QuickBooks Online Reviews

& Product DetailsWhat is QuickBooks Online?

QuickBooks Online is a cloud-based accounting software designed to help small businesses, freelancers, and accountants manage their financial tasks with ease. The platform offers a variety of features that simplify bookkeeping processes such as invoicing, tracking expenses, managing payroll, and generating financial reports. Its user-friendly interface allows businesses to monitor cash flow, reconcile accounts, and manage their finances from anywhere with internet access.

One of QuickBooks Online’s key benefits is its automation capabilities. It automatically syncs with bank accounts, categorizes transactions, and even provides real-time financial insights, helping users save time on manual data entry and focus on more important tasks. Additionally, users can create custom invoices, set up recurring payments, and track their accounts receivable, streamlining the billing process.

QuickBooks Online also integrates with various third-party apps, enhancing its functionality and making it easier for businesses to manage their workflows. The software’s reporting tools offer detailed financial insights, allowing businesses to track profitability and make data-driven decisions.

QuickBooks Online is ideal for small to medium-sized businesses that need a scalable and flexible accounting solution. Whether you’re managing day-to-day expenses or preparing for tax season, QuickBooks Online provides the tools needed to maintain financial health efficiently.

Best For

- StartUps

- Freelancers

- Small Business

- Medium Business

- Large Enterprise

- Non-profit Organization

- Personal

- Cloud, SaaS, Web-Based

- Mobile - Android

- Mobile - iPhone

- Mobile - iPad

- Desktop - Mac

- Desktop - Windows

- Desktop - Linux

- Desktop - Chromebook

- On-Premise - Windows

- On-Premise - Linux

-

Company Name

Intuit

-

Located In

United States

-

Website

intuit.com

Starting from:

$35 /month

Pricing Model: Subscription

- Free Trial

- Free Version

Pricing Details:

QuickBooks Online offers four pricing plans: Simple Start at $35/month, Essentials at $65/month, Plus at $99/month, and Advanced at $235/month. Each plan adds more features like enhanced reports, inventory tracking, and project profitability. Discounts include 50% off for the first three months and savings with annual billing. A 30-day free trial is also available for new users.

Simple Start

Essentials

Plus

- "What If" Scenarios

- Account Reconciliation

- Accounts Payable

- Accounts Receivable

- ACH Payment Processing

- Approval Process Control

- Asset Tracking

- Audit Trail

- Billing & Invoicing

- Budgeting/Forecasting

- Cash Flow Management

- Client Management

- Compliance Management

- Contact Database

- Contract/License Management

- Core Accounting

- Direct Deposit

- Electronic Payments

- ERP

- Estimating

- Expense Tracking

- Financial Management

- Fraud Detection

- Integration APIs

- International Utilization

- Interoperability

- Inventory Tracking

- Invoice Management

- Mobile Access

- Multi-Currency

- Online Payments

- Payroll Management

- Profit/Loss Statement

- Project Management

- Purchasing & Receiving

- Quotes/Estimates

- Recurring/Subscription Billing

- Reporting & Statistics

- Sales Orders

- Self Service Portal

- Smart and Automated Systems

- Scheduling

- Activity Dashboard

- Forecasting

- Tax Management

Additional Features

- Document Templates

- Tax Compliance

- Discount Management

- Multi-Department/Project

- Bank Reconciliation

- Email Management

- Donation Tracking

- Mobile Receipt Upload

- Revenue Recognition

- Exemption Management

- Receipt Management

- Commission Management

- Tax Filing

- Asset Accounting

- Check Printing

- Customizable Reports

- Dunning Management

- Project Billing

- Strategic Planning

- Payroll Outsourcing

- Address Validation

- Fund Management

- For Nonprofits

- Time Tracking

- K-12

- Cost Management

- Third-Party Integrations

- Inventory Management

- Multi-Country

- Check Processing

- Vacation/Leave Tracking

- Real-Time Reporting

- Accrual Accounting

- Cash Management

- Tax Calculation

- For Trucking Industry

- For Real Estate

- Data Import/Export

- 1099 Preparation

- Reimbursement Management

- Consumer Use Tax

- Self-Service Reporting

- Mobile App

- Donor Management

- Time & Expense Tracking

- Credit Card Management

- Credit Card Processing

- Electronic Signature

- Attendance Management

- SSL Security

- Mobile Payments

- Aging Tracking

- Real-Time Data

- Customizable Fields

- Purchase Order Management

- Invoice History

- Partnership Accounting

- Sales Tax Management

- API

- Taxability Verification

- Payment Reconciliation

- Payroll Reporting

- Customizable Invoices

- Fund Accounting

- Spend Management

- Financial Reporting

- Version Control

- Partial Payments

- For Small Businesses

- Purchase Order Reconciliation

- Financial Aid Management

- Automatic Backup

- Job Costing

- Check Writing

- Real-Time Updates

- Data Visualization

- Billing Portal

- Project Accounting

- Point of Sale (POS)

- Ad hoc Reporting

- Income & Balance Sheet

- PCI Compliance

- Expense Claims

- Accounting

- Customer Statements

- Cross Ledger Posting

- Payment Processing

- Donation Management

- Billable Items Tracking

- Cost Estimating

- Customizable Templates

- W-2 Preparation

- Electronic Funds Transfer

- Recurring Invoicing

- Fixed Asset Management

- Multi-Period Recurring Billing

- Remote Access/Control

- Reporting/Analytics

- Financial Analysis

- Transaction Tracking

- Categorization/Grouping

- Receivables Ledger

- 401(k) Tracking

- Benefits Management

- For AEC Industry

- Duplicate Payment Alert

- General Ledger

- Expense Management

- Wage Garnishment

- Progress Reports

- Recurring Payments

- Customizable Branding

- Multi-Company

- For Religious Organizations

- For Medical Purposes

- Invoice Processing

- Consolidation/Roll-Up

- Drag & Drop

- Asset Lifecycle Management

- Activity Tracking

- Hourly Billing

- Value Added Tax (VAT)

- Overpayment Processing

- User Management

- Grant Management

- Multi-State

- Vendor Management

- Trust Accounting

- Chart of Accounts

- Customizable Forms

- Invoice Creation

- For Higher Education

- Fee Calculation & Posting

- Automatic Billing

- Contingency Billing

- Nonprofits

- Payment Collection

- Online Invoicing

-

Ease of Use

QuickBooks is frequently praised for its user-friendly interface, which makes it accessible for both accounting professionals and novices.

-

Comprehensive Features

It offers a wide range of accounting features, including invoicing, payroll, expense tracking, and inventory management, catering to the needs of small to medium-sized businesses.

-

Integration Capabilities

QuickBooks integrates well with other software and services, enhancing its utility in various business ecosystems.

-

Cloud-Based Option

The availability of QuickBooks Online allows users to access their accounts anytime, anywhere, which is a significant advantage for businesses on the go.

-

Customer Support

There’s a solid base of support resources, including tutorials, forums, and customer service, which helps users navigate through any issues they encounter.

-

Pricing

The cost of QuickBooks, especially for the desktop version and its subscription model, can be a point of contention for some users, particularly small businesses with tight budgets.

-

Complexity with Advanced Features

While its comprehensive feature set is a positive, some users find the software can become complex and overwhelming, particularly when delving into more advanced functions.

-

Performance Issues

There have been reports of performance slowdowns, especially with the desktop versions or when using extensive data files.

-

Integration Challenges

Despite its robust integration capabilities, some users experience difficulties in setting up and maintaining integrations with specific third-party applications.

-

Limited Customization

Some reviews indicate a desire for more customization options for invoices, reports, and user permissions to better fit specific business processes.

Disclaimer

Here at Tekpon's Global Buzz, we blend AI smarts with a human touch to offer a snapshot of user reviews from the web. While we carefully craft these summaries, please remember they reflect diverse user views and experiences, not Tekpon’s own opinions.

-

HubSpot CMS Hub

Content Management Systems

-

HubSpot Operations Hub

Data Integration Software

-

Katana

Inventory Management Software

-

HubSpot Service Hub

Help Desk Software

-

Microsoft 365

Productivity Software

-

MaroPost

Marketing Automation Software

-

Chargebee

Subscription Management Software

-

Adobe Commerce

eCommerce Software

-

Jira

Project Management Software

-

MailChimp

Marketing Automation Software

-

Online Check Writer

Payroll Software

-

Veem

Accounting Software

-

BigCommerce

eCommerce Software

-

Connecteam

Field Service Management Software

-

Zenefits

HR Software

-

Rewind

Utility Software

-

Houzz Pro

Construction Software

-

Campaign Monitor

Email Marketing Software

-

HubSpot CRM

CRM Software

-

7shifts

Scheduling Software

-

HubSpot Marketing Hub

Marketing Automation Software

-

HubSpot Sales Hub

Sales Acceleration Software

-

Zoho People

HR Software

-

Jobber

Scheduling Software

-

ShipStation

Dropshipping Software

-

Buddy Punch

Time Tracking Software

-

NiceJob

Online Reputation Management Software

-

Synder

Accounting Software

-

Salesforce CRM

CRM Software

-

QuickBooks Payroll

Payroll Software

-

Melio

Payment Processing Software

-

Gusto

Payroll Software

-

WooCommerce

eCommerce Software

-

BILL

Accounting Software

-

FreshBooks

Accounting Software

-

Plooto

Accounts Payable Automation Software

-

PandaDoc

Document Management Software

-

PayPal

Payment Processing Software

-

WordPress.com

Content Management Systems

-

Salesforce Sales Cloud

Sales Acceleration Software

-

Quickbooks Time

Time Tracking Software

-

Acuity Scheduling

Scheduling Software

-

Wix

Website Builder Software

-

Rippling

HR Software

-

Shopify

eCommerce Software

-

Eventbrite

Event Management Software

-

Vagaro

Scheduling Software

-

TaxDome

Accounting Software

-

Housecall Pro

Workforce Management Software

-

Zoho CRM

CRM Software

-

Zapier

Data Integration Software

-

Square Point of Sale

POS Software

-

Freshdesk

Help Desk Software

-

Pipedrive

CRM Software

-

ClockShark

Time Tracking Software

-

ActiveCampaign

Marketing Automation Software

-

Procore

Construction Software

-

Xero

Accounting Software

-

Clio

Legal Software

-

ShippingEasy

Dropshipping Software

-

Microsoft Power BI

Business Intelligence Software

-

Constant Contact

Email Marketing Software

-

Wrike

Project Management Software

-

Buildertrend

Construction Software

-

Tick

Time Tracking Software

-

SAP Concur

Travel & Expense Management Software

-

CoConstruct

Construction Software

-

DonorPerfect

Fundraising Software

-

Zoho Expense

Travel & Expense Management Software

-

Timesheets.com

Workforce Management Software

-

Peek Pro

Scheduling Software

-

Foxit eSign

Digital Signature Software

-

When I Work

Workforce Management Software

-

Bonterra Guided Fundraising (formerly Network for Good)

Fundraising Software

-

HoneyBook

CRM Software

-

Paymo

Project Management Software

-

TimeSolv

Legal Software

-

Timely

Time Tracking Software

-

Expensify

Accounting Software

-

Birdeye

Online Reputation Management Software

-

Process Street

Business Process Management Software

-

MyCase

Legal Software

-

AxisCare

Health Care Software

-

Deputy

Scheduling Software

-

Teamwork

Project Management Software

-

Justworks

Payroll Software

-

Loyverse POS

POS Software

-

TimeCamp

Time Tracking Software

-

OnPay

Payroll Software

-

Paychex

HR Software

-

Sortly

Inventory Management Software

-

BQE CORE Suite

Legal Software

-

Jackrabbit Class

Gym Management Software

-

BigTime

Project Management Software

-

PracticePanther

Legal Software

-

Harvest

Time Tracking Software

-

Emburse Nexonia

Travel & Expense Management Software

-

eWay-CRM

CRM Software

-

Innago

Real Estate Software

-

Make

Data Integration Software

-

Everhour

Time Tracking Software

-

Freedcamp

Project Management Software

-

Freshsales

CRM Software

-

Avaza

Project Management Software

-

inFlow Inventory

Inventory Management Software

-

Contractor Foreman

Construction Software

-

JobNimbus

CRM Software

-

ProcurementExpress.com

Accounting Software

-

Keap

CRM Software

-

A2X

eCommerce Software

-

mHelpDesk

Field Service Management Software

-

ConstructionOnline

Construction Software

-

noCRM.io

CRM Software

-

iDeals Virtual Data Room

Data Management Software

-

Cin7 Core

Inventory Management Software

-

MuleSoft Anypoint Platform

Data Integration Software

-

Qwilr

Sales Acceleration Software

-

Fishbowl

Inventory Management Software

-

busybusy

Construction Software

-

Little Green Light

Fundraising Software

-

Pipeline

CRM Software

-

Copper

CRM Software

-

Bitrix24

CRM Software

-

Stampli

Accounts Payable Automation Software

-

Atera

IT Asset Management Software

-

Smokeball

Legal Software

-

Neon CRM

Online Community Management Software

-

ServiceTitan

Field Service Management Software

-

Cin7 Omni

Inventory Management Software

-

Sisense

Business Intelligence Software

-

OwnerRez

Real Estate Software

-

ShareFile

Document Management Software

-

Pipefy

Business Process Management Software

-

Grow

Business Intelligence Software

-

Zoho Inventory

Inventory Management Software

-

Ramp

FinTech Software

-

ServiceM8

Field Service Management Software

-

TrueContext

Field Service Management Software

-

Precoro

Accounts Payable Automation Software

-

Pleo

Travel & Expense Management Software

-

WellnessLiving

Gym Management Software

-

Kantata

Project Management Software

-

Shopmonkey

Workforce Management Software

-

Podium

Customer Success Software

-

TravelBank

Travel & Expense Management Software

-

Workzone

Project Management Software

-

Nutshell

CRM Software

-

Kickserv

Field Service Management Software

-

Checkfront

Scheduling Software

-

Finale Inventory

Inventory Management Software

-

Bill4Time

Time Tracking Software

-

Lightyear

Accounts Payable Automation Software

-

Commusoft

Field Service Management Software

-

Kindful

Fundraising Software

-

ServeManager

Legal Software

-

Mangomint

Scheduling Software

-

CASEpeer

Legal Software

-

Eleo

Fundraising Software

-

PaySimple

Accounting Software

-

PCRecruiter

Recruiting Software

-

Google Cloud Looker

Business Intelligence Software

-

Klipfolio

Business Intelligence Software

-

Expensya

Travel & Expense Management Software

-

Thryv

CRM Software

-

Quickbase

Workflow Management Software

-

Zoho Analytics

Business Intelligence Software

-

Insightly

CRM Software

-

Scoro

Project Management Software

-

Trunk

Inventory Management Software

-

Celoxis

Project Management Software

QuickBooks Online Featured Comparisons

Looking to buy QuickBooks Online for your business?

Tekpon’s procurement team can help you negotiate a better deal, or suggest more cost-effective alternatives.

Save time and money—starting at just $3,000/year.

Request a Custom OfferIncludes expert support and direct vendor negotiation.

Tell us your opinion about QuickBooks Online and help others.

Table of Contents

- Intuit QuickBooks

- QuickBooks Online Review

- QuickBooks Online vs. QuickBooks Desktop

- Benefits of QuickBooks Online

- Online QuickBooks Detailed Features

- QuickBooks Online Essentials vs. QuickBooks Online Advanced

- QuickBooks Accountant Online – Tools for Accountants

- Who Should Use QuickBooks Online?

- QuickBooks Cost

- Alternatives to QuickBooks

- Detailed QuickBooks Integrations

- Pros and Cons of QuickBooks Online

- Quickbooks Review Conclusion

QuickBooks is a popular accounting software that was launched in 1992. The initial version of QuickBooks was based on a previous project developed by Quicken, a subsidiary of Intuit. The software is designed for small and medium-sized businesses, but it is now used by more than 4.5 million businesses worldwide.

Intuit QuickBooks

Intuit is a corporation based in the United States. It was founded by Scott Cook and Tom Proulx in 1983 in Palo Alto, California. The company generates most of its revenue from financial services software such as TurboTax, Mint, Credit Karma, ProConnect, and QuickBooks, commonly used by businesses of all sizes in the US market.

QuickBooks Online Review

QuickBooks Online is a cloud-based accounting software that simplifies financial management for small to medium-sized businesses. Whether you’re tracking income and expenses or preparing for tax season, QuickBooks Online offers a full stack of tools to manage your company’s finances from virtually anywhere.

Unlike traditional desktop software, QuickBooks Online allows business owners and accountants to access their data in real time across multiple devices, making it a flexible solution for teams working remotely or on the go.

Due to its ease of use, automated features, and integrations with popular business apps, this software has become a go-to choice for entrepreneurs, freelancers, and growing businesses.

The platform offers various subscription plans, such as QuickBooks Online Essentials and QuickBooks Online Advanced, each tailored to different business needs, ensuring that whether you’re just starting out or managing a growing team, there’s an option to suit your requirements.

Additionally, QuickBooks Online integrates seamlessly with other Intuit products and third-party applications, allowing users to create a custom accounting system that fits their unique business processes.

With constant updates and new features added regularly, it’s no surprise that QuickBooks Online remains a popular choice for businesses looking to streamline their accounting operations.

How to use QuickBooks Online?

The accounting software is incredibly user-friendly, making it easy to navigate and learn even for beginners. It comes packed with numerous tutorials to help you master every feature quickly. We highly recommend the online version, as it allows you to start using the product right away without any need for installation.

Create an account

So, to use QuickBooks online, you have to sign up for the service and start with the 30-day trial version, which gives you more than enough time to learn all its features.

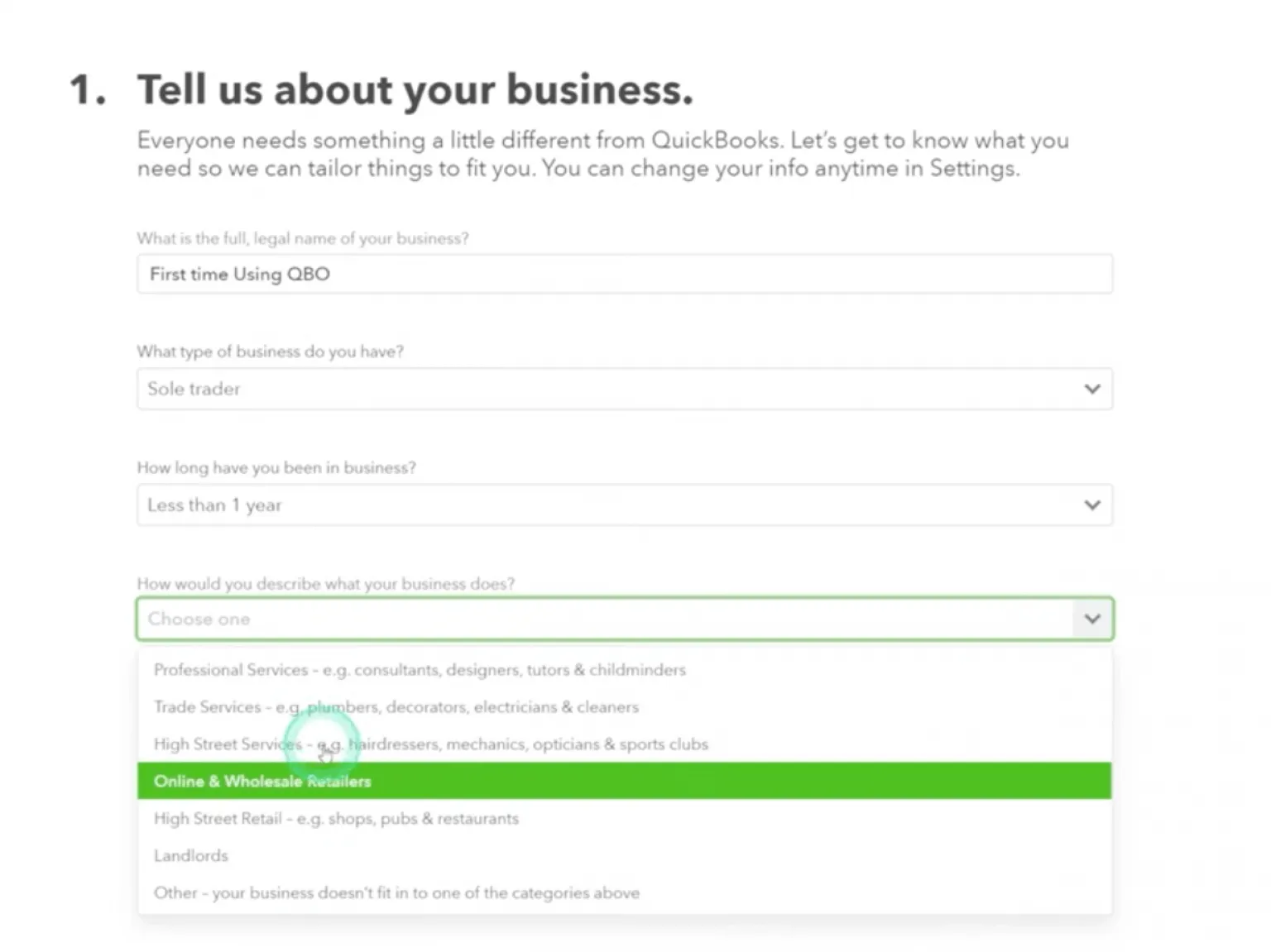

If you are new to the accounting software, you will first be asked to fill out your company’s information, such as the legal name, business type, how long you have been in business, and how you would describe your business.

The purpose behind these questions is to get an idea of what features might be the most suitable for your business, which leads us to the second point: Choose what you want to do with Intuit QuickBooks.

However, whatever you choose here will not affect the software. It will only settle everything for you the first time you get there.

There is nothing permanent there. After you complete that, you will be asked to take a quick tour to familiarize yourself with all the features.

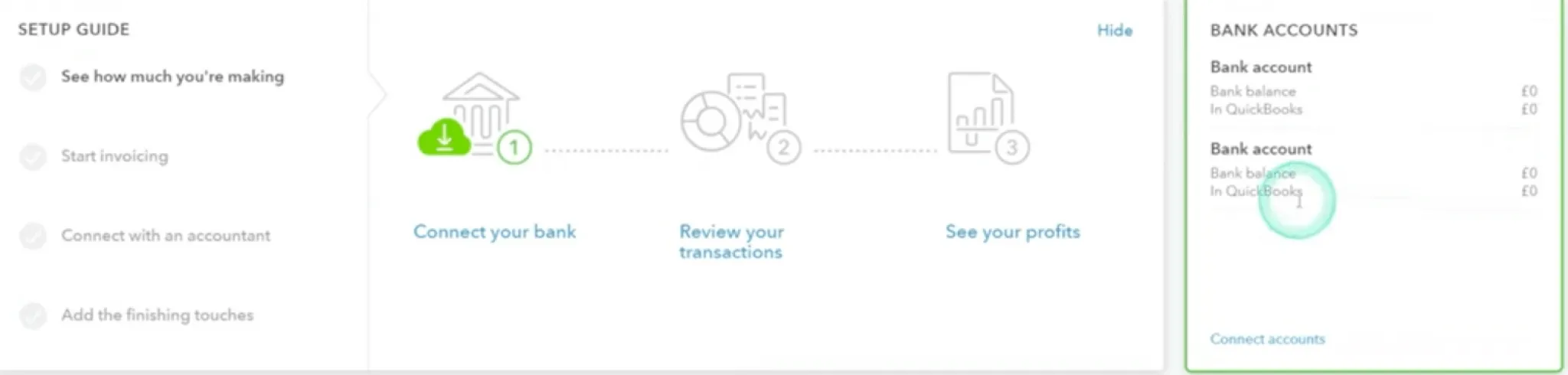

Configuration

The third step is to start adding data to the accounting software. Start by connecting your bank account. Remember that you can check if all is okay by checking if the figures you have in QuickBooks match your bank account figures.

You are not limited to one bank account, so keep adding all of them.

Fourth, you will need to go to the upper right corner, click the settings section, and start setting up all your company information and the advanced settings to set up the correct first month of the financial year.

So, now you are all settled in and set up with Intuit Quickbooks; you can start setting up your income, creating invoices, tracking miles, and all the other aspects.

We hope this clarifies using Quickbooks. For more detailed information, we advise you to check out their tutorial.

QuickBooks Online vs. QuickBooks Desktop

QuickBooks Desktop and QuickBooks Online are both accounting solutions by Intuit, but they cater to different needs and preferences.

Desktop:

- One-time Purchase: Requires a one-time software purchase.

- Installation: Installed on a specific computer or server.

- Features: Offers more advanced features, especially for inventory and job costing.

- Access: Limited to the computer it’s installed on unless paired with hosting services.

- Updates: Manual updates are needed; newer versions are released annually.

Online:

- Subscription-Based: Monthly or yearly subscription fees.

- Cloud-Based: Accessible from any device with an internet connection.

- Features: Continuously updated with new features; integrates seamlessly with many third-party apps.

- Access: Multiple users can access simultaneously from different locations.

- Updates: Automatic updates without needing to purchase new versions.

While Desktop might appeal to those wanting robust features and a one-time purchase, Online offers flexibility, remote access, and ease of collaboration.

So, let’s examine the most apparent differences between the software’s online and desktop versions.

One of the most notable benefits of using the online version of QuickBooks Online is its flexibility. You can also access first-hand updates and new features without purchasing the latest product version.

With this in mind, let’s take a closer look at the features of the Intuit QuickBooks cloud-based version.

Benefits of QuickBooks Online

Using Online QuickBooks at its full potential can save you time that would be better spent developing and growing your business. So, let’s take a look at this QuickBooks review of some of the most relevant benefits of using QuickBooks online and on the desktop for SMEs.

-

Synchronizing Online QuickBooks to your payment gateways

This has the potential to save you about 45 minutes of your precious time every week. How does it do that? Sales transactions involve lots of data, such as invoices, recipes, and other aspects. Therefore, accounting and bookkeeping have become a piece of cake for keeping things neat and organized in sales tax filing.

-

Customer synced history

To enjoy the full benefits of QuickBooks, integrate your CRM software to have a complete overview of your purchase history and complete customer information. This will save you about 58 minutes per week.

Online QuickBooks Detailed Features

Let’s take a closer look at the features of the online version and what each one can do to keep track of your accounting and invoices. Furthermore, this section of the QuickBooks online review will give an excellent overview of the software’s functionalities and technical aspects.

Cloud Accounting

The benefits of working with cloud accounting are multiple, one of the most important being flexibility. First, you can access all your information from anywhere and on any device.

Second, you can share and collaborate with accountants’ clips without compromising security. Last, you can take your data with you anywhere you go and make decisions based on real-time data.

Online invoicing

QuickBooks Online streamlines invoicing, allowing users to send custom, professional invoices via email or even text messages. It integrates with QuickBooks Payments for fast, secure payment processing. You can set up recurring invoices, send payment reminders, and accept various payment methods, including credit cards and ACH transfers.

Customize Invoice

QuickBooks invoice allows you to customize your invoices by adding brand-related elements such as logo and signature. Furthermore, you can choose multiple templates and make your invoice represent you. Nothing special so far, you would. Well, well, don’t throw in the towel just yet. This had plenty more to give.

Second, create quotes that include discounts, payment terms, prices, and many more to speed up your invoicing procedure and maximize optimization.

Track Payment

Thirdly, you can track your payments in real time. This means that you can check from any of your devices if customers are late on their payments and set up automatic reminders to speed up the process.

Additionally, don’t forget about the fantastic integrations that can help you optimize the invoice payment process and make it as easy as possible for your clients to pay your invoices.

Fourth, automate your invoicing process to gain time to focus on other essential aspects of your business. For example, you can send recurring invoices to customers you bill regularly. Last, QuickBooks invoice will automatically track your taxes, discounts, and shipping if appropriately set. Also, it will provide you with a P&L, so you never have to be blind-sighted.

Import invoices into QuickBooks desktop

You can import invoices from your QuickBooks Online to your QuickBooks desktop. However, remember that you can only import an IIF format into the software, so make sure you have one. Here is how it is done:

- Sign in as an Admin to the company file

- Switch to single mode from the File menu

- From the same menu, click Utilities

- Select Import IIF files

- Search & find the IIF file

- Open and click ok

See, not that hard after all. Now, let’s take a look at how it’s done the other way around.

Import invoices from desktop to QuickBooks Online

Even more straightforward than the other way around. Let’s take a look at how we do it step by step.

- From QuickBooks Desktop, click Export Company File to Quickbooks Online.

- Go to Quickbooks online and choose where you want to import your data

- Chose the company where you want to import the list or create a new one

- Get informed by email when the import is ready

Above all, this simple yet efficient feature applies to more importing tasks from desktop to online, such as inventories.

Last, let’s look further into this Quickbooks review at reporting and another critical feature for commerce and e-commerce: inventory.

Accounting Reports

QuickBooks Online offers a unique feature of customizable accounting reports. This feature allows you to access and review your financial data online and create custom reports that are tailored to your business needs.

The tool utilizes the data you have shared, such as invoices, banking information, and inventories, to generate accurate profit and loss statements, customer balance sheets, and company snapshots.

The profit and loss statement is a valuable tool for entrepreneurs, business owners, and freelancers. It provides an easy-to-use report that shows whether your business is profitable.

Additionally, QuickBooks Online’s custom balance sheets feature is generated based on the data gathered from all your financials, which can be considered your company’s “health check.”

Advanced users can leverage QuickBooks Advanced features like detailed reporting and workflow automation.

Inventory Management

Inventory management is one of the unique features of Quickbooks. It can synchronize with online sales platforms such as Amazon, BigCommerce, and Shopify. Each one of them comes with a fantastic set of custom integration facilities.

For example, Amazon has a master inventory list, while with Shopify, you can import all your orders and manage refunds.

Now, moving on to what you can do in this Quickbooks review of functions and features section, let’s begin with keeping track of your quantities on hand.

This feature will ensure you are always aware of when your stock comes in and out with its auto-update function. This will make it a piece of cake to see what is selling and what’s not.

Second, tracking stock value in real time will update your balance sheet when the value of your stock changes.

Time Tracking

QuickBooks Online integrates with QuickBooks Time, enabling businesses to track billable hours and employee time accurately. Managers can approve timesheets and link them directly to payroll and invoicing.

Mobile Access

The mobile app allows users to manage their finances on the go, providing access to invoicing, expense tracking, and reports, making it easy to handle financial tasks remotely.

Third-Party Integrations

QuickBooks Online integrates seamlessly with numerous third-party applications like Shopify, PayPal, HubSpot, and Square, allowing businesses to expand their accounting capabilities without switching platforms.

QuickBooks Online Essentials vs. QuickBooks Online Advanced

Online QuickBooks offers multiple subscription plans, with Essentials and Advanced catering to different business needs.

QuickBooks Online Essentials

Essentials is ideal for small businesses that need basic accounting tools, such as invoicing, bill management, and the ability to track income and expenses. It supports up to three users and includes features like time tracking and integration with QuickBooks Payments for easier client billing.

QuickBooks Online Advanced

Advanced is designed for larger businesses or those with complex needs. It includes everything in Essentials plus enhanced reporting, custom workflows, and access for up to 25 users. Advanced users also benefit from a dedicated account team and premium support.

For businesses requiring advanced automation, custom roles, and detailed financial insights, QuickBooks Online Advanced is the better choice. However, if you’re just starting out or run a smaller business, Essentials offers all the core features at a lower price point.

QuickBooks Accountant Online – Tools for Accountants

QuickBooks Accountant Online is specifically designed for accounting professionals who manage multiple clients. This version provides specialized tools like Client File Review, enabling accountants to review, adjust, and correct transactions quickly.

It also supports batch processing for reclassifying transactions or making multiple adjustments at once, which saves significant time for accountants managing high client volumes.

Additionally, accountants get exclusive access to QuickBooks Online Accountant ProAdvisor, which includes training, certifications, and support to help enhance their services.

Who Should Use QuickBooks Online?

QuickBooks Online is ideal for small to medium-sized businesses that need flexible, cloud-based accounting software. It’s perfect for entrepreneurs, freelancers, and growing businesses that require real-time access to their financial data across multiple devices.

For companies managing a few clients and employees, Essentials or Plus may be sufficient, while Advanced is best for larger businesses or those with complex accounting needs. Additionally, accountants can benefit from the QuickBooks Accountant version to manage multiple clients with ease.

QuickBooks Cost

QuickBooks Online offers four main pricing plans:

- Simple Start – $35/month: Basic features like invoicing, expense tracking, and sales tax management.

- Essentials – $65/month: Adds bill management and multi-user support (up to 3 users).

- Plus – $99/month: Includes project tracking and inventory management (up to 5 users).

- Advanced – $235/month: Advanced automation, custom workflows, and support for up to 25 users.

All plans offer a 50% discount for the first three months or a 30-day free trial.

Alternatives to QuickBooks

Some of the most popular alternatives to Intuit Quickbooks are:

- Xero

- Sage

- Zoho Finance

- Freshbooks

There are many more Quickbooks alternatives, but I believe these are the most competitive in their segment. Check out the alternatives section for more information and an in-depth Quickbooks review vs. competitors.

Detailed QuickBooks Integrations

QuickBooks Online can connect with many other apps, such as Shopify, PayPal, Square, and Stripe, to make transactions and data flow smoother. It also works with CRM tools, payroll software, and inventory management systems, so it’s really versatile for different industries.

Moreover, the QuickBooks App Store features numerous apps for further customization, helping businesses create a more tailored accounting solution. This flexibility ensures that QuickBooks Online can fit into nearly any business workflow.

The platform also added the DocuSign feature, which allows small businesses to sign estimates directly from the platform, making it even more work-friendly.

Additionally, QuickBooks introduced an AI-powered software called D, which helps users to process bills, manage expenses, capture receipts, and run all reports from one location using several apps. This integration greatly reduces the need for business owners to navigate through multiple apps to access reports.

Pros and Cons of QuickBooks Online

- Ease of Use

- Cloud-Based Accessibility

- Extensive Integrations

- Automation

- Scalability

- Pricing can increase with more advanced features.

- The learning curve for complex features

- Reports and workflows have customization limits in lower-tier plans.

Quickbooks Review Conclusion

In conclusion, we believe that QuickBooks Online is a smart, easy-to-use accounting tool that helps businesses manage their finances. From sending invoices to tracking expenses and managing payroll, it has everything you need to keep your books in order.

Whether you’re running a small business or growing a larger team, it’s flexible enough to grow with you. Plus, its cloud-based platform means you can manage your money from anywhere!

While learning all the features might take some time, it’s worth the investment for most businesses.

Ready to take control of your business finances? Give QuickBooks Online a try today! Whether you’re just starting or scaling up, QuickBooks offers all the tools you need to simplify accounting and grow your business.

Sign up now for a QuickBooks Online free trial and experience how QuickBooks can save you time, reduce stress, and help you focus on what matters—growing your business!