

Melio Integrations detailed

Melio continues to impress with its strong integrations.

It connects directly with QuickBooks Online, QuickBooks Desktop, and Xero, pulling in vendor and bill data automatically. Once synced, you don’t need to re-enter vendor details, Melio imports them for you and updates your accounting system after every payment.

- Automatically sync bills and vendor lists from accounting software

- Mark bills as paid automatically after sending payments via Melio

- Avoid duplicate data entry between Melio and QuickBooks/Xero

- Use AI-based OCR to scan and extract invoice details automatically

- Integrate with select U.S. banks for direct account verification and faster transfers

Melio’s integrations make it a top choice for accountants and finance teams, reducing reconciliation time and keeping books perfectly aligned.

Once connected, every transaction you complete in Melio reflects instantly in your accounting records, making financial reporting faster, cleaner, and more accurate.

Melio Payments Review Conclusion

In conclusion, Melio Payments stands out as one of the most practical and user-friendly fintech tools for small businesses in the U.S. It’s designed for business owners, accountants, and freelancers who want to manage payments and invoices efficiently, without the hassle of complex accounting software.

Whether you’re paying vendors, collecting from clients, or managing multiple accounts, Melio gives you full control from one dashboard. Its combination of ACH transfers, card payments, and check delivery makes it highly flexible for real-world business scenarios.

Beyond simplicity, Melio offers strong automation features, including approval workflows, AI bill scanning, and integration with QuickBooks and Xero, all of which help reduce manual errors and improve visibility over cash flow.

Accountants and bookkeepers can manage all client payments within the same workspace, switching between businesses with just a click. With tools like vendor management, W-9 and 1099 tracking, and real-time reporting, Melio helps businesses stay compliant and organized year-round.

The addition of international USD payments, mobile access via the Melio app, and improved automation has made Melio even more competitive against other platforms like Plastiq or Bill.com. It’s especially useful for U.S.-based companies working with remote contractors or global vendors.

If your goal is to save time, simplify accounts payable, and avoid late or missed payments, Melio Payments is a strong, reliable option to consider. It’s an intuitive system built around the real needs of modern small businesses, and it continues to evolve with every new update.

Tekpon’s Expert Conclusion: What Real Users Say About Melio

Users call Melio a “time-saver and cash-flow booster”, especially for paying vendors by credit card when they don’t accept cards directly. However, some report slow customer support and occasional check delays, showing room for improvement in responsiveness.

Overall, real users see Melio as a reliable, affordable, and intuitive payment tool that removes the friction from accounts payable. For U.S. businesses that value simplicity and transparency, it’s one of the best-rated fintech options available today.

Melio Frequently Asked Questions

Melio is a B2B accounts payable and receivable platform that allows businesses to pay bills and get paid digitally.

It supports multiple payment methods (ACH, credit card, checks, instant transfers), invoice creation, and integrates with accounting systems like QuickBooks and Xero.

Yes. Melio is a fully operational fintech, processing billions in payments for hundreds of thousands of U.S. businesses.

It uses secure infrastructure, is PCI-compliant, and provides audit trails for transactions.

- To pay bills: you upload or sync invoices (via scanning, email forwarding, or accounting software).

- Then you choose how fast to pay (standard, same-day, instant) and which method (ACH, card, check).

- To get paid: you create invoices and send payment links. Your customers pay via ACH or card, and funds go to your bank.

- Everything syncs with your accounting software (QuickBooks, Xero) for easier reconciliation.

It depends on the payment type:

- Standard ACH transfers usually take 1-3 business days.

- For faster options (same-day ACH, instant transfers), you can pay extra to accelerate delivery.

In short: Melio enables businesses to pay bills, receive payments, and manage cash flow in one platform.

It offers features like: invoice creation, payment links, multiple pay methods (ACH, card, check), approval workflows, and accounting sync.

No. Melio is not shutting down. After its acquisition by Xero, Melio.com will continue to operate independently.

While a previous Bill Pay integration with QuickBooks was discontinued, Melio still supports integrations with QuickBooks Online, QuickBooks Desktop, and Xero.

- Outgoing ACH (paying vendors via bank transfer): In many cases, there is no fee for standard ACH payments (especially within your free usage limits).

- Incoming ACH (when receiving payments via invoice links): Also free if you accept via ACH.

- Other premium speeds or special transfer types (same-day, instant, cross-border) may carry extra fees.

- Credit card payments do incur a fee (e.g. 2.9%) when used.

Yes – by using a credit card to pay your vendors via Melio, you can earn rewards or cashback (depending on your card issuer). Melio also promotes scenarios where cashback or card rewards help offset processing fees.

The Melio app is the mobile version of Melio’s platform, allowing users to manage payments, approve bills, and monitor cash flow on the go. It mirrors core web features so you stay in control even away from your desk.

“Melio Bill Pay” generally refers to Melio’s feature that lets businesses pay their bills (utilities, vendors, suppliers, etc.) through the platform via various payment methods.

Note: Melio’s Bill Pay integration with QuickBooks was retired in 2024, but the bill-paying capability within Melio remains active.

Melio is simpler and more affordable than Bill.com or PayPal for everyday business payments. It lets you pay vendors by ACH, card, or check without vendor sign-up and with no monthly fees. Bill.com offers deeper enterprise features but costs more, while PayPal focuses on e-commerce, not AP workflows.

Melio stands out for ease of use, accounting sync, and flexibility for SMBs that need a fast, low-overhead way to handle bills and get paid.

Melio is designed mainly for small and mid-sized businesses, but it can manage high transaction volumes efficiently. It handles multiple payables, approval flows, and accounting integrations well. However, very large enterprises needing custom ERP integrations or global spend controls may outgrow it.

For most U.S.-based SMBs, Melio scales comfortably without the complexity or high subscription costs of enterprise systems like Bill.com or Coupa.

Melio supports international payments from U.S. accounts to over 80 countries via wire transfer. You can pay in USD or local currency with built-in exchange rates. Standard transfers take about 1–4 business days and carry a flat $20 fee (plus 2.9% if using a credit card).

While not a full global FX platform, Melio makes occasional cross-border vendor payments easy for U.S. businesses that mostly operate domestically.