Pilot Reviews for 2026

Save 40% on your SaaS stack with expert guidance

Free Consultation

What is Pilot?

Pilot is an enterprise accounting and general ledger software for startups or small enterprises. The platform helps them handle bookkeeping, taxes, and other financial operations. For example, administrators can submit federal, state, and local income taxes and receive real-time progress information on filings.

Annual budgeting, investor reporting, pitch evaluations, fundraising tactics, forecasting, and other professional services are all managed through the platform. Managers may use Pilot to evaluate transactions and create financial statistics such as profit and loss, cash flow, and balance sheet every month. Burn rates may also be calculated, and inventory updates can be shared with eCommerce shops.

Pilot allows businesses to process bills, produce and distribute invoices with relevant staff, manage costs, develop budgets, and assess the financial health of their organizations. Employees can also track R&D costs and gather supporting documentation.

Found in these Categories

Best For

- StartUps

- Small Business

- Medium Business

Pilot Pricing

Looking to Save Time & Money

Audit, consolidate, and save—powered by our internal buying team. Let our experts analyze your current software stack and identify opportunities for cost savings and efficiency improvements.

- Stack Audit

- Cost Reduction

- Expert Team

Pilot Features

- Smart and Automated Systems

- Expense Tracking

- Tax Management

- Core Accounting

- Accounts Receivable

- Multi-Currency

- Activity Dashboard

- Accounts Payable

- Bank Reconciliation

- Bookkeeping Services Integration

- CPA Firms

- Core Accounting

- Corporate/Business

- Electronic Filing

- Financial Management

- Financial Reporting

- For Small Businesses

- General Ledger

- Income & Balance Sheet

- Profit/Loss Statement

- Revenue Recognition

- Tax Calculation

Pilot Integrations

User Sentiment - Pilot Reviews

-

Comprehensive Financial Services:

Pilot offers an all-in-one approach, covering bookkeeping, CFO services, tax, and R&D, which is highly valued by customers for its efficiency and effectiveness.

-

User-friendly and Automated

The software is praised for its ease of use, automation, and the quality of bookkeeping, removing the need for in-house expertise at a fraction of the cost.

-

Responsive and Professional Support

Pilot’s support team receives high marks for being responsive, patient, and professional, often seen as an extension of the customer’s team.

-

Effortless Integration

Customers appreciate Pilot’s ability to integrate seamlessly with other software packages like Quickbooks and Stripe, facilitating a smoother workflow.

-

Customizable Service Packages

Pilot offers flexibility in services tailored to meet the specific needs of businesses, from startups to large enterprises, including the option for accrual or cash basis bookkeeping.

-

Pricing

While many find Pilot’s services valuable, some users consider the pricing premium, especially for tax filing services, which may not always meet expectations in terms of responsiveness.

-

Bugs and Improvements in Portal

The transaction classification portal, though improving, can be buggy, indicating room for enhancement in the user interface.

-

Tax Service Responsiveness

There’s a noted need for improvement in the customer support outside of bookkeeping, specifically for tax return assistance, where responsiveness could be enhanced.

-

CPA Relationships

Users who prefer building long-term relationships with CPAs noted that changes in assigned CPAs without notice could be a downside.

-

Feature Development

There’s a desire for continuous development of automation to reduce manual adjustments, suggesting that while the automation is appreciated, there’s room for further enhancement.

Leave a Review

Pilot Company Details

Company Name

Pilot

Headquarters

United States

Website

pilot.com

Own this Software?

Pilot vs. Similar Products

Select up to 3 Software, to enable Comparison

Compare Selected SoftwareEditorial Review: Pilot Deep Dive

Table of Contents

Pilot is a virtual accounting solution for small companies. Each firm is assigned a dedicated financial specialist who regularly reconciles its books, compiles reports, and advises on best practices. Pilot is highly suited for high-growth potential startups, with a discount for pre-revenue firms, burn-rate estimates incorporated in each plan (an essential measure for venture capitalist-backed organizations), and an add-on CFO service offered. So, let us dig into the detailed Pilot review without further ado.

Pilot: Payroll Management Software

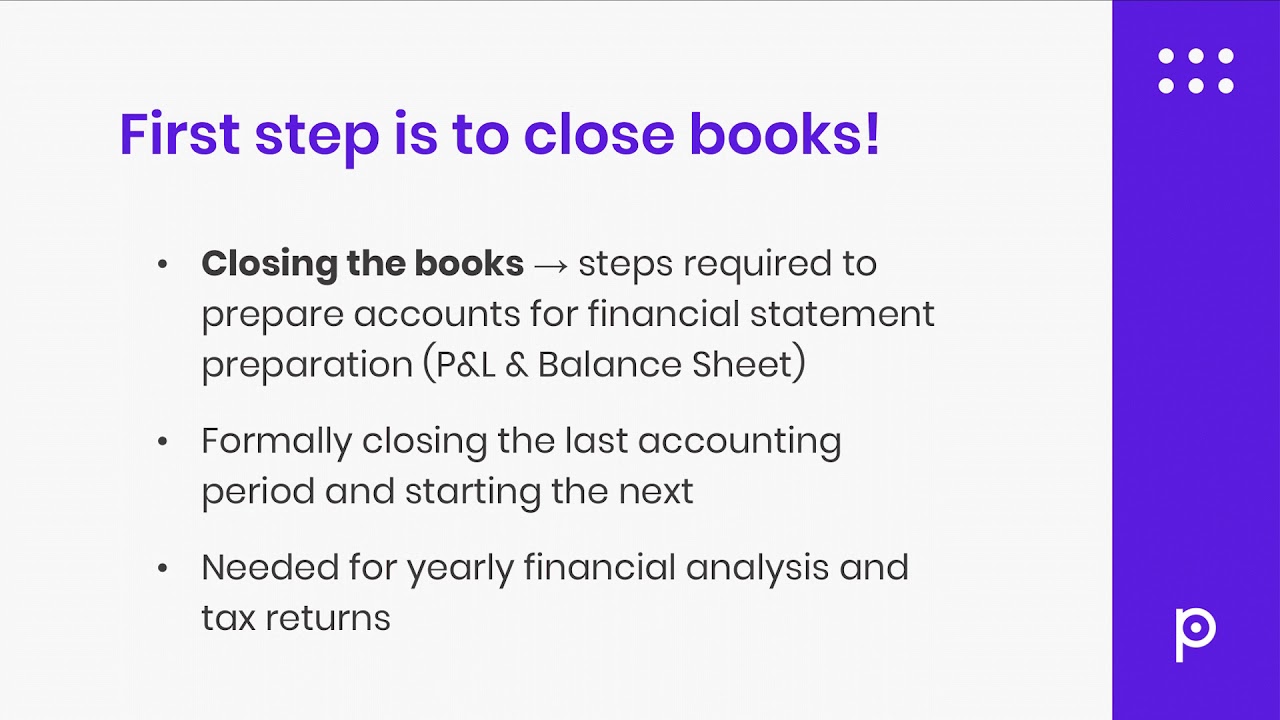

Bookkeeping is a time-consuming and labor-intensive task. As a result, company owners begin to seek out people, products, and software that may assist them. However, even though the software and other tools are excellent, you must still perform a significant amount of manual labor before your computer or phone to ensure that everything is input and completed on time and accurately.

With Pilot bookkeeping, you won’t have to worry about anything. Everything will be done for you by the Pilot. You will receive your monthly and on-demand reports without performing any work, allowing you to focus only on operating your business.

Pilot Story

Pilot Accounting, founded in 2017, is a financial services company that specializes in bookkeeping, chief financial officer (CFO), and tax services for startups and small enterprises. It caters to fast-growing enterprises and serves as a one-stop financial shop for CFO consultants, including aiding with R&D loan applications for a charge.

It also works with high-growth digital companies, eCommerce, professional service providers, and charitable organizations. In addition, a team of engineers assists the Pilot’s bookkeepers by automating the data input process, guaranteeing that the books are always accurate.

Moreover, Pilot is a cloud-based accounting application that helps small and medium-sized enterprises manage their finances and cash flow. Important features are accounts payable/receivable, bookkeeping, data export, expenditure calculations, invoice volume, ledger, and reimbursements.

The program includes an accrual-based bookkeeping tool that gives business insights to teams. It connects consumers’ existing services, such as Gusto and Expensify, and automates data collecting. The reporting feature generates monthly reports, including profit and loss statements, balance sheets, and cash flow statements.

Pilot works with third-party apps like QuickBooks and Stripe, and it can handle an infinite number of transactions and connections. In addition, it is accessible on a yearly subscription basis, including phone and email assistance.

Who can use Pilot?

- Fast-Growing Businesses, such as High-Growth Technology Startups: Pilot’s accrual-basis and complex bookkeeping tools will be useful as your company expands and maybe takes on finance.

- Companies need a CFO and/or tax services: You may use Pilot CFO and Pilot Tax to get a CFO consultation and submit corporate taxes and 1099-MISC forms for your firm.

- Businesses that require bookkeeping catch-up and/or cleanup: Pilot may assist you with bookkeeping if you’ve gotten behind or need to guarantee that your books are accurate for an extra cost.

- Several entities: Pilot’s Plus package, which has bespoke pricing, includes support for multiple businesses.

What can Pilot be used for?

Pilot accounting is a bookkeeping firm specializing in providing bookkeeping and other financial services to startups and small enterprises. Therefore, they have extensive knowledge and expertise in this area. In addition, they have a staff of bookkeeping specialists working on your books and a team of developers developing technologies to automate some of the bookkeeping labor.

They do accrual-basis bookkeeping, which is critical for growing businesses. QuickBooks Online is Pilot’s accounting software, which means you’ll always have access to your accounts and may switch to another bookkeeping service or hire an in-house bookkeeper. It can also undertake catch-up work and interact with your books and bookkeeping system.

You may easily contact the Pilot bookkeeping team if you have any questions. Your account manager will contact you through email if more information is required. You may rest easy knowing that your funds are always up-to-date and nicely structured. You will be able to make better financial decisions for your startup since you will have a more realistic financial picture.

Pilot provides a wide range of financial services to its customers, including the following:

- Dedicated bookkeeper for accounts

- Accounting on an accrual basis

- Preparation of financial accounts by industry standards

- Import transactions automatically

- Categorization of Transactions

- Every month, accounts are reconciled.

- Inventory accounts payable and accounts receivable tracking

- Bookkeeping cleanup and catch-up

- Preparing and submitting your taxes

- Forecasting cash flow

- Support for several currencies

- Accounts can be connected indefinitely.

How does the Pilot work?

After you join Pilot, you will only need to complete a few steps before your accounting can be handed over to one of their bookkeepers:

- Introducing your account manager – You will assign a dedicated account manager. It’s convenient to have a continuous point of contact and someone who will learn more about you and your company over time.

- System integration – Your account manager will show you how to link QuickBooks with your existing procedures and software so that they can automate as much of your bookkeeping as feasible.

- Examine your month-to-month reports — All you can do now is review your monthly reports, including cash flow statements, profit and loss statements, and balance sheets, and raise any questions you have if necessary.

If you have any questions during the month, you may contact your account manager for free via the QuickBooks site or email.

A company must satisfy three conditions to participate in Pilot:

- First, allow Pilot to participate in electronic transactions.

- Second, have expense-reporting software on your computer.

- Third, there is no mixing of personal and business spending.

If you meet those criteria, you can sign up for Pilot and be matched with a personal bookkeeper who will assist you with the onboarding process. The bookkeeper will become acquainted with your financial situation, link any financial program with QuickBooks Online, and set up your automatic transaction import.

Then you won’t have to worry about bookkeeping. Your bookkeeper will handle reconciliation and prepare monthly financial reports for you, including a profit and loss statement, balance sheet, and cash flow statement. If you have any questions, you may contact your bookkeeper through email.

Details of Pilot Features

The list of features that makes Pilot stand out among its competitors are listed down below:

-

Dedicated accounting

Pilot matches you with a professional bookkeeper, so you don’t have to worry about keeping track of your finances on your own. Your bookkeeper will handle all reconciliation and monthly reporting and assist you in setting up QuickBooks Online and integrating it with other company software.

With the Core and Select plans, Pilot offers burn-rate calculations and 20 special transactions each month — bills, invoices, checks, and reimbursements — in addition to conventional bookkeeping and reporting.

In addition, your bookkeeper is accessible to answer any queries, provide financial best practices, and function as a company partner. If you choose the Select plan, you’ll get priority services and industry-standard financial statistics like free cash flow and margin % included in your reporting.

The Plus subscription offers sophisticated capabilities like accounts receivable and payable tracking, billable expenditures tracking, and inventory monitoring for the most personalized bookkeeping Pilot has to offer.

-

Benefits for entrepreneurs

Pilot accounting is tailored to meet the needs of rapidly expanding firms and includes benefits tailored to high-growth potential entrepreneurs. For example, Pilot provides a pre-revenue discount for businesses with less than $15,000 in total sales – $200 off the Core or Select plans per month for the first subscription year.

All of the company’s bookkeeping plans contain burn-rate estimates, especially crucial for venture capital or investor funding organizations.

Pilot also assists firms with the research and development, or R&D, tax credit, which is offered to companies in the technology, e-commerce, biotech, and other high-growth industries.

-

Services offered as an add-on

In addition to bookkeeping services and R&D tax credit help, Pilot charges a fee for financial support from the company’s financial team. You can also include:

- Services for accounts payable and receivable start at $125 per hour.

- Supplemental services (custom reports, recruit training, etc.) are available at $195 per hour.

- Starting at $200 per hour for controller services (revenue recognition, cost of goods sold categorization).

Pilot also provides CFO and tax services, which may be utilized alone or in conjunction with its bookkeeping services. Another benefit for companies that want further financial assistance is Pilot CFO Services.

Alternatives to Pilot

The top alternatives that are available in the market for Pilot are listed down below:

- Bench

- Bookkeeping.com

- QuickBooks Live

- Merritt Bookkeeping

- Bookkeeper 360

- Xero

- NetSuite

- Zoho Books

- Budgyt

- Deskera Books

- Deel

Bench vs. Pilot, which one is better?

Bench Price – The Core plan starts at $299 per month. Why do we like it? Compared to Pilot Bookkeeping, Bench has a cheaper beginning fee, making it more accessible for ordinary small businesses. Bench also comes with its bookkeeping software, making it an excellent choice for newer firms who haven’t yet committed to a bookkeeping or accounting program – or those wishing to switch. Bench also provides tax preparation and filing with all of its services, a feature that other rivals don’t provide or charge extra for.

Pilot vs. Bookkeeper 360

Price: Bookkeeper360’s pay-as-you-go plan starts at $19 per month ($99 per hour for assistance).

Why do we like it?Because Bookkeeper360 is easily customizable, it’s a good fit for a wide range of small enterprises. You can work with a specialized accountant for on-demand bookkeeping on a pay-as-you-go basis or choose a monthly or weekly plan utilizing the cash or accrual-based accounting technique. For organizations with up to $20,000 in monthly costs, monthly reconciliation plans utilizing the cash method start at $399 per month.

Bookkeeper360 is a powerful program for measuring business performance, managing cash flow, and collaborating with the company’s bookkeeping professionals that works with both QuickBooks Online and Xero. In addition, Bookkeeper360 offers additional services such as CFO Advisory, Taxes, and Payroll.

Pilot Review Conclusions

In this Pilot bookkeeping review, we’d want to conclude that the Pilot will look after your bookkeeping, accounting, and other financial services. It’s ideal for small firms and start-ups.

The best part of Pilot is that you won’t have to worry about keeping up with your bookkeeping, or anything else for that matter, because Pilot is more than just accounting software; it’s a dedicated team of bookkeeping experts. As a result, you can dedicate more time to important items now that bookkeeping is no longer on your to-do list.

It is fairly simple to begin utilizing these accounting services because they can provide numerous connections with most top software and online apps and handle bookkeeping catch-up if necessary. If you have any queries, your dedicated financial manager is always accessible.