Rocket Money Reviews

& Product DetailsWhat is Rocket Money (formerly Truebill)?

Rocket Money, formerly known as Truebill, is a financial management platform designed to empower users to take control of their finances. The software offers a comprehensive suite of tools to track, manage, and optimize personal finances.

With Rocket Money, users can effortlessly monitor their spending habits, identify recurring subscriptions, and even negotiate bills to save money. Its intuitive dashboard provides a clear overview of one’s financial health, highlighting areas for potential savings.

Additionally, Rocket Money offers features to set savings goals and automate the savings process, ensuring users can build wealth over time. The platform’s rebranding from Truebill to Rocket Money signifies its commitment to propelling users towards financial success.

In essence, Rocket Money is not just a budgeting tool; it’s a comprehensive financial assistant aimed at maximizing savings and financial growth.

Found in these Categories

Best For

- StartUps

- Freelancers

- Small Business

- Medium Business

- Large Enterprise

- Non-profit Organization

- Personal

- Cloud, SaaS, Web-Based

- Mobile - Android

- Mobile - iPhone

- Mobile - iPad

- Desktop - Mac

- Desktop - Windows

- Desktop - Linux

- Desktop - Chromebook

- On-Premise - Windows

- On-Premise - Linux

-

Company Name

Rocket Money

-

Located In

United States

-

Website

rocketmoney.com

Starting from:

FREE

Pricing Model: Subscription

- Free Trial

- Free Version

Pricing Details:

Rocket Money offers two pricing tiers: a free plan and a Premium plan. The free plan includes account linking, balance alerts, subscription management, and spend tracking. The Premium plan enhances the experience with concierge services like subscription cancellation, chatting with money experts, and bill negotiations. It also introduces financial offerings like a Smart Savings Account and the Rocket Signature Card, along with other advanced features.

- Activity Dashboard

- Reporting/Analytics

- Mobile Access

Additional Features

- Autopilot Savings

- Bill Negotiation

- Budget Creation

- Credit Score Monitoring

- Expense Tracking

- Financial Insights

- Manage Subscriptions

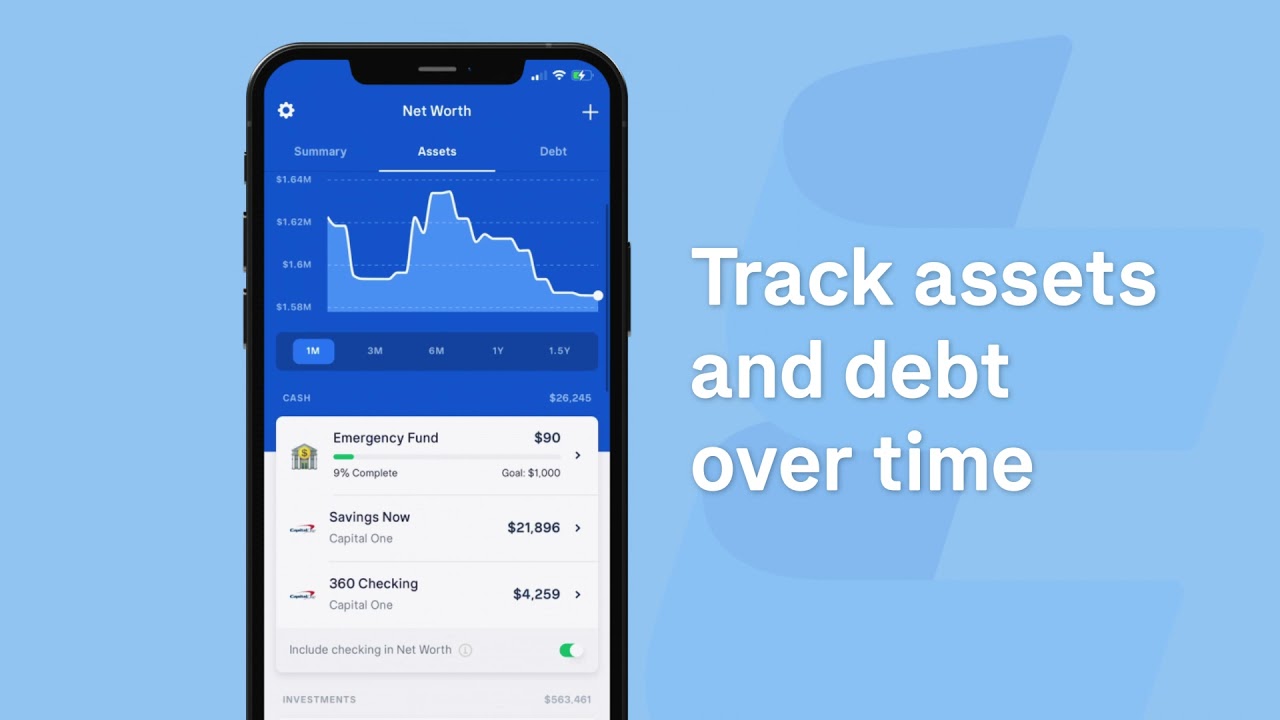

- Net Worth Calculation

- Spending Analysis

- Subscription Cancellation

-

Functionality

TrueBill offers features like finding and canceling unused or forgotten subscriptions, negotiating bills to save money, and monitoring cable, internet, and utility outages.

-

Ease of Use

Users find TrueBill simple to use. The app guides users in tracking budgets and expenses and managing subscriptions effectively.

-

Comprehensive Financial Overview

It allows users to view all their financial accounts in one place, simplifying the management of personal and business finances.

-

Customer Service

Although there are mixed opinions, some users report quick responses and satisfactory resolutions from the customer service team.

-

High Ratings on App Stores

TrueBill enjoys high ratings in app stores, which points to a generally positive reception among many users.

-

Customer Service Accessibility

There is no direct phone support, and users have reported varied experiences with email support. This can be a drawback for users who prefer more immediate or direct forms of customer service.

-

Cost Clarity and Premium Service Pricing

The pricing model, especially for the premium service, can be confusing with different information from various sources. This lack of clarity could be improved for better user understanding.

-

Account Connectivity Issues

Some users have experienced annoyances with needing to frequently reset account access, which can be inconvenient.

-

Negative Feedback on Social Media

There are reports of being overcharged for services and dissatisfaction with bill negotiations on platforms like Facebook.

Disclaimer

Here at Tekpon's Global Buzz, we blend AI smarts with a human touch to offer a snapshot of user reviews from the web. While we carefully craft these summaries, please remember they reflect diverse user views and experiences, not Tekpon’s own opinions.

Tell us your opinion about Rocket Money and help others.

Table of Contents

Truebill: Helps you Save Money

Most individuals contemplate evaluating their budget and looking for methods to save money at some time. Fortunately, several simple methods are available to reduce your expenditures, including one that requires no effort: utilizing money-saving applications that do the job for you.

Since the launch, the firm has assisted consumers in saving over $14 million by locating and canceling unneeded subscriptions, lowering monthly expenses, and obtaining refunds on their behalf. However, the program is about more than just those instant savings; it also teaches you how to notice and improve your spending habits to manage your money better.

About Rocket Money (formerly Truebill)

Rocket Money, formerly known as Truebill, is a comprehensive financial management platform designed to empower users to take control of their financial life. The platform offers a suite of features tailored to enhance financial visibility and optimization. Users can effortlessly manage subscriptions, ensuring they only pay for services they use.

The Autopilot Savings feature automates the savings process, making it easier to achieve financial goals. Rocket Money provides insightful spending breakdowns, helping users understand their financial habits and make informed decisions. The platform also aids in lowering bills by negotiating better rates on users’ behalf. Additionally, users can monitor their net worth, credit score, and even set up a personalized budget.

The platform’s integration with RocketCard offers additional benefits, such as earning cash back on purchases, which can be applied towards mortgage savings.

Whether it’s tracking expenses, saving money, or understanding credit, Rocket Money offers a holistic solution for modern financial management.

You can have access to the following things with a free Truebill account:

- Keep track of your finances. View your bank account balances, recent transactions, a monthly spending breakdown, impending invoices, subscriptions, and more. Once a day, the balances are updated.

- Budgeting. Make up two budgeting categories and keep track of them.

- Credit rating. Experian will provide you with your credit score.

- Alerts about the balance. When your bank account balances reach a specific level, you’ll be alerted.

- The following features are available when you upgrade to a premium account:

- Concierge for Cancellations. This service handles the cancellation of paid subscriptions and recurring invoices.

- Accounts that are shared. Allows another person to access the account, such as a spouse.

- Credit score and credit report are two different things. First, get access to your credit score and credit report, updated every 30 days. Truebill also monitors and alerts you to recent activity on your account. Then, make a payment in advance. For example, you might get a $120 advance on your next pay.

- Smart savings. An FDIC-insured bank account that seeks to assist you in automatically saving for your financials.

- Synchronization in real-time. Accounts are updated in real-time, in the free version, rather than once a day.

- This is a premium chat. During business hours, you can get immediate assistance.

- Data should be exported. This benefit can be useful when you don’t have a separate checking account, like running a side company or a small business. Your spending may be tax-deductible in this situation, and being able to export a detailed list of those expenses at the end of the year might save you time when filing your taxes.

Is it safe to use Rocket Money (formerly Truebill)?

Rocket Money (formerly Truebill) emphasizes user security by implementing robust encryption and security protocols to protect user data. The platform does not store sensitive bank login credentials and uses bank-level 256-bit encryption for data transmission. Additionally, Rocket Money operates in a read-only mode, ensuring that no transactions can be made through the platform.

While it’s always essential for users to exercise caution and regularly monitor their accounts, Rocket Money’s security measures aim to provide a safe environment for users to manage their finances.

As with any online service, it’s advisable to research and read user reviews to gauge overall trustworthiness.

Is Truebill insured by the Federal Deposit Insurance Corporation (FDIC)?

Yes. Truebill’s Smart Savings function places your money in an FDIC-insured, non-interest-bearing account. This means your money is safe for up to $250,000.

But how much will it cost?

You’ll have to hand up your bank data, a major red signal that should not be overlooked. Second, while Truebill will save you money by lowering your subscriptions, the site will deduct a 40% fee from your overall yearly savings. Would Truebill’s cost-cutting services save you money, or would you be able to cut your costs?

Truebill distinguishes itself apart in key areas among the many budgeting and money applications available:Truebill distinguishes itself apart in key areas among the many budgeting and money applications available:

- Even if you purchase Premium, Truebill is a reasonably priced program. Trim’s premium plan, for example, costs $99 per year.

- Truebill provides subscription cancellation and bill negotiating options, which are not available through applications like Mint.

- Truebill includes budgeting and savings capabilities and unique features, allowing you to accomplish more with one app rather than downloading multiple.

How does Rocket Money (formerly Truebill) Works?

Rocket Money (formerly Truebill) is a financial management platform designed to help users optimize their finances. Users connect their bank accounts to the platform, allowing Rocket Money to analyze their spending habits, subscriptions, and bills.

The platform identifies unused subscriptions, enabling users to cancel them directly. It also negotiates bills on the user’s behalf, seeking potential savings. Features like Autopilot Savings allow automatic transfers to savings, while Spending Insights provide a clear view of where money goes.

Additionally, Rocket Money offers tools for budgeting, tracking net worth, and monitoring credit scores.

Through a combination of automation and insights, Rocket Money aims to simplify and enhance personal financial management.

For whom is Rocket Money (formerly Truebill) most suitable?

Rocket Money (formerly Truebill) is most suitable for individuals seeking a comprehensive overview of their finances and wanting to optimize their spending. It’s ideal for those who have multiple subscriptions and bills, as the platform can identify and cancel unused services and negotiate better rates.

People aiming to save more will benefit from its Autopilot Savings feature. Additionally, those wanting to track and improve their financial health through budgeting, net worth calculations, and credit score monitoring will find Rocket Money valuable.

In essence, it’s best for anyone looking to gain more control over their financial landscape without the manual hassle.

Rocket Money (formerly Truebill) Features Detailed

The list of features that makes Rocket Money (formerly Truebill) stand out in the market are as follows:

-

Manage Subscriptions:

Rocket Money offers a centralized dashboard where users can view all their subscriptions in one place. This feature helps users identify and cancel any unwanted or forgotten subscriptions, ensuring they only pay for services they actively use.

-

Autopilot Savings:

This feature allows users to set aside a specific amount or percentage of their income automatically. It’s a hassle-free way to save money without thinking about it, making it easier for users to reach their financial goals.

-

Spending Insights:

Rocket Money provides detailed insights into users’ spending habits. By categorizing transactions and presenting them in easy-to-understand charts and graphs, users can quickly identify areas where they might be overspending and adjust accordingly.

-

Lower Your Bills:

One of the standout features of Rocket Money is its ability to negotiate bills on behalf of the user. Whether it’s a cable bill, phone bill, or any other recurring expense, Rocket Money can potentially secure a lower rate, saving users money in the long run.

-

Net Worth Tracking:

By connecting various accounts, users can get a holistic view of their financial health. This feature calculates the total net worth by considering assets and liabilities, giving a clear picture of one’s financial standing.

-

Credit Score Monitoring:

Rocket Money provides regular updates on users’ credit scores. This is crucial for those looking to maintain or improve their creditworthiness, especially if they’re considering taking out loans or applying for credit cards in the future.

-

Create a Budget:

Budgeting is made simple with Rocket Money. Users can set spending limits for different categories, track their progress, and receive alerts if they’re nearing or exceeding their set limits. This proactive approach ensures users stay within their financial means.

-

RocketCard:

RocketCard is a no-fee debit card offered by Rocket Money. It integrates seamlessly with the Rocket Money app, allowing users to make purchases, withdraw cash, and manage their card settings directly from the app.

Rocket Money, with its array of features, provides a comprehensive solution for individuals looking to take control of their finances. From managing subscriptions to saving money and monitoring credit scores, it offers tools that cater to various financial needs, making it a one-stop-shop for personal finance management.

Alternatives to Rocket Money (formerly Truebill)

You’re not alone if you’re trying to figure out how to handle your money. You’re among those individuals who take the time to learn more about their finances and how to save money daily.

However, if Rocket Money (formerly Truebill) doesn’t appear to be the ideal personal finance tool for you to meet these objectives, don’t worry; there are many other methods to save money, including some money-saving applications that need minimal work.

The top alternatives that are available in the market to Rocket Money (formerly Truebill) are listed down below:

- Trim

- Ibotta

- Billshark

- Personal Capital

- Bobby

- Capital One Shopping

Rocket Money (formerly Truebill) vs. Trim: What’s the Difference Between the Two?

Truebill and competing financial app Trim are easily confused by most users. Both companies started to address many of the same issues: decreasing monthly payments, managing subscriptions, and identifying savings opportunities. Both companies work with over 15,000 different financial institutions. Their names begin with the same two letters, striking similarity.

However, for comparison shopping, we may discern certain distinctions. The most noticeable distinction is the percentage charged by each provider for locating savings. For example, Truebill charges 40%, whereas Trim is a little cheaper, at 33%.

The following are some minor distinctions:

- Trim cancels subscriptions for free; at Truebill, this is a premium (read: expensive) service.

- Trim provides a tool to help you negotiate lower interest rates on your debts and set up a payback plan for $10 each month.

- Truebill and Trim have free iOS and Android applications, although Truebill does not.

Is Rocket Money (formerly Truebill) a genuine company?

It’s normal to be nervous or suspicious when a service requests your financial information. But unfortunately, scams and dishonest enterprises exist in the financial services area, and many people have fallen prey.

Users are, of course, urged to stay careful. Truebill, fortunately, understands that clients are likely to feel this way. Their website has a section dedicated to assuage consumers’ fears about the service’s security risks. Truebill promises to use “the best encryption in the industry to protect your data.” Some of the security elements they provide are as follows:

- Amazon Web Services (AWS) is a cloud computing service. Amazon Web Services is used by the Department of Defense and the Financial Industry Regulatory Authority to host and safeguard online data. NASA even uses it. Thanks to this web host, your data on Truebill’s servers will never be used or accessed by a third party.

- Plaid Truebill connects over 15,000 financial institutions throughout the United States with Plaid. Plaid is a data transmission network that numerous fintech and digital financial apps use to send and receive data. When you use Plaid, your online banking credentials never access Truebill’s servers and are never stored. Due to this, Truebill cannot make any changes or remove monies from your account. In addition, to invalidate the platform’s read-only access token, you can unlink your bank account at any moment.

- Clauses of Protection. According to the site, your data will only be used to offer services. In addition, Truebill guarantees that your information will never be sold or shared with anyone else.

Rocket Money (formerly Truebill) Review Conclusions

Because so much money is spent on subscriptions rather than one-time purchases, I believe that most people (even the most frugal spenders) should utilize programs like Truebill or Trim. Truebill provides unique information (particularly regarding changes to your monthly subscription rates) that might help you keep track of your spending rather than thinking you’re receiving the greatest bargain.

It isn’t easy to judge if the premium service will be worth the money. Trim provides free bill cancellation services, although its offerings are more limited than Truebill’s. Even if you go back to the free service after a few months, it may be worth upgrading to the paid premium service for a brief period to take advantage of the cancellation option. Truebill’s bill negotiating service is also more expensive than Trim’s, but Truebill’s approach is more in-depth and may be worth the extra cost.

First, I believe it is useful to download the free Truebill app and observe whether it causes any changes in behavior. If it doesn’t, paying for the negotiations and upgrading to terminate subscriptions is a good idea. Truebill might save you hundreds of dollars every year in a short period.

Is Rocket Money (formerly Truebill) a good investment?

Rocket Money (formerly Truebill) is primarily a personal finance management tool designed to help users optimize their spending, save money, and gain insights into their financial habits. Its value as an “investment” is subjective and depends on individual financial goals.

For those seeking to streamline their finances, reduce unnecessary expenses, and save more efficiently, Rocket Money can be a beneficial tool.

However, it’s essential to differentiate between using a service to manage finances and investing in assets or securities that appreciate over time. Always conduct thorough research or consult with a financial advisor before making investment decisions.