Running a small business doesn’t sound like a big deal. Few employees, not so many customers, and a few contracts. That’s how a layperson would see it. But for the owner, things are more complicated than it seems. They know that their business can scale up at any moment, and the administrative staff can get quickly out of hand if not organized carefully. At the same time, expenses can add up very quickly. Thus, to stay on top of the bookkeeping process, every small business should be prepared with secret weapons: accounting tools. This way, businesses can enjoy well-structured financial management, not so expensive or time-consuming.

Accounting tools for SMB

As I was saying, accounting platforms can make your everyday duties and responsibilities more relaxed. You can find many accounting tools on the market, but which one you choose depends largely on your bookkeeping needs. Thus, let’s see the top accounting software we pick for you today!

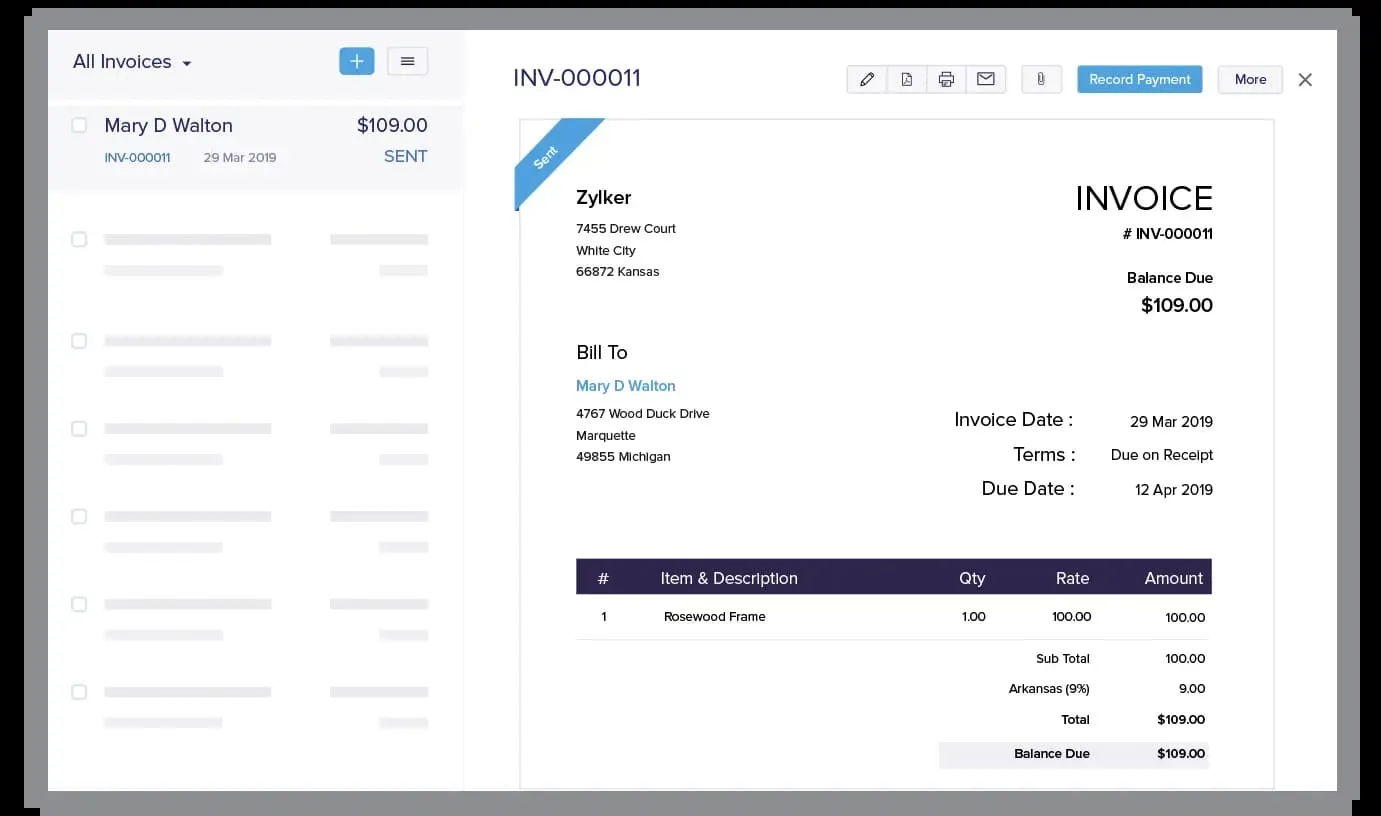

Zoho Books

Zoho Books is a software that offers small businesses accounting support. It streamlines the communication process between business owners and accountants, automates the workflow, and enhances back-office operations. For example, with Zoho Books, you can track your bank account activities and credit card transactions, such as refunds, credits, expenses, checks, and deposits. Moreover, Zoho accounting allows you to delegate accounting duties to your collaborators. So, this app improves the business’ workflow by providing teams a platform to collaborate across departments.

It is important to mention that Zoho doesn’t operate alone, but its efforts are supported by many apps integrations like PayPal, Slack, G Suite, Stripe, and Dropbox. Likewise, other Zoho app integrations do not miss this list: Zoho Analytics, Zoho CRM, Zoho Inventory, or Zoho CRM.

BILL

BILL is a powerful accounting solution for small businesses that automates critical financial tasks, helping them save time and reduce errors. By integrating seamlessly with popular accounting software, BILL ensures real-time synchronization of financial data, reducing manual entry and improving accuracy. With features like automated invoicing, real-time payment tracking, and multiple payment options, BILL enables small businesses to maintain better control over their cash flow. Automated reminders and follow-ups ensure timely payments, while detailed financial reporting provides insights into spending patterns and financial health.

BILL’s expense management tools allow small businesses to track and control expenses easily. Virtual cards with customizable limits, automated expense reports, and fast reimbursement processes ensure efficient business expenditure management. Designed with ease of use in mind, BILL’s intuitive interface makes it accessible even to those with limited accounting experience. Comprehensive tutorials and helpful customer support further simplify the onboarding process, making it an ideal choice for small businesses looking to streamline their accounting operations.

BILL is an excellent accounting solution for small businesses. It offers automation, integration, and mobile accessibility. By simplifying financial management and providing robust tools for cash flow and expense control, BILL helps small businesses focus on growth and efficiency.

Synder

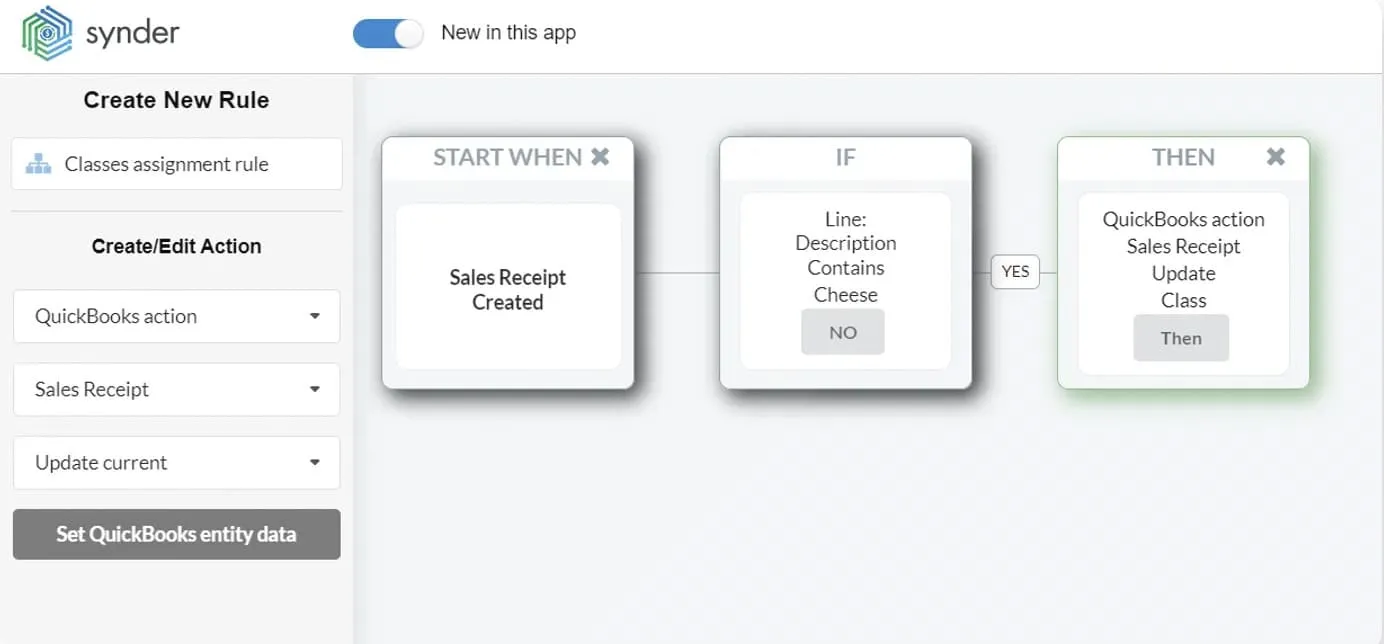

Another accounting automation tool comes from Synder. It is an all-in-one online accounting platform that helps small businesses centralize financial processes faster. Synder is an efficient and accurate solution that can keep your business accounting and transactions in a single place. Moreover, if your business is eCommerce oriented, learn that Synder can sync with many eCommerce platforms such as Shopify, eBay, Amazon, Etsy, Woo Commerce, or Stripe.

So, no more manually tracking online payments and transactions. Instead, its integrations with digital payment processors let you synchronize data so that you can do less work. At the same time, the platform allows you to send and receive payments no matter the channels you use and send invoices to clients digitally.

Plooto

With Plooto, a platform for small business accounting, you can keep your finances in order. To begin with, it is an easy-to-use platform that offers support through valuable tutorials. In addition, thanks to its quick setup and automation functionalities, every small business can save much time. Plooto helps you manage cash flow by handling your accounts payable and receivables. In addition, payments by email work well for Plooto. Thus, you can save money from possible transfer costs and vendors’ details for future transactions.

Plooto integrates smoothly with other accounting tools in the USA like QuickBooks Desktop, QuickBooks Online, and Xero. Furthermore, you can make international payments without having a bank account in that certain currency. Instead, Plooto makes the conversions for you.

FreeTaxUSA

FreeTaxUsa is a tax management and tax refund website that helps small businesses prepare, print and e-file their taxes. Moreover, this is a safe tax preparation solution complying with IRS regulations and requirements. This tax software allows you to pay taxes online, enabling you to prepare and file State Tax Returns in a breeze. In addition, the process of a tax return is easy because of the free federal tax returns e-filing functionality. More than this, Free Tax USA works as a smart accountant providing smart security options.

TaxAct

Our last pick is TaxAct software, a small business accounting software that allows you to file taxes digitally. This digital payment tool lets you file state and federal taxes. No matter if you are an individual who’s interested in deductions or filing a federal return, TaxAct responds promptly to your needs. You’ll get the TaxAct calculator that simplifies deductions and complex tax laws using this electronic billing software. In addition, TaxAct bookkeeping software provides users with support and features such as deduction maximizer, refund transfer, and personal tax plan to reduce their tax bills.

So, if you own a small business and have limited bookkeeping knowledge, the best thing to do is reach for accounting tools. This way, you can automate your invoicing workflow and free up your time for more important tasks.