BILL Reviews

& Product DetailsWhat is BILL?

BILL (formerly bill.com) is a comprehensive financial operations platform designed to streamline and automate various financial tasks for businesses. It offers a suite of solutions, including Accounts Payable (AP) and Accounts Receivable (AR) automation, Spend & Expense management, and a dedicated platform for accounting firms.

The AP automation feature allows businesses to save time on payments, streamline the entire AP process, and easily sync with accounting software.

The Spend & Expense feature provides access to credit lines and helps optimize cash flow through spend control. Additionally, BILL enables businesses to create professional invoices, receive payments directly to bank accounts, and manage financial operations with simple integration into the tech stack.

The platform also offers a partner program for accountants to streamline clients’ financial operations and grow their firms.

With a focus on efficiency, control, and visibility, BILL transforms the financial operations of thousands of businesses, offering an integrated approach to managing AP, AR, spend, and expenses.

Tekpon Awards

Best For

- StartUps

- Freelancers

- Small Business

- Medium Business

- Large Enterprise

- Non-profit Organization

- Personal

- Cloud, SaaS, Web-Based

- Mobile - Android

- Mobile - iPhone

- Mobile - iPad

- Desktop - Mac

- Desktop - Windows

- Desktop - Linux

- Desktop - Chromebook

- On-Premise - Windows

- On-Premise - Linux

-

Company Name

Bill Ltd, Co.

-

Located In

United States

- Website bill.com

Starting from:

$45 /user/month

Pricing Model: Subscription

- Free Trial

- Free Version

Pricing Details:

BILL features diverse pricing plans tailored for businesses, accountants, and nonprofits, starting at $45/user/month, with specialized and free options available. The platform imposes transaction fees, including a 2.9% credit card fee. Users can explore its extensive features through a free 30-day trial. Also, the Spend & Expense option is completely Free to use.

Essentials

For Business

Team

For Business

Corporate

For Business

- Tax Management

- Accounts Receivable

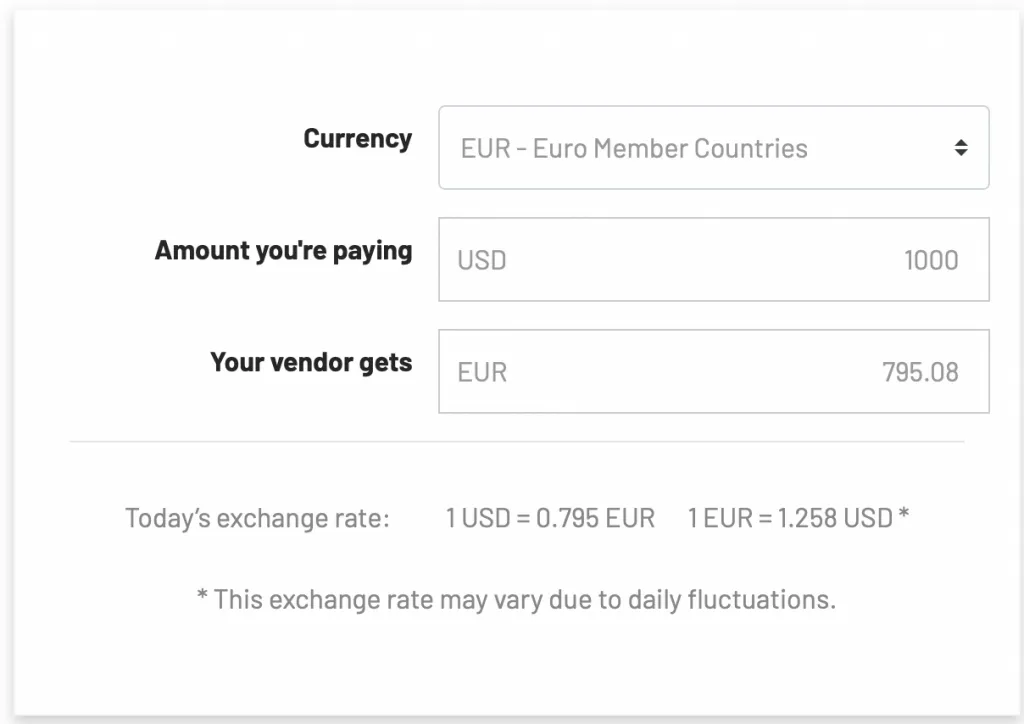

- Multi-Currency

- Activity Dashboard

- ACH Payment Processing

- Account Reconciliation

- Accounts Payable

- Approval Process Control

- Billing & Invoicing

- Budgeting/Forecasting

- Cash Flow Management

- Compliance Management

- Contact Database

- Core Accounting

- Electronic Payments

- Forecasting

- Fraud Detection

- Invoice Management

- Mobile Access

- Online Payments

- Purchasing & Receiving

- Recurring/Subscription Billing

- Self Service Portal

- Workflow Management

Additional Features

- Data Import/Export

- Customer Statements

- Electronic Signature

- Payment Processing

- Recurring Payments

- Electronic Funds Transfer

- Recurring Invoicing

- Email Management

- Alerts/Notifications

- Debit/Credit Card Processing

- Receivables Ledger

- Client Portal

- Email Reminders

- Check Writing

- Billing Portal

- Project Billing

- For Small Businesses

- Duplicate Payment Alert

- Access Controls/Permissions

- PCI Compliance

- Invoice Processing

- Document Management

- Real Time Data

- Financial Reporting

- Bank Reconciliation

- Customizable Invoices

- Online Invoicing

- Reminders

- Check Processing

- Overpayment Processing

- PO Reconciliation

- Payment Collection

- Partial Payments

- Third Party Integrations

- Fixed Asset Management

- Vendor Management

- Tax Calculation

- API

- Accounting Integration

- Cash Management

- Credit Card Processing

- Revenue Recognition

- Contingency Billing

- Mobile Payments

- Accounting

- Multiple Payment Options

- Invoice Creation

- Projections

- Status Tracking

- Data Security

- Invoice History

- Time & Expense Tracking

- Spend Management

- General Ledger

-

Integration with Accounting Systems

Bill software seamlessly syncs with significant accounting systems like QuickBooks, Sage, Intaact, and NetSuite, enhancing its utility for SMBs.

-

Functionality

The software’s overall functionality is highly rated, suggesting that it effectively meets the needs of its users in financial automation.

-

Value for Money

Users feel that Bill software offers good value for its price, aligning well with the features and benefits it provides.

-

Customer Support

The software receives commendable ratings for customer support, indicating responsive and helpful service.

-

Ease of Use

Bill software is rated positively for its ease of use, with an average rating of 4/5, suggesting that users find the interface and navigation straightforward.

-

Customer Service

Despite generally positive reviews, there’s a slightly lower rating (3.8/5) for customer service on specific platforms, suggesting room for improvement.

Disclaimer

Here at Tekpon's Global Buzz, we blend AI smarts with a human touch to offer a snapshot of user reviews from the web. While we carefully craft these summaries, please remember they reflect diverse user views and experiences, not Tekpon’s own opinions.

-

FreshBooks

Accounting Software

-

QuickBooks Online

Accounting Software

-

Slack

Team Collaboration Software

-

Xero

Accounting Software

-

Sage Intacct

Accounting Software

-

Dynamics 365

CRM Software

BILL Featured Comparisons

Looking to buy BILL for your business?

Tekpon’s procurement team can help you negotiate a better deal, or suggest more cost-effective alternatives.

Save time and money—starting at just $3,000/year.

Request a Custom OfferIncludes expert support and direct vendor negotiation.

Tell us your opinion about BILL and help others.

The billing software is highly intuitive with a clean user interface. Key features include customizable invoices, automated reminders, and robust reporting tools. It integrates seamlessly with other platforms and supports multi-currency transactions. Performance is reliable with minimal bugs. While pricing is competitive, the value justifies the cost, enhanced by responsive 24/7 customer support. Pros include ease of use and integration capabilities, but the learning curve for complex features might be a drawback for some. Overall, a great tool for streamlining billing processes.

The billing software presents a steep learning curve, especially for its advanced features, which might be daunting for new users trying to quickly onboard. Customization options are somewhat limited, particularly in tailoring invoices and reports, which could be a setback for those seeking specific personalization. Integration gaps are noticeable, as the software may not seamlessly connect with certain third-party applications users already utilize, potentially disrupting workflows. Additionally, while the software offers comprehensive features, its pricing could be prohibitive for smaller businesses or startups operating under strict budgets. Lastly, the mobile application version lacks some of the intuitive design and features found in the desktop version, which can hinder the user's experience on the go.

Table of Contents

BILL, previously known as Bill.com, is a leading software company headquartered in the United States. The platform is highly favored by a majority of the top 100 accounting firms across the nation. The company is dedicated to empowering small and medium-sized enterprises (SMEs) by alleviating them from the challenges of manual processing through its innovative software solutions. BILL (formerly bill.com) is an advanced financial operations platform designed to automate and streamline financial tasks for businesses of all sizes. Key features include Account Payable (AP) and Account Receivable (AR) automation, Spend and expense management, and robust integration with popular accounting software. BILL enhances financial operations with efficiency, control, and visibility, transforming the way businesses manage their finances.

Key features include:

- Accounts Payable & Receivable Automation: BILL reduces manual processing time and errors, offering streamlined workflows for AP and AR.

- Spend & Expense Management: Offers access to credit lines, budget management, virtual cards, reimbursements, and rewards.

- Payment Options: Supports ACH payments, card payments, and international transactions to over 130 countries.

- Invoicing and Approvals: Simplifies the creation, sending, and tracking of invoices with customizable templates and automated approval workflows.

- Artificial Intelligence: Utilizes AI to enhance bill pay efficiency and reduce human error.

- Mobile App: Manage financial operations on the go with full functionality from mobile devices.

- Integration: Seamlessly integrates with major accounting software like QuickBooks, Sage Intacct, Xero, and NetSuite.

Bill is an all-encompassing platform designed to streamline businesses’ financial operations. It includes a wide array of tools and features that enable the effective and efficient management and control of financial processes.

Details of BILL Features

Moving on with the BILL review to the features section to see what this software can do. As with any review, we advise you to take this with “a grain of salt.”

Accounts Payable

If you have experience with accounting software like Xero or NetSuite, you probably know that they cover a lot of accounts payable tasks. However, using specialized accounts payable software like BILL can help you make your accounting process more efficient and keep track of all your payments without redundant data entry. By integrating BILL with your current accounting software, you can avoid accounting errors and consistently keep your bills organized and up-to-date. With its payment automation and segmentation features, you can easily assign bills to specific parties or automate them entirely.

Automating bill payments can save you up to 50% of your time and ensure that you never miss paying your bills. If you’re not fully comfortable with automating the process, you can still benefit from receiving notifications when bills are due and setting different levels of permissions.

- Invoice Capture & Processing – BILL’s AP automation starts with capturing invoices through various methods like email, mobile, or manual upload. AI technology extracts critical data, minimizing manual entry errors and speeding up the process.

- Automated Approval Workflows – Customizable approval workflows ensure that every invoice is reviewed and approved by the right people at the right time. Notifications and reminders help streamline the process, ensuring timely approvals.

- Payment Processing – BILL offers multiple payment options including ACH, virtual card, and international wire transfers. Scheduled payments, early payment discounts, and real-time payment tracking add to its efficiency.

- Fraud Detection – Advanced security features and AI-driven fraud detection help protect businesses from unauthorized transactions, ensuring safe and secure payment processing.

Accounts Receivable

BILL, formerly known as bill.com, offers a comprehensive solution for managing receivables. To begin with, the tool provides a customizable invoicing template, allowing users to create and personalize invoices directly within the accounts receivable software. Additionally, the platform enables users to send and track invoices, including via US Post. Furthermore, users can send payment reminders to customers to ensure prompt payments. Customers are also able to select from various payment options, including direct bank account withdrawals, facilitating faster payments. Lastly, BILL seamlessly integrates your accounting system with the AP/AR software, ensuring smooth reconciliation.

- Invoicing – BILL simplifies invoice creation and delivery with customizable templates and automated distribution. Businesses can send professional-looking invoices directly from the platform, reducing administrative overhead.

- Customer Portals – Customers can access their invoices, make payments, and track their payment history through self-service portals, enhancing customer experience and reducing support queries.

- Payment Collection – Automated reminders and follow-ups help ensure timely payments. Businesses can offer multiple payment methods to customers, including credit card and ACH, making it easier for customers to pay on time.

- Reconciliation – Integration with accounting software ensures that all received payments are automatically reconciled with invoices, providing an up-to-date view of receivables and reducing manual reconciliation efforts.

Spend & Expense Management

The platform aims to make the process of sending international payments as effortless as sending domestic payments. To elaborate on this, BILL offers the option to send payments within the domestic market through two convenient methods. This approach ensures that international payments are just as simple and seamless as domestic transactions.

- $0 wire transfer fee in local currencies

- International transfers in dollars at $9.99 per transfer

- Virtual Cards – BILL offers virtual cards for managing expenses, which provide better control and tracking of business expenditures. Each card can be assigned specific spending limits and categories.

- Expense Reports – Employees can easily submit expense reports through the mobile app or web portal. Automated approval workflows ensure that expenses are reviewed and approved promptly.

- Reimbursements – The platform supports fast and efficient reimbursement processes, ensuring that employees are reimbursed for their expenses quickly and accurately.

- Budgeting & Reporting – Detailed spending analysis and budgeting tools help businesses monitor expenses, identify trends, and make informed financial decisions. Customizable reports provide insights into spending patterns and compliance.

Automatic Check Payments

These two features function similarly. However, one of the main advantages of using BILL is its ability to automate checks and ACH Payments. You may be surprised to know that checks are still a commonly used payment method in the US, despite the prevalence of electronic payments. Vendors often prefer checks for one of two reasons: they may prefer paper records, or they wish to avoid credit card fees. For example, your landlord may require check payments, which can be a time-consuming process. BILL can simplify this process.

Now, let’s take a look at how automated check payments work.Finally, after going through all the steps, you will check what happened with the transaction and avoid the mess that can arise from check payments.

ACH Payments

ACH, or Automated Clearing House, is a method commonly used to transfer money electronically between banks in the United States. While not as widely utilized as other methods, ACH offers a solution to the challenge of sharing bank account information by enabling ACH Payments, similar to the process with checks. Furthermore, you can easily invite vendors to set up payments, establish connections with them, and use BILL to securely and conveniently transfer money.

Keep in mind that, against an extra cost, BILL gives you the option to speed up the process.

- Same-day – $9.99

- Next day – $9.99

- 2- 5 days – $0.49

1099 Contractor Payments

Bill integrates with Tax1099 to streamline and optimize the process. This software allows you to easily import all the required information using CSV files, which is especially useful if you don’t use the list feature.

Customer Service

Although BILL’s tutorials are helpful and well thought out, some customers may need more assistance than just a video to properly set up the software. Unfortunately, it does not offer phone support, which can be frustrating for those who are not willing to wait for email replies. While the tool itself is simple to use, we believe that their customer support service could be improved. It’s worth noting that if you have a product that integrates with the software, you may be able to receive some support through that integration. Ultimately, the satisfaction of the end customer should be the top priority, and offering phone support as an option should be considered to enhance the overall customer experience.

BILL App

The software offers the option of approving bills or sending invoices on the go from the BILL app. The apps offer the full functionality of the cloud version with the extra mobility associated with the applications.

- Full Functionality on the Go – The BILL mobile app provides all the functionalities of the desktop version, allowing users to manage invoices, approve payments, and track expenses from anywhere.

- Real-Time Notifications – Push notifications keep users informed about approvals, payments, and other critical updates, ensuring timely actions and decisions.

BILL Integrations detailed

BILL com comes with several integrations, as follows:

AP and AR Sync:

- Direct two-way sync with NetSuite, Sage Intacct, QuickBooks, Microsoft, and Xero.

- Automatic or on-demand sync.

Integration with Any Accounting Software:

- Use CSV templates for easy import and export with any system.

Spend & Expense Sync:

- Sync card transactions with QuickBooks, NetSuite, and Sage Intacct.

- Integrate BILL Spend & Expense account with Slack.

Automated Sync Across AP, AR, and S&E:

- Streamlined setup with single login.

- Automatic sync across integrated product suite.

Additional Integrations:

- Tallie, HubDoc, Tax1099, and Earth Class Mail.

Sync Features:

- Automatic sync runs every 24 hours.

- Option for on-demand sync.

Integration Support:

- The onboarding process for setup.

- Solution specialists for complex deployments.

Other Notable Integrations:

- HRIS, Expense Management, Budget Management, Corporate Card, Virtual Card, Reimbursements, Rewards, Mobile App, Payments Services, and Reporting Insights.

BILL Review Conclusion

In conclusion, our review of BILL has led us to confidently say that it is easy to use. While it may lack customer service, its automation and time-saving features certainly make up for it.

Additionally, it has an impressive range of integrations that make it accessible to 80% of small and medium-sized businesses. We would love to hear your personal review of BILL, including what you love and what you don’t.

Related In-depth Comparison

We’ve got you covered if you’re struggling to decide on an accounting software. Our in-depth comparison will provide you with all the information you need to make an informed decision.

BILL Frequently Asked Questions (FAQs)

Are you tired of spending hours on tedious tasks? BILL can help you automate those tasks and reduce your time spent on account payables by 50%. Their main goal is to help small and medium-sized businesses save time by providing them with useful tools.

BILL integrates with other software like Quickbooks, Xero, and Oracle NetSuite to streamline your workflow. In addition, the BILL app for Apple and Android allows you to approve and pay bills on the go.

BILL is an accounting software that automates the accounts payable (AP) and accounts receivable (AR) processes. It enables businesses to manage bills, invoices, and payments efficiently by offering features such as bill entry, approval workflows, payment options (ACH, virtual card, credit card, etc.), and a centralized inbox for managing bills. BILL also provides a secure connection with over 4 million vendors through its network.

The best part about BILL is its user-friendly interface. It’s easy to set up and use. To get started, all you need to do is register an account on their website, add your company information, and connect your bank account/accounts. BILL automatically integrates with your existing accounting software and registers your transactions on your behalf.

With BILL, you can manage your finances without any hassle and keep your books up-to-date effortlessly.

Yes, all bills paid through BILL are FDIC-insured. Additionally, the company undergoes regular SOC 1 and Type 2 audits to ensure that its processes maintain industry-standard criteria for security, confidentiality, and transaction processing integrity.

As your business grows, you may want to separate the accounting and payments sides to protect against fraud. BILL offers this option through its separation of duties feature, allowing you to delegate tasks and increase security while freeing up some of your time. You can even assign an approval role to a designated person for review before making any transactions.

Overall, it provides a secure and reliable platform for all your business payment needs.

BILL is used for streamlining and automating financial operations, including managing accounts payable and receivable, spend, and expenses. It helps businesses automate approval workflows, pay bills, create and send invoices, set up payment reminders, and track invoices and payments.

For Businesses:

Accounts Payable:

- Essentials: $45/user/month

- Team: $55/user/month

Accounts Receivable:

- Essentials: $45/user/month

- Team: $55/user/month

AP & AR Corporate: $79/user/month

Enterprise: Custom Pricing

Spend & Expense: $0/user/month

For Accountants:

- BILL AP & AR Partner: $49/month

- BILL Spend & Expense Partner: $0

To use BILL, businesses should:

- Choose the appropriate plan based on their needs (AP, AR, or both).

- Integrate Bill.com with their accounting software (automatic sync available with QuickBooks, Xero, etc.).

- Set up user roles and approval policies.

- Start entering bills or creating invoices.

- Utilize the payment options to manage and track payments.

- Use the centralized inbox to manage bills and invoices.

- For spend and expense management, access credit lines, set budgets, and track spending using Bill.com’s software and corporate cards.

BILL automates financial operations for businesses, including accounts payable, accounts receivable, spend management, and expense management. It offers tools for bill entry, invoice creation, automated approval workflows, and various payment options, along with a centralized platform for managing financial transactions.

BILL focuses on automating accounts payable and receivable processes, providing a platform for managing bills, invoices, and payments. QuickBooks is a comprehensive accounting software offering a broader range of features, including bookkeeping, tax preparation, payroll, and financial reporting. It can integrate with QuickBooks to enhance financial operations by automating payment processes.