FreshBooks Reviews

& Product DetailsWhat is Freshbooks?

FreshBooks is a cloud-based accounting software designed to help small businesses, freelancers, and self-employed professionals manage their finances with ease. It offers a range of features that simplify invoicing, expense tracking, time tracking, and reporting. The intuitive interface allows users to create and send professional invoices, track payment statuses, and automatically send payment reminders, making the billing process efficient and stress-free.

One of the standout features of FreshBooks is its robust expense tracking capabilities. Users can easily log and categorize expenses, attach receipts, and monitor cash flow in real time. This ensures that financial data remains organized, which is particularly useful when preparing for tax season or tracking business performance.

FreshBooks also includes project management tools, allowing users to track time spent on tasks, collaborate with team members, and bill clients accordingly. This integration of accounting and project management helps businesses streamline their workflow and improve productivity.

Ideal for service-based businesses, FreshBooks is tailored to help professionals stay on top of their finances while focusing on their core operations. Whether you need to manage clients, track payments, or monitor expenses, FreshBooks provides an all-in-one solution that simplifies accounting and boosts efficiency.

Best For

- StartUps

- Freelancers

- Small Business

- Medium Business

- Large Enterprise

- Non-profit Organization

- Personal

- Cloud, SaaS, Web-Based

- Mobile - Android

- Mobile - iPhone

- Mobile - iPad

- Desktop - Mac

- Desktop - Windows

- Desktop - Linux

- Desktop - Chromebook

- On-Premise - Windows

- On-Premise - Linux

-

Company Name

2NDSITE Inc.

-

Located In

Canada

-

Website

freshbooks.com

Starting from:

$5.70 /month

Pricing Model: Subscription

- Free Trial

- Free Version

Pricing Details:

FreshBooks pricing starts at $5.70/month for the Lite plan, with advanced options like the Plus plan ($9.90/month) and Premium plan ($18/month) offering more clients and features. Custom pricing is available for larger teams with the Select plan. Payroll is an add-on starting at $40/month plus $6 per employee.

FreshBooks Lite

FreshBooks Plus

FreshBooks Premium

- Accounts Receivable

- Activity Dashboard

- Core Accounting

- Expense Tracking

- International Utilization

- Multi-Currency

- Payroll Management

- Smart and Automated Systems

- Scheduling

- Tax Management

Additional Features

- Project Accounting

- Bank Reconciliation

- Spend Control

- Billing Portal

- Online Invoicing

- Receipt Management

- Recurring Invoicing

- Mobile Payments

- Online Payments

- Payment Processing

- Time Tracking

- Customizable Invoices

- Mobile Receipt Upload

- Activity Tracking

- Billable & Non-Billable Hours

- Contact Database

- Project Tracking

- Recurring/Subscription Billing

- Time & Expense Tracking

- Timesheet Management

- Mobile Time Tracking

- Multi-Period Recurring Billing

- Multiple Billing Rates

- Deferred Billing

- Automatic Time Capture

- Hourly Billing

- Project Billing

- Time Tracking by Client

- Time Tracking by Project

-

User-Friendly Interface

Users often appreciate software that offers a straightforward and intuitive user interface, making it easier for them to navigate and perform their accounting tasks efficiently.

-

Efficient Invoicing Features

Effective invoicing capabilities, including customizable invoice templates and automatic billing, are usually highly valued.

-

Comprehensive Reporting

Access to detailed financial reports and analytics helps businesses make informed decisions.

-

Excellent Customer Support

Responsive and helpful customer service is a critical factor that contributes to user satisfaction.

-

Integration Capabilities

The ability to integrate with other tools and services, such as payment gateways or project management apps, is often praised.

-

Pricing Flexibility

Users might find the pricing plans to be expensive or wish for more flexible options that cater to small businesses or freelancers.

-

Feature Limitations

Some users may encounter limitations in features, wishing for more advanced options or customizability.

-

Learning Curve

New users might experience a learning curve with some advanced features or when first adapting to the software.

-

Mobile App Functionality

While having a mobile app is beneficial, users might seek improvements in its functionality or user experience.

-

Integration Challenges

Some users could face difficulties in integrating FreshBooks with other tools, needing smoother integration processes.

Disclaimer

Here at Tekpon's Global Buzz, we blend AI smarts with a human touch to offer a snapshot of user reviews from the web. While we carefully craft these summaries, please remember they reflect diverse user views and experiences, not Tekpon’s own opinions.

-

Adobe Commerce

eCommerce Software

-

Trello

Project Management Software

-

MailChimp

Marketing Automation Software

-

LiveChat

Live Chat Software

-

Gravity Forms

Form Builder Software

-

BigCommerce

eCommerce Software

-

Freshdesk

Help Desk Software

-

AWeber

Email Marketing Software

-

Sprout Social

Social Media Management Software

-

NiceJob

Online Reputation Management Software

-

Constant Contact

Email Marketing Software

-

Calendly

Scheduling Software

-

Slack

Team Collaboration Software

-

Pipedrive

CRM Software

-

WooCommerce

eCommerce Software

-

Teamwork

Project Management Software

-

Todoist

Task Management Software

Looking to buy FreshBooks for your business?

Tekpon’s procurement team can help you negotiate a better deal, or suggest more cost-effective alternatives.

Save time and money—starting at just $3,000/year.

Request a Custom OfferIncludes expert support and direct vendor negotiation.

Tell us your opinion about FreshBooks and help others.

Table of Contents

About Freshbooks

Let’s start talking about Fresh books and what benefits they can bring to your business. To cover all that in the following Freshbooks review, we will be going through the following aspects:

- Features

- Integrations

- Pricing

- Alternatives

Now that we know Freshbooks let’s look at how to use Freshbooks.

How to use Freshbooks?

Easy peasy! Start by creating an account with them and configure all about your company. Then, once you are on the Fresh books dashboard, start the configuration process by linking it to your e-commerce store, your bank, and payment gateways. Last, automate your invoicing process and save yourself some time with features such as recurring invoices.

Details of Freshbooks Features

Invoicing

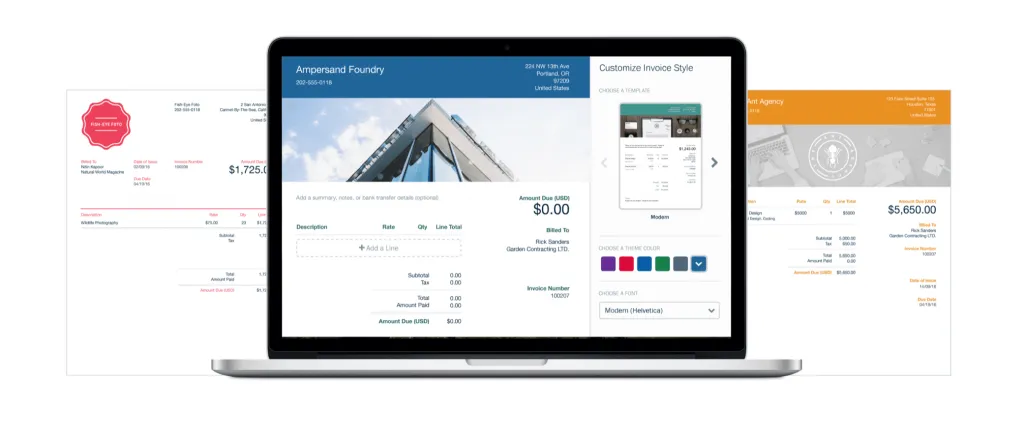

Above all, remember that invoices help you bill a client for products or services and help you keep track of your income. Fresh books invoice makes creating personalized invoices fun and easy. Furthermore, you can make all the tedious manual work disappear by automating a major part of the invoicing process. For example, you can automate payment reminders and charge penalties for past-due invoices. Finally, end your clients’ coverage using an interesting feature offered by Freshbooks that allows you to set a percentage for upfront payments on an invoice.

Moreover, remember that you can always opt for the Freshbooks recurring invoice if you have a client who works with you regularly. You can automate the process and make Freshbooks invoice customers for you regularly.

How do I create a Freshbooks invoice?

- Log in

- Go to the Create new section on the Dashboard

- Select Invoice

- You will get to the New Invoice Screen

- Customize your Invoice Style

- Fill out your invoice

Furthermore, you can also reach the same process by going to the invoice section and selecting New Invoice.

Expenses

Moving on with the Freshbooks review to the expenses feature. First, the feature will automate most of the things you do manually, like inserting your expenses. What would be the right question to ask right now? Yes, you! We know you are asking yourself that. Good! Now, let’s take it to step by step.

First, by connecting your bank account to Fresh Books, all your expenses will be pulled from your bank account and added to the software without you lifting a finger every day you make a transaction.

Second, say goodbye to losing receipts. To keep a tidy and organized working space, snap a picture of every receipt you have for your business using the Freshbooks mobile app every time you purchase.

Third, make filling in your taxes easy for you or your accountant by categorizing your expenses right from the start instead of going back and forth every time you have to do it.

Fourth, we must make purchases on their behalf when working on complex projects. To make the process of recovering your money and billing your client for that purchase, Freshbook created a feature that allows you to mark an expense as billable, automatically drag it into an invoice, and send it to the desired client.

Last, split your expenses on projects. You can allocate each expense you or your team does to a project to better overview the expenses.

Estimates

Create unique proposals by clearly outlining the scope, timeline, and deliverables of projects for your clients. Moreover, have a clear outline and a sharp answer for all your clients by looking into the calendars and the running projects. This means delivering a clear answer when you can start a project in seconds without wasting time researching your next opening. Finally, deliver Freshbooks invoices quickly by transforming your estimates into them without effort. Now, isn’t that something you have always dreamed of? We sure are impressed by this and are thinking of how much time we could have saved using this software.

Payments

Let’s move on with this Freshbooks review to how you bring the cash home. Well, let us review the Freshbooks way, which is pretty awesome, to be honest. So, optimize the process of paying your Fresh books invoice by providing your customers with several payment options, such as card payments available straight from the invoice. The benefits of having such an option are that you make it extremely easy for them to pay you and avoid getting your invoice tossed around the office. Even cooler is the transparency of the whole process. Freshbooks payments, Stripe, and Paypal, will provide all the transaction fee information.

Reports

Due to the expense and income approach, Fresh books will always have a clear overview of how your business is doing at all times. Moreover, this approach will save you tons of time in the tax season as you will be ready to send your taxes. Also, don’t forget that your account can access all your activity.

Mobile

Keep on track with your projects, payments, and reports on the go through the Freshbooks mobile apps. First, get instant updates on the projects that are going on in your team. For example, be aware of every file a client shares with you. Second, keep track of all your receipts by taking pictures of them and adding them directly to Fresh books on the go.

![]()

Third, create Fresh books invoices from anywhere. And the coolest part is yet to come! So forth, automatically track the mileage as you drive by swiping that you are on a business trip and be aware of all the potential tax deductions.

Integrations

Now that we have gone through all the Freshbooks features let us look at the Freshbooks integrations. Above all, we have to mention that they have an exciting and distinctive approach to integrations. They split them into two: Freshbooks and Freshbooks classic.

Now that we clarified this let’s look at what each of them has in store for the user and the difference. Before we get to the integration available for each of them, let’s look at the difference between these two versions.

So essentially, the difference is that Freshbooks Classic was developed for small businesses, and Freshbooks focuses on business owners. To be more specific, the classic version is simplified, while the Freshbooks for owners is the version with all the features we’ve been discussing so far.

However, let’s see further in this Freshbooks review what the software integrates.

- Outlook

- Gsuite

- Gusto

- Fundbox

- Stripe

- Bench

- Income Importer

- Indeed

- Keypay

- Freshbooks MTD

- Mazuma

- Paymentevolution

- Squarespace

- Shopify

- Dropbox

- Hubspot

- Zoom

- Transfermate

- Simpletax

- Mailform

- Onelocal

- Capsule

- Zapier

- Greatland Yearly

- Hurdlr

- Revamp CRM

- NoCRM.io

- 123Formbuilder

- AcuityScheduling

- Bidsketch

- Avalara

- Trustfile

- 2Ship

- Partial.ly

- Boomr

- Teamwork

- Asana

- Trello

- PayPal

- Square

- Yalla

- Everlance

Above all, remember that Freshbooks classic integrates with only seven tools: Bench, Gusto, Fundbox, Google, Zapier, Stripe, and Hubspot.

Alternatives to FreshBooks: A Comprehensive Review

FreshBooks is a cloud-based accounting software designed primarily for small businesses and freelancers. It offers features such as invoicing, expense tracking, time tracking, and reporting. While it is a popular choice for many, there are several alternatives that offer similar or enhanced features.

In this review, we’ll explore the best FreshBooks alternatives, including QuickBooks, Xero, and Wave, comparing them across key features, pricing, and usability. FreshBooks initially focused on small businesses, startups, and single-owner businesses.

Over time, it expanded its product to suit various business entities, including large enterprises. Let’s now compare each of the FreshBooks alternatives.

FreshBooks Overview

Before diving into the alternatives, it’s essential to understand what FreshBooks offers and why someone might look for alternatives.

Key Features of FreshBooks:

- Easy invoicing and payment tracking

- Expense and time tracking

- Financial reports such as profit & loss

- Integration with multiple payment gateways

- Client management

- Automated reminders for unpaid invoices

Pricing:

- Lite: $17 per month (billed annually) for up to 5 clients

- Plus: $30 per month (billed annually) for up to 50 clients

- Premium: $55 per month (billed annually) for unlimited clients

While FreshBooks is user-friendly and designed for small business owners, some users may find the pricing higher compared to alternatives or might need more advanced features for managing larger businesses.

QuickBooks: The Feature-Rich Alternative

The two products, FreshBooks and QuickBooks, may seem similar at first. They both target small and growing businesses as accounting tools. However, there are significant differences in features and pricing between the two. Let’s compare FreshBooks vs QuickBooks to understand each of them better.

QuickBooks is a widely used accounting software solution, popular among businesses of all sizes. When comparing FreshBooks and QuickBooks, QuickBooks stands out for its comprehensive features that cater to small, medium, and large businesses.

Key Features of QuickBooks:

- Invoicing, expense tracking, and payment processing

- Advanced accounting features such as bank reconciliation and double-entry accounting

- Payroll integration (an additional cost)

- Inventory tracking for product-based businesses

- Customizable financial reports

- Integration with hundreds of third-party apps, including PayPal, Shopify, and Stripe

Freshbooks vs. Quickbooks Features

First, most of the features are the same. So, the battle between Freshbooks vs. QuickBooks will be mainly between the features that set them apart. The latest is more oriented towards all businesses. FreshBooks has developed over time into a more feature-diverse product suitable for a larger spectrum of companies.

FreshBooks vs. QuickBooks have three features in common: invoicing, expenses, and cloud accounting. So these would be the similarities the two software share.

Second, each one chose to differentiate from the other with district features. For example, in contrast to QuickBooks offering Projects, FreshBooks does the tracking and collaboration directly with the client, while QuickBooks offers an online inventory feature.

Third, QuickBooks repeatedly underlines its security, and while FreshBooks offers the same security level, its emphasis is more on the features. Less on these aspects, as we think, is expected from a company that you share all your financial information.

Fourth, while the two share many standard features, FreshBooks has gained some extra points with fantastic features such as the Time tracking feature and millage tracking, which we enjoyed. Finally, we would say that FreshBooks took the extra step and managed to integrate some excellent project management features into its software.

Fourth, looking at the integration between FreshBooks vs. QuickBooks, FreshBooks is outshined by QuickBooks as it comes with 650 + integrations.

Last, both apps are compatible with all devices and are great on the go.

FreshBooks vs. QuickBooks Value For Money

When comparing FreshBooks and QuickBooks, pricing and features are key differentiators. FreshBooks starts at $5.70/month for the first three months (Lite plan), which is ideal for freelancers or small businesses, but limits you to 5 clients. The Plus plan ($9.90/month) adds features like recurring invoices and can handle up to 50 clients. The Premium plan ($18/month) offers unlimited clients and project profitability tracking.

QuickBooks starts higher at $17.50/month (Simple Start) but doesn’t limit client numbers. Its Essentials plan ($32.50/month) adds features like bill management and multi-currency support, while the Plus plan ($49.50/month) includes inventory tracking and project profitability. The Advanced plan ($117.50/month) is designed for larger businesses, offering custom reporting, workflow automation, and up to 25 users.

For smaller businesses, FreshBooks offers excellent value with easy invoicing, expense tracking, and basic reports. It’s ideal for freelancers or small service-based companies looking for straightforward accounting tools at a lower cost. QuickBooks, on the other hand, offers a more robust feature set, including inventory management, payroll integration, and more advanced accounting tools, making it better suited for growing businesses or those needing more comprehensive accounting solutions.

In summary, FreshBooks is best for small, service-based businesses and freelancers, while QuickBooks is more suitable for businesses that need advanced accounting, payroll, and scalability options.

Pros and Cons:

- FreshBooks: Easier for freelancers and service-based businesses. Simpler user interface.

- QuickBooks: Extensive features for accounting, inventory, payroll, and large-scale business management.

- FreshBooks: Limited accounting features compared to QuickBooks.

- QuickBooks: Can be more complex for new users or those with smaller businesses.

QuickBooks vs FreshBooks – Key Differences:

- Accounting Features: QuickBooks provides more advanced accounting tools, including bank reconciliation, which FreshBooks lacks.

- Inventory Management: QuickBooks is ideal for businesses that need inventory management, a feature FreshBooks does not include.

- Payroll Integration: While FreshBooks handles invoicing and payments well, QuickBooks integrates payroll, making it better suited for businesses with employees.

Zoho Invoice vs. FreshBooks

Zoho Invoice is an online invoicing service provided by Zoho, which offers an entire suite of software meant to help you run your business. While we will be looking strictly at Zoho Invoice vs. Freshbooks today, we have to admit that we were pretty impressed with the arsenal of tools Zoho has.

Moving on to FreshBooks Competitor – Zoho Invoice. The two apps are even more similar to FreshBooks and QuickBooks. As you are probably used to, we will look at the similarities and differences between the two and give you a verdict that we think brings more value.

Zoho Invoice vs. FreshBooks Features

First, both tools are compatible with all devices and portable. Second, they come with customizable invoices, recurring payments, and multiple currencies. However, Zoho Invoice vs. FreshBooks has multiple languages support (10+ languages) to accommodate all your customers.

Third, Zoho Invoice and FreshBooks are integrated with multiple payment gateways, giving you detailed reports and sending friendly payment reminders. Fourth, both also come with an estimate function that works similarly and a client portal that enables collaboration between you and your clients. Fifth, Zoho Invoice and Freshbooks have time tracking and expense features. So far, so good, you might say; what is the difference? Well, there aren’t many, to be fair.

Last, the only feature that sets them aside is the mileage tracking that FreshBooks offers. Pretty amazing one, we can say but not enough for us to say that FreshBooks wins the Zoho Invoice vs. FreshBooks battle. Therefore, let’s move on, and maybe we can settle this in the pricing comparison section.

Value For Money

The Zoho Invoice vs. FreshBooks pricing battle is the first thing that draws our attention. The Zoho Invoice free package essentially comes with a full feature availability for up to 5 customers. This is a competitive advantage against Freshbooks, which charges $15/month for the same number of customers and a limited number of features. But, above all, FreshBooks doesn’t offer any freemium.

Furthermore, looking at the pricing of the other packages Zoho Invoice offers, we must say that it brings more value for money than FreshBooks. Therefore, while it is evident that we like FreshBooks and think it provides a great product, we believe that this FreshBooks Alternative offers a product that is 95% the same at a better price point.

Xero: The Cloud-Based Competitor

Xero is another excellent alternative to FreshBooks, designed for small to medium-sized businesses. The FreshBooks vs Xero comparison is often driven by the need for more advanced accounting features in Xero.

Key Features of Xero:

- Double-entry accounting system

- Automated bank reconciliation

- Inventory tracking

- Fixed asset management

- Payroll integration (available in some regions)

- Integration with over 800 third-party apps, including Stripe and PayPal

- Multi-currency accounting (available in the Premium plan)

Pricing:

- Early: $13 per month

- Growing: $37 per month

- Established: $70 per month

FreshBooks vs Xero – Pros and Cons:

- FreshBooks: Simpler invoicing and user interface for freelancers and service-based businesses.

- Xero: More powerful accounting features, particularly for businesses needing inventory tracking and asset management.

- FreshBooks: Lacks advanced accounting features like inventory management.

- Xero: Higher learning curve for new users, especially for those without an accounting background.

Key Differences:

- Accounting Depth: Xero offers more advanced accounting features, such as bank reconciliation, double-entry accounting, and inventory management, making it more suitable for medium-sized businesses.

- Third-Party Integrations: Xero integrates with a broader range of third-party apps, giving it a more customizable experience.

- Multi-Currency Support: Xero provides multi-currency functionality, making it ideal for businesses operating in multiple countries.

Best for:

Xero is the best FreshBooks alternative for growing businesses that need a robust accounting solution with more advanced features like inventory management, fixed asset tracking, and multi-currency support.

Wave: The Free Option for Small Businesses

Wave is a highly attractive alternative to FreshBooks due to its entirely free accounting features. For freelancers and small businesses, Wave vs FreshBooks is a common comparison, as Wave offers many of the essential features at no cost.

Key Features of Wave:

- Invoicing and payment tracking

- Expense tracking

- Basic accounting reports

- Integration with payment gateways like Stripe and PayPal

- Bank reconciliation

- Payroll (available as a paid feature in some regions)

Pricing:

Wave’s core features, including accounting and invoicing, are free. Payroll and payment processing have additional costs:

- Payroll: Starts at $20 per month plus $6 per employee (available in the U.S. and Canada).

- Payment Processing: 2.9% + 30¢ per credit card transaction.

FreshBooks vs Wave – Pros and Cons:

- FreshBooks: More advanced invoicing and client management features.

- Wave: Free to use for core features, making it ideal for small businesses and freelancers with limited budgets.

- FreshBooks: Paid plans can be expensive for small businesses.

- Wave: Fewer advanced accounting tools, no built-in project management.

Key Differences:

- Cost: Wave’s free model is its most significant advantage over FreshBooks, making it the preferred choice for budget-conscious users.

- Features: While FreshBooks offers more robust client management and integrations, Wave is sufficient for basic accounting needs.

- Scalability: FreshBooks is better suited for businesses looking to scale and needing more extensive features, while Wave is best for smaller businesses with simpler requirements.

Best for:

Wave is the ideal FreshBooks alternative for freelancers and small businesses that want to manage basic accounting functions without any upfront costs.

FreshBooks Alternatives Conclusion

When considering FreshBooks alternatives, the right choice depends on your business size, accounting needs, and budget.

FreshBooks remains a strong contender for freelancers and small service-based businesses, offering an intuitive interface and features tailored to invoicing and expense management. However, businesses with more complex requirements or a need for scalability may find better options with QuickBooks, Xero, or Wave.

Ultimately, the best choice will depend on your business’s current and future needs, but all of these alternatives offer valuable features for effective accounting and financial management.

FreshBooks Review Conclusion

To wrap things up, we have to say that we are quite impressed by the Freshbooks platform. The tool is easy to use, flexible, saves time, and brings a lot of value for money. However, we must admit that it will probably be a tool we will switch to for its expenses approach and P&L outlook.

Moreover, we would say that it has just enough features to solve all your problems and not too many to overwhelm you.